This version of the form is not currently in use and is provided for reference only. Download this version of

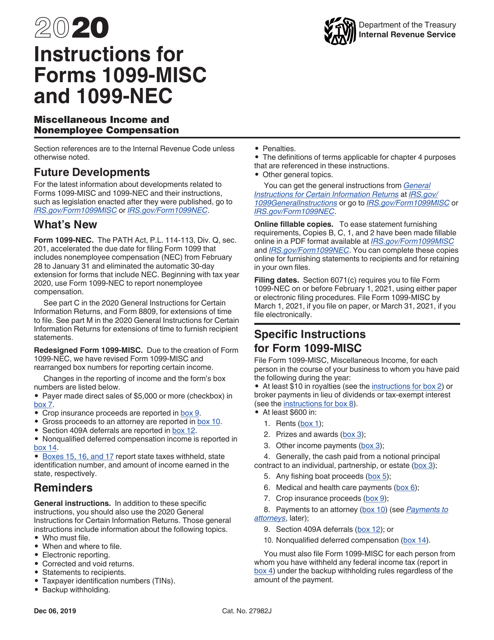

Instructions for IRS Form 1099-MISC, 1099-NEC

for the current year.

Instructions for IRS Form 1099-MISC, 1099-NEC Miscellaneous Income and Nonemployee Compensation

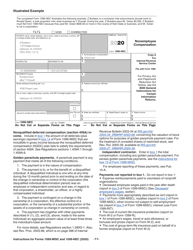

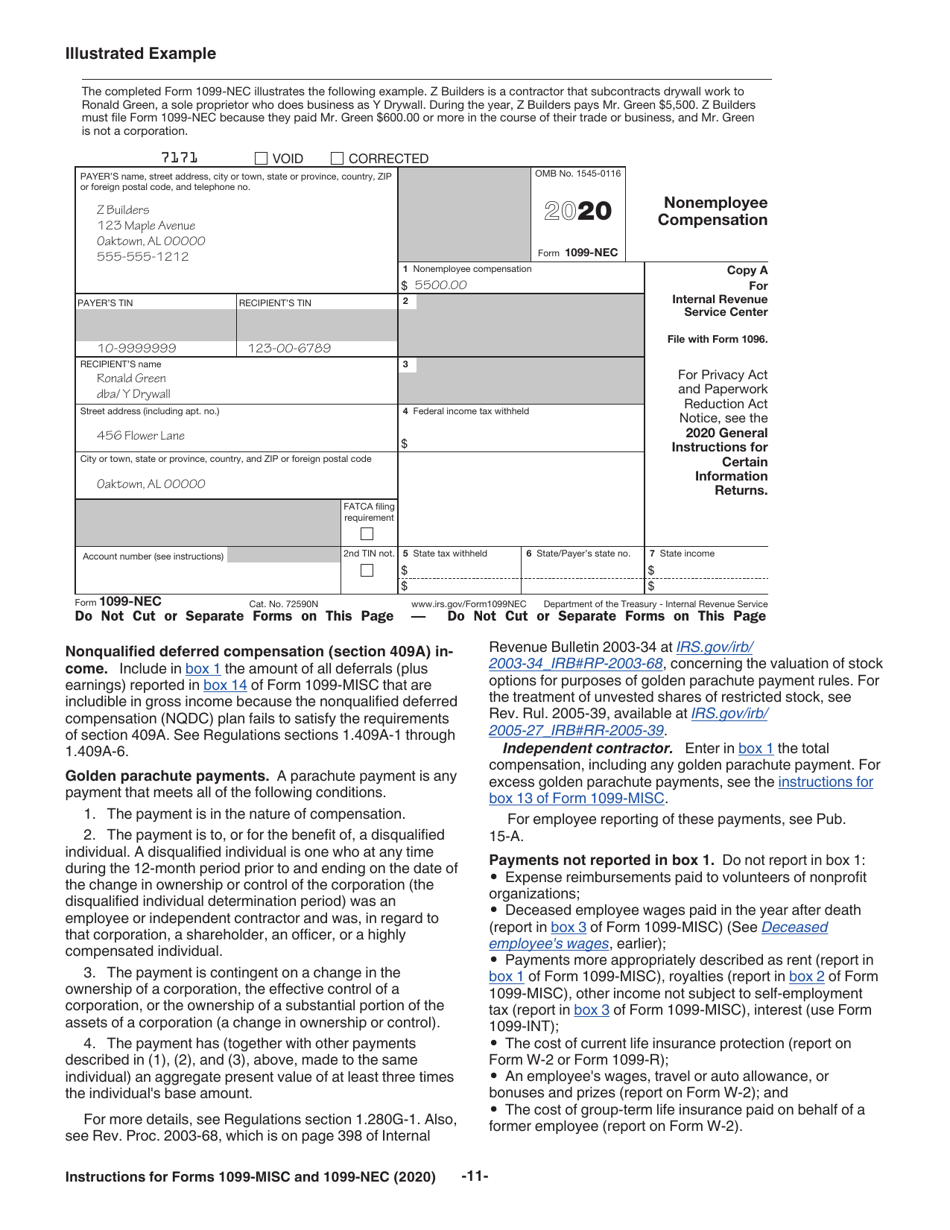

This document contains official instructions for IRS Form 1099-MISC , and IRS Form 1099-NEC . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-MISC is available for download through this link. The latest available IRS Form 1099-NEC can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-MISC?

A: IRS Form 1099-MISC is used to report miscellaneous income received by an individual or business.

Q: Who needs to file Form 1099-MISC?

A: Any individual or business that made payments of $600 or more in miscellaneous income during the tax year needs to file Form 1099-MISC.

Q: What types of income are reported on Form 1099-MISC?

A: Form 1099-MISC is used to report various types of income, such as rent, royalties, awards, prizes, and more.

Q: When is the deadline for filing Form 1099-MISC?

A: The deadline for filing Form 1099-MISC is typically January 31st.

Q: When is the deadline for filing Form 1099-NEC?

A: Starting with tax year 2020, the deadline for filing Form 1099-NEC is typically January 31st.

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.