This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-QA, 5498-QA

for the current year.

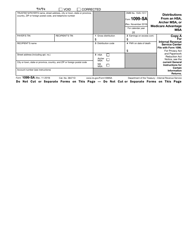

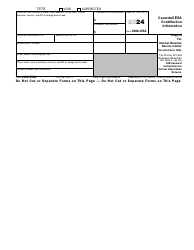

Instructions for IRS Form 1099-QA, 5498-QA Distributions From Able Accounts and Able Account Contribution Information

This document contains official instructions for IRS Form 1099-QA , and IRS Form 5498-QA . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-QA is available for download through this link. The latest available IRS Form 5498-QA can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-QA?

A: IRS Form 1099-QA is used to report distributions from Able Accounts.

Q: What is IRS Form 5498-QA?

A: IRS Form 5498-QA is used to report information about contributions made to Able Accounts.

Q: What are Able Accounts?

A: Able Accounts are tax-advantaged savings accounts for individuals with disabilities.

Q: Who needs to file IRS Form 1099-QA?

A: Financial institutions that make distributions from Able Accounts need to file IRS Form 1099-QA.

Q: Who needs to file IRS Form 5498-QA?

A: Financial institutions that receive contributions to Able Accounts need to file IRS Form 5498-QA.

Q: What information is reported on IRS Form 1099-QA?

A: IRS Form 1099-QA reports the amount and type of distributions made from Able Accounts.

Q: What information is reported on IRS Form 5498-QA?

A: IRS Form 5498-QA reports the amount and type of contributions made to Able Accounts.

Q: When are IRS Form 1099-QA and 5498-QA due?

A: IRS Form 1099-QA and 5498-QA are typically due by January 31st of the following year.

Q: Are distributions from Able Accounts taxable?

A: Distributions from Able Accounts are generally tax-free if used for qualified disability expenses.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.