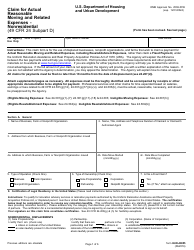

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3903

for the current year.

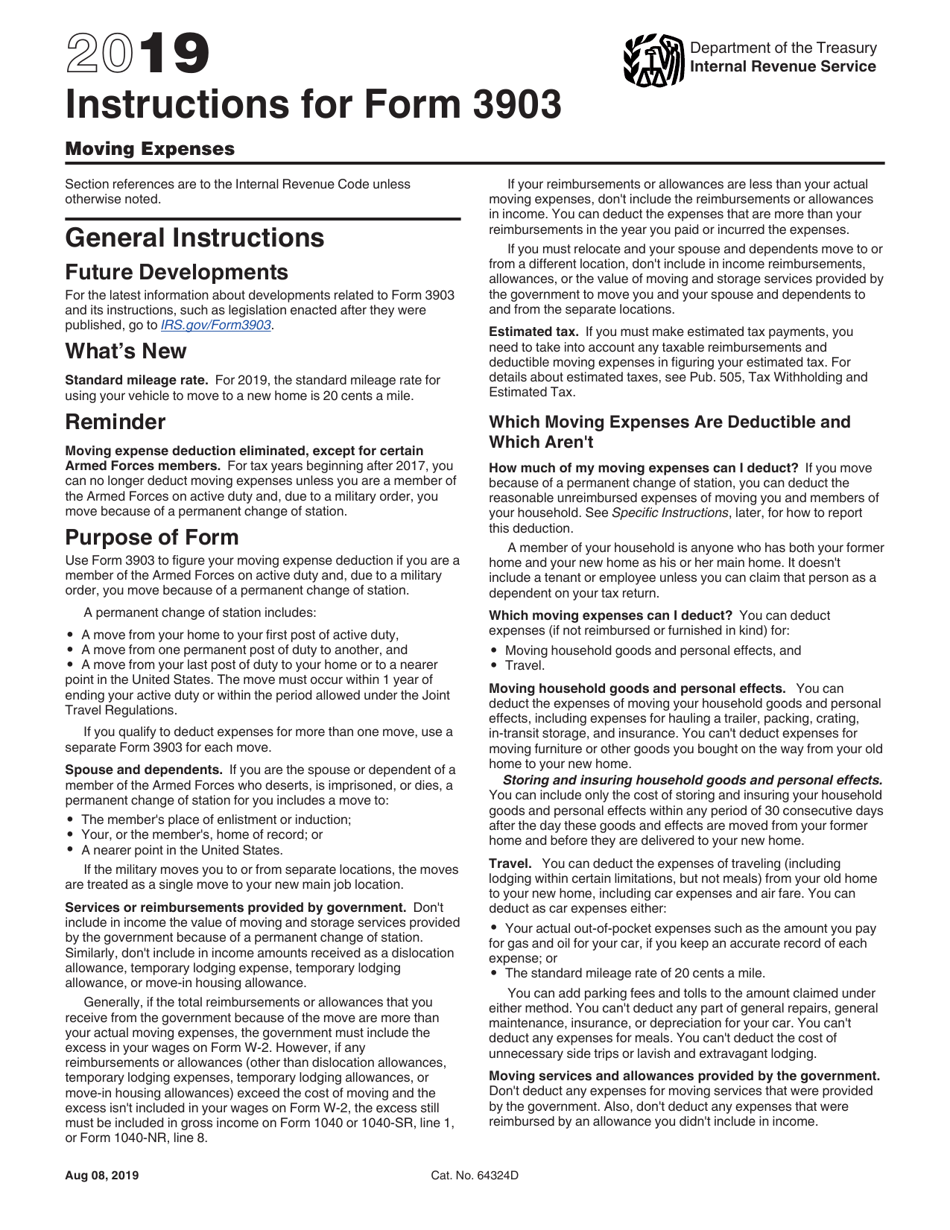

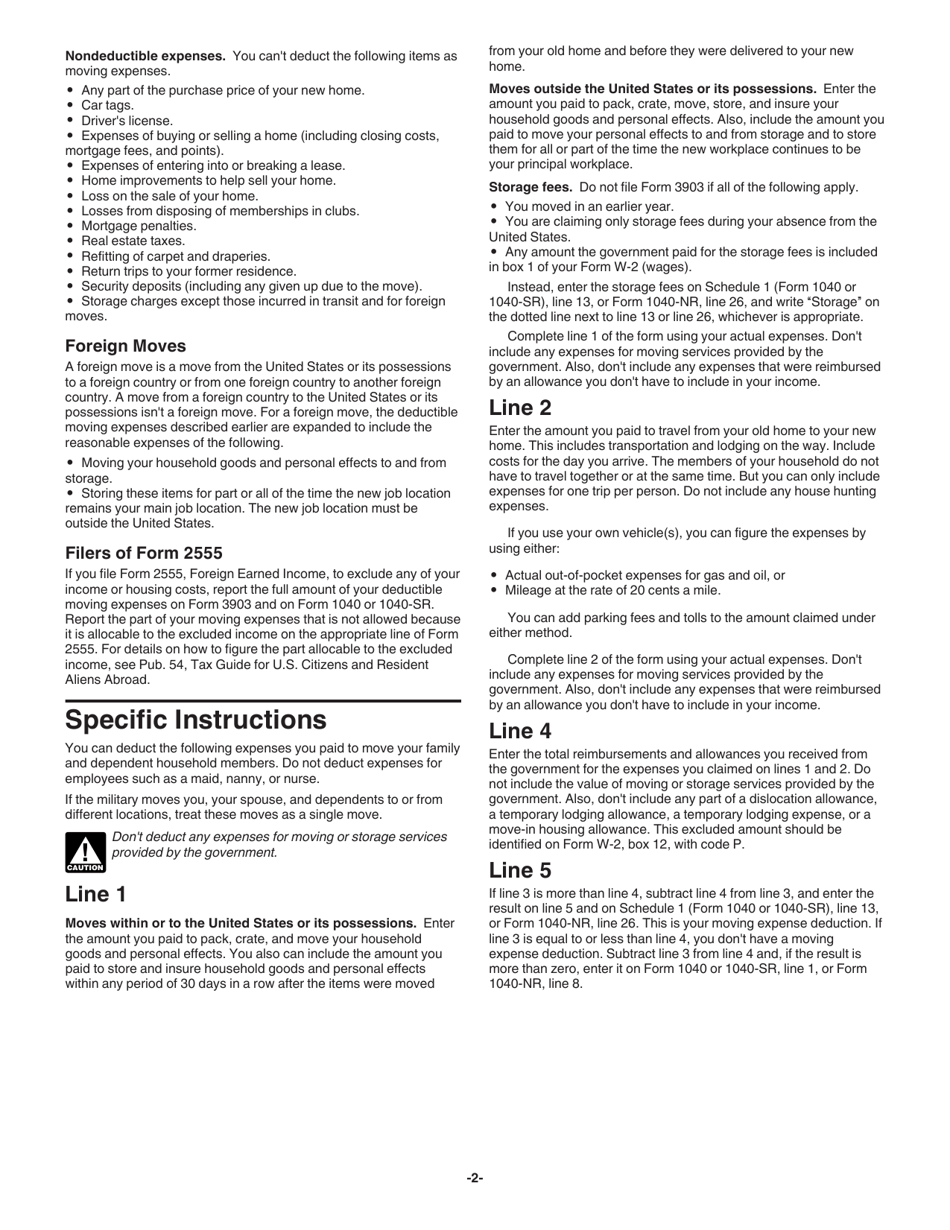

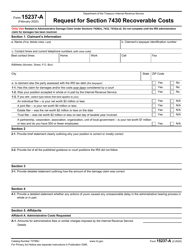

Instructions for IRS Form 3903 Moving Expenses

This document contains official instructions for IRS Form 3903 , Moving Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3903 is available for download through this link.

FAQ

Q: What is IRS Form 3903?

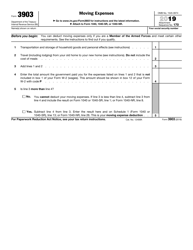

A: IRS Form 3903 is used to claim moving expenses on your federal tax return.

Q: Who can use IRS Form 3903?

A: Anyone who has moved for work purposes and meets the IRS criteria for deducting moving expenses can use Form 3903.

Q: What expenses can be claimed on IRS Form 3903?

A: IRS Form 3903 allows you to claim expenses related to moving yourself, your household goods, and your pets to a new home due to work.

Q: Can I claim all moving expenses on IRS Form 3903?

A: No, only certain qualifying expenses are eligible for deduction on IRS Form 3903.

Q: What documentation do I need to include with IRS Form 3903?

A: You should keep records of your moving expenses, including receipts, invoices, and any other relevant documents to support your claims.

Q: Can I claim moving expenses on both my federal and state tax returns?

A: The eligibility and rules for claiming moving expenses on state tax returns may vary. You should consult your state tax authority or a tax professional for guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.