This version of the form is not currently in use and is provided for reference only. Download this version of

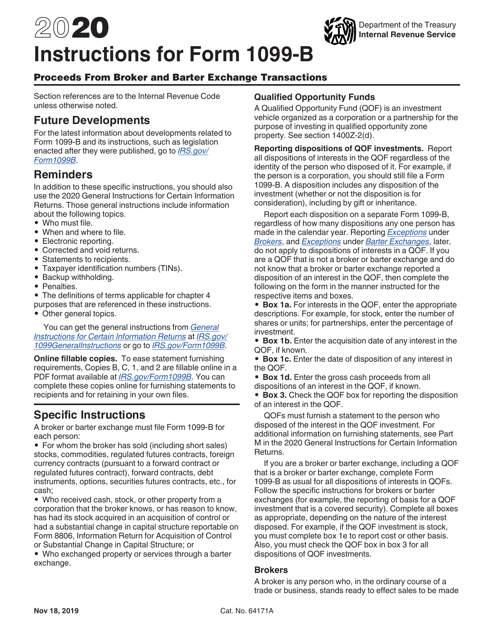

Instructions for IRS Form 1099-B

for the current year.

Instructions for IRS Form 1099-B Proceeds From Broker and Barter Exchange Transactions

This document contains official instructions for IRS Form 1099-B , Proceeds From Broker and Barter Exchange Transactions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-B is available for download through this link.

FAQ

Q: What is IRS Form 1099-B?

A: IRS Form 1099-B is a tax form used to report proceeds from broker and barter exchange transactions.

Q: Who should file IRS Form 1099-B?

A: Brokers and barter exchanges should file IRS Form 1099-B.

Q: What transactions are reported on IRS Form 1099-B?

A: IRS Form 1099-B is used to report transactions such as the sale of stocks, bonds, and mutual funds.

Q: What information is required to complete IRS Form 1099-B?

A: You will need to provide the taxpayer identification number, name, and address of the recipient of the proceeds, as well as details of the transaction.

Q: When is the deadline to file IRS Form 1099-B?

A: The deadline to file IRS Form 1099-B is January 31, following the end of the calendar year.

Q: Do I need to send a copy of IRS Form 1099-B to the recipient?

A: Yes, you must provide a copy of IRS Form 1099-B to the recipient of the proceeds.

Q: What are the consequences of not filing IRS Form 1099-B?

A: Failure to file IRS Form 1099-B or filing incorrect information may result in penalties imposed by the IRS.

Q: Can I file IRS Form 1099-B electronically?

A: Yes, you can file IRS Form 1099-B electronically through the IRS Filing Information Returns Electronically (FIRE) system.

Q: Is there a minimum threshold for reporting on IRS Form 1099-B?

A: Yes, you are only required to report transactions that meet certain threshold requirements outlined by the IRS.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.