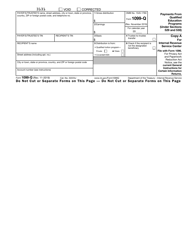

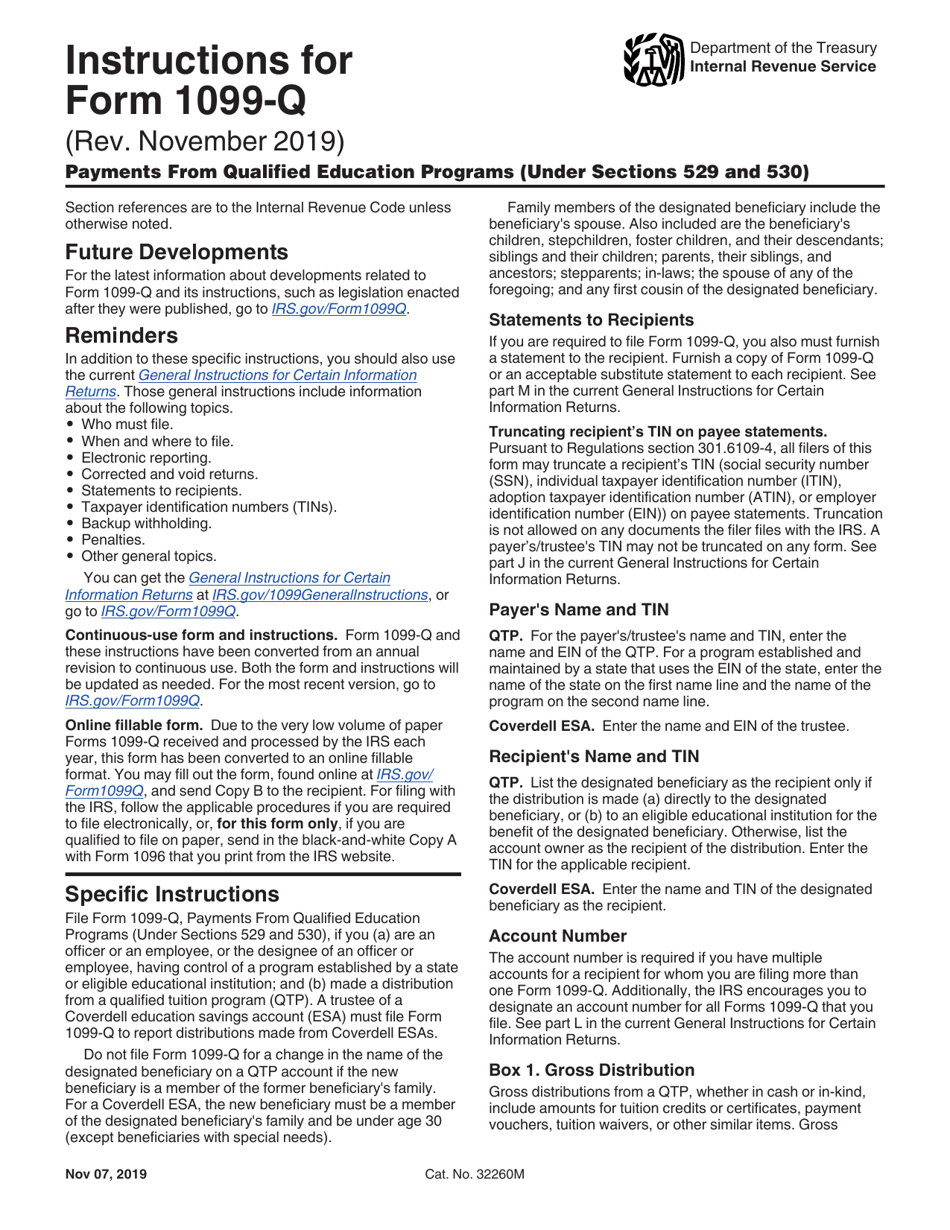

Instructions for IRS Form 1099-Q Payments From Qualified Education Programs (Under Sections 529 and 530)

This document contains official instructions for IRS Form 1099-Q , Payments From Qualified Education Programs (Under Sections 529 and 530) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-Q is available for download through this link.

FAQ

Q: What is IRS Form 1099-Q?

A: IRS Form 1099-Q is used to report payments received from qualified education programs under sections 529 and 530.

Q: Who needs to file IRS Form 1099-Q?

A: Financial institutions, such as banks or educational institutions, that make payments from qualified education programs, need to file IRS Form 1099-Q.

Q: What are qualified education programs?

A: Qualified education programs include state tuition programs (529 plans) and savings bonds programs (Education Savings Bonds).

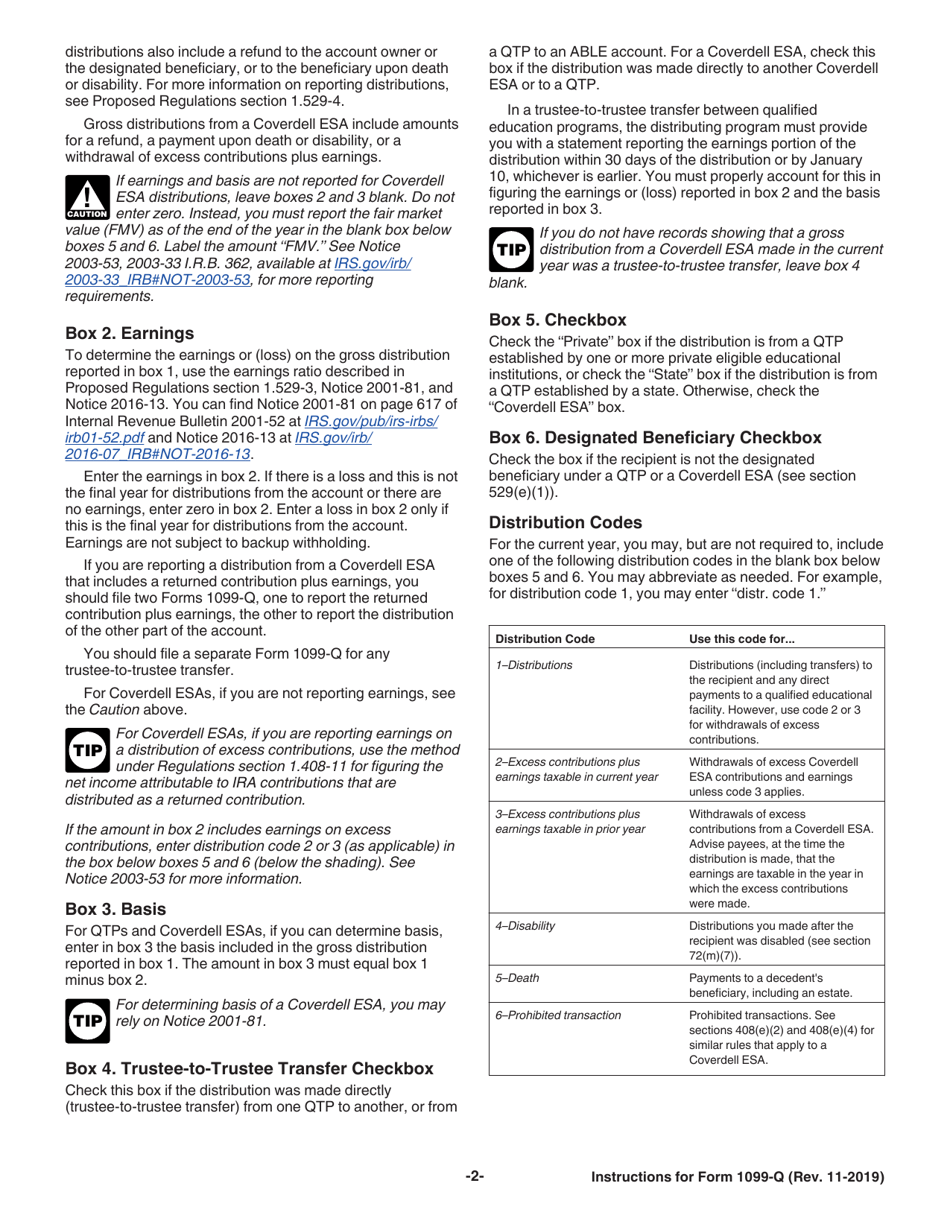

Q: What information is required on IRS Form 1099-Q?

A: IRS Form 1099-Q requires information such as the recipient's name, address, taxpayer identification number, account number, and the amount of distributed earnings or basis.

Q: When is IRS Form 1099-Q due?

A: IRS Form 1099-Q must be furnished to recipients by January 31, and the form must be filed with the IRS by February 28 (or March 31 if filed electronically).

Q: What happens if I don't file IRS Form 1099-Q?

A: Failure to file IRS Form 1099-Q may result in penalties imposed by the IRS.

Q: Can IRS Form 1099-Q be filed electronically?

A: Yes, IRS Form 1099-Q can be filed electronically through the IRS's Filing Information Returns Electronically (FIRE) system.

Q: Do I need to include IRS Form 1099-Q with my tax return?

A: You do not need to include IRS Form 1099-Q with your tax return. However, you should keep a copy of the form for your records in case of audit or other verification purposes.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.