IRS Form 1099-LTC Long-Term Care and Accelerated Death Benefits

What Is IRS Form 1099-LTC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 24, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1099-LTC?

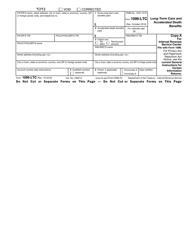

A: IRS Form 1099-LTC is a tax form used to report Long-Term Care and Accelerated Death Benefits.

Q: What are Long-Term Care benefits?

A: Long-Term Care benefits refer to payments made by insurance companies to cover expenses related to long-term care services.

Q: What are Accelerated Death Benefits?

A: Accelerated Death Benefits are payments made by insurance companies to policyholders who are terminally ill or have a life-threatening condition.

Q: Who needs to file IRS Form 1099-LTC?

A: Insurance companies are required to file IRS Form 1099-LTC if they made Long-Term Care or Accelerated Death Benefit payments of $600 or more to an individual.

Q: Is the Long-Term Care benefit taxable?

A: In most cases, Long-Term Care benefits are not taxable.

Q: Are Accelerated Death Benefits taxable?

A: In most cases, Accelerated Death Benefits are not taxable if they are paid under a life insurance policy.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form 1099-LTC through the link below or browse more documents in our library of IRS Forms.