This version of the form is not currently in use and is provided for reference only. Download this version of

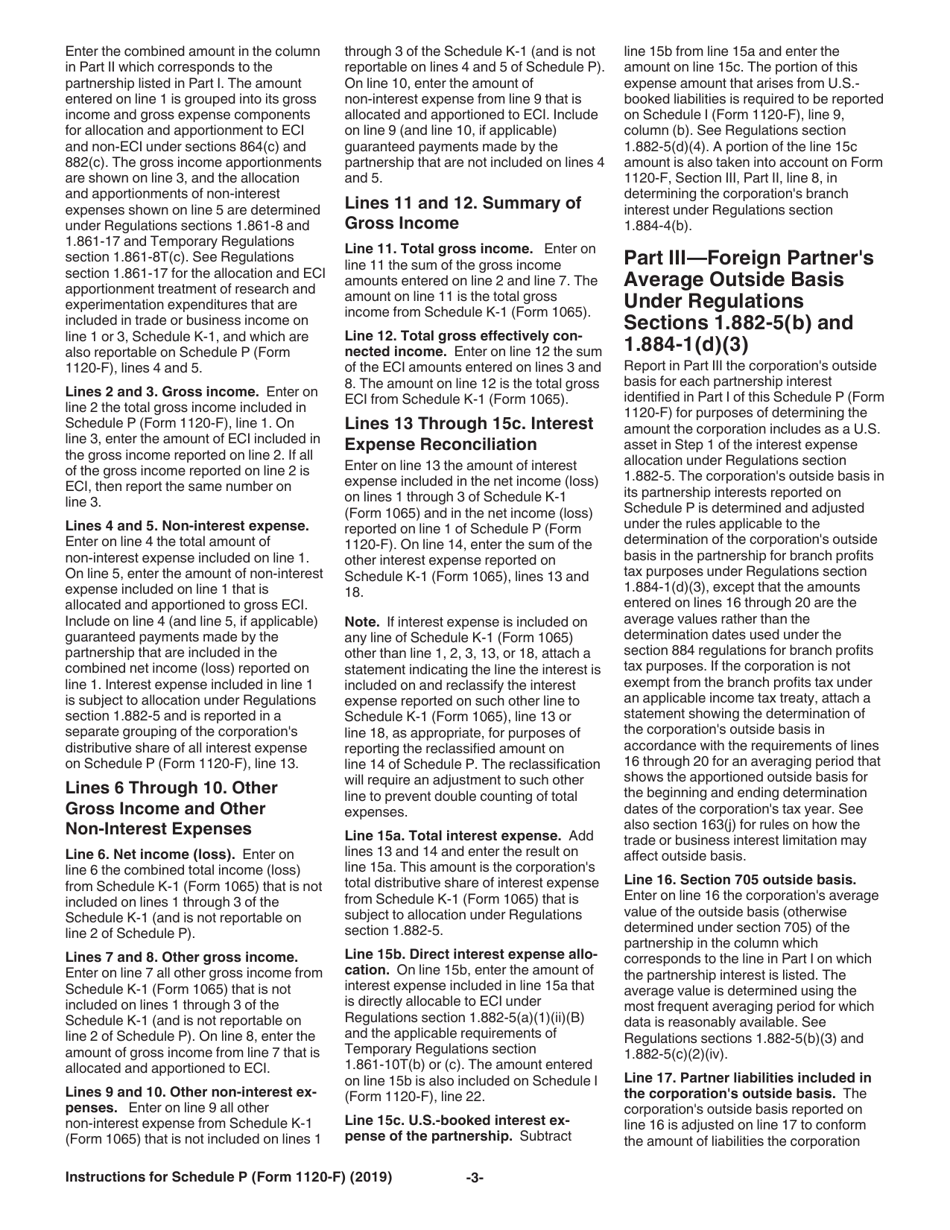

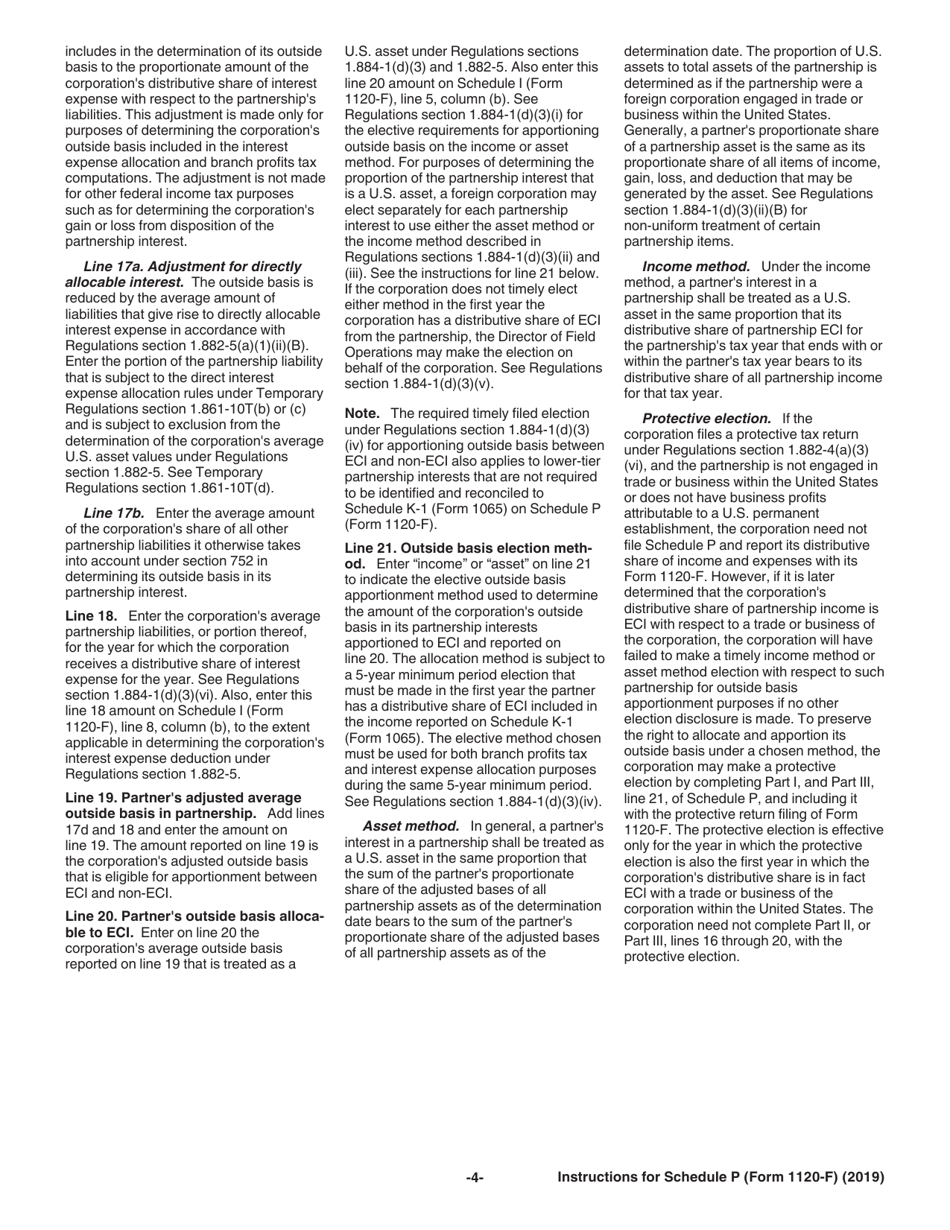

Instructions for IRS Form 1120-F Schedule P

for the current year.

Instructions for IRS Form 1120-F Schedule P List of Foreign Partner Interests in Partnerships

This document contains official instructions for IRS Form 1120-F Schedule P, List of Foreign Partner Interests in Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule P is available for download through this link.

FAQ

Q: What is IRS Form 1120-F Schedule P?

A: IRS Form 1120-F Schedule P is a form used to list foreign partner interests in partnerships.

Q: Who needs to file IRS Form 1120-F Schedule P?

A: Taxpayers who are filing IRS Form 1120-F and have foreign partners in their partnerships need to file Schedule P.

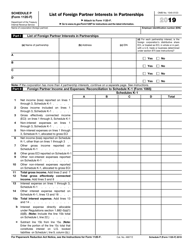

Q: What information needs to be provided in IRS Form 1120-F Schedule P?

A: IRS Form 1120-F Schedule P requires taxpayers to provide information about the foreign partners in their partnerships, including their names, addresses, and percentage of ownership.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.