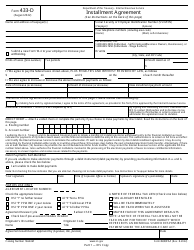

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8804-W

for the current year.

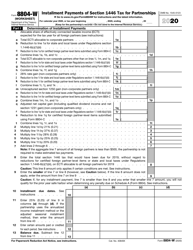

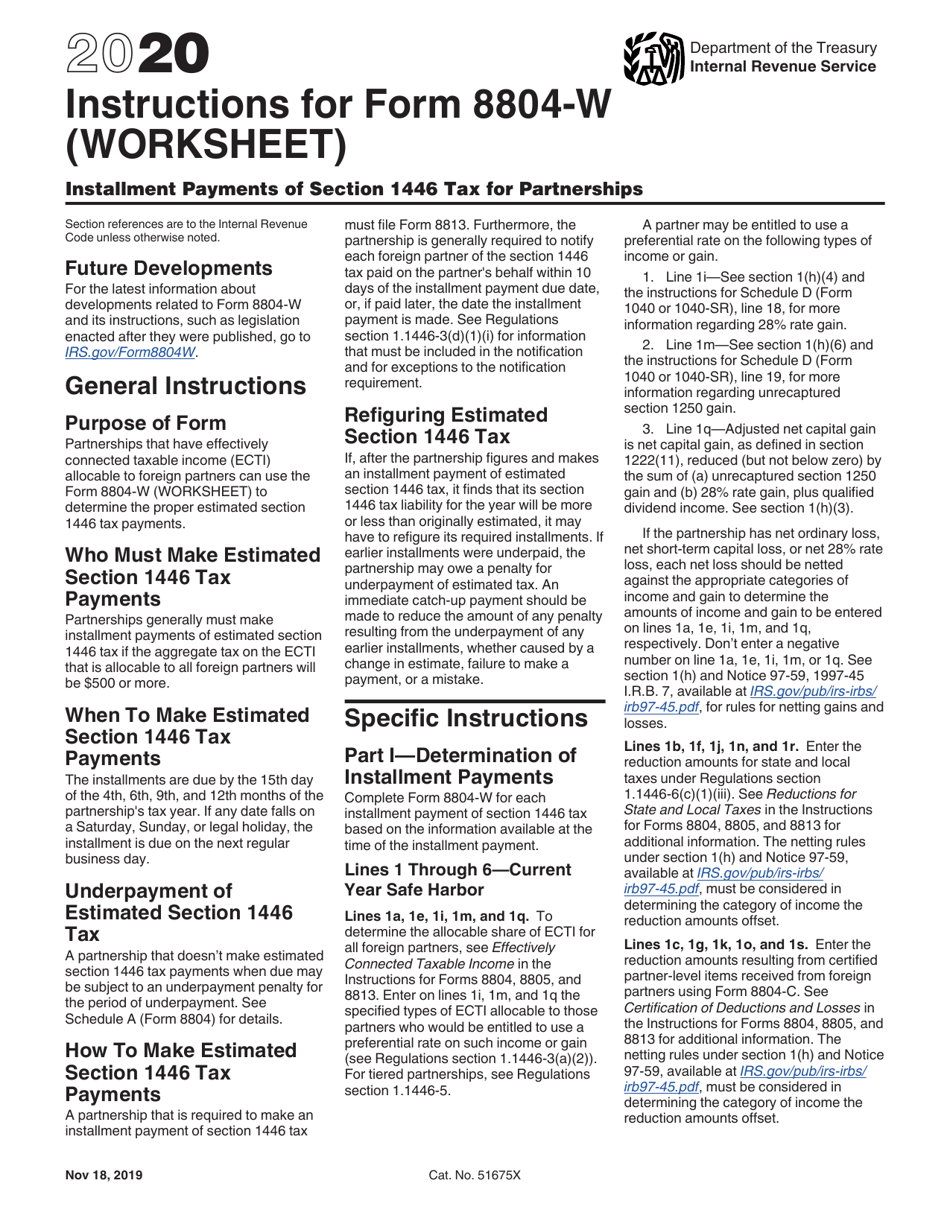

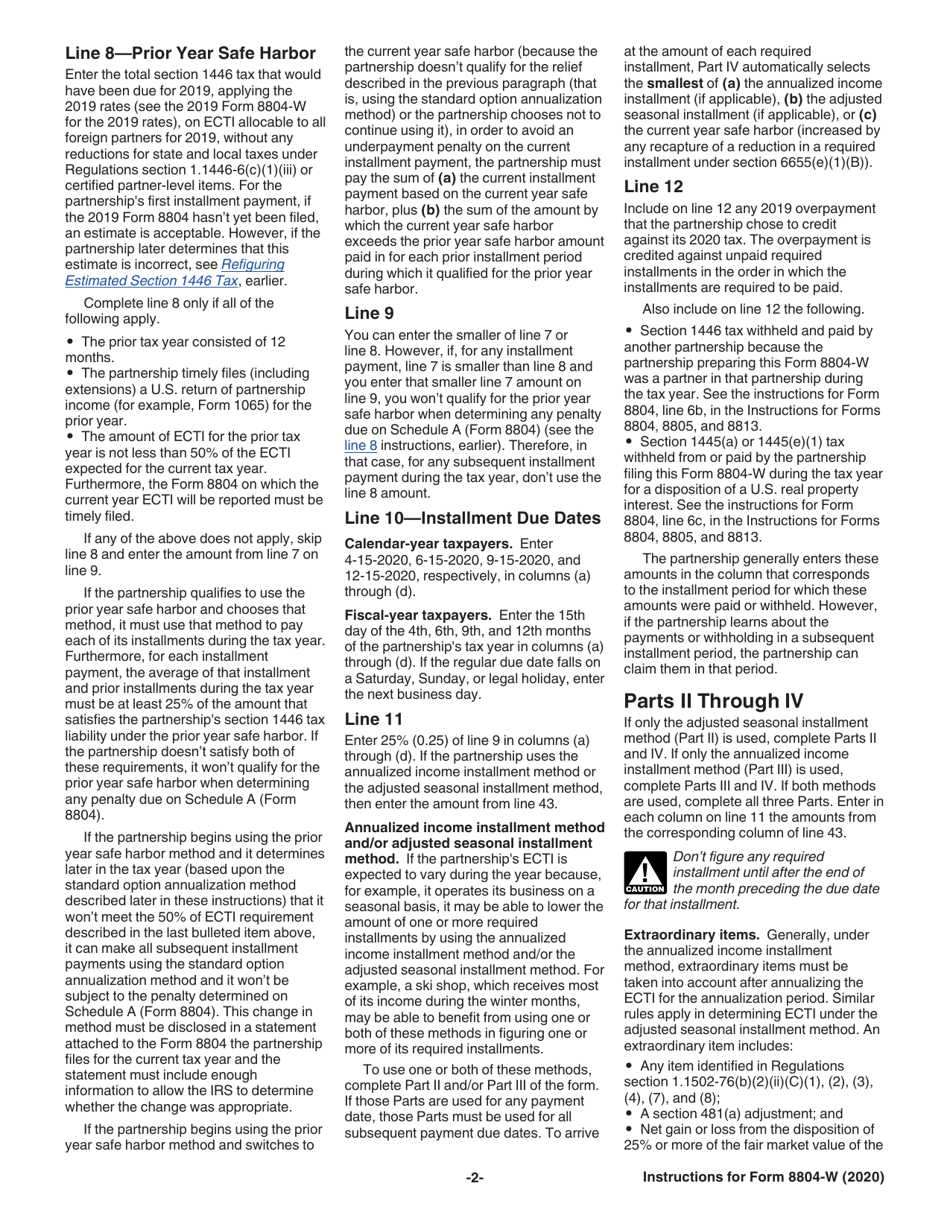

Instructions for IRS Form 8804-W Installment Payments of Section 1446 Tax for Partnerships

This document contains official instructions for IRS Form 8804-W , Installment Payments of Section 1446 Tax for Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8804-W is available for download through this link.

FAQ

Q: What is IRS Form 8804-W?

A: IRS Form 8804-W is a form used by partnerships to make installment payments of Section 1446 tax.

Q: What are installment payments of Section 1446 tax?

A: Installment payments of Section 1446 tax are periodic payments made by partnerships towards their tax obligation on income from effectively connectedtaxable income.

Q: Who needs to file Form 8804-W?

A: Partnerships that have a Section 1446 tax liability and want to pay in installments need to file Form 8804-W.

Q: How do I make installment payments?

A: To make installment payments, partnerships need to calculate the projected Section 1446 tax liability and submit payment using IRS Form 8804-W.

Q: Are all partnerships required to make installment payments?

A: No, only partnerships that have a Section 1446 tax liability and choose to pay in installments need to make these payments.

Q: When is Form 8804-W due?

A: Form 8804-W is due on the 15th day of the 6th month following the close of the partnership's tax year.

Q: What happens if I don't file Form 8804-W?

A: If you don't file Form 8804-W or make the required installment payments, you may be subject to penalties and interest on the outstanding tax liability.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.