Instructions for IRS Form 1099-CAP Changes in Corporate Control and Capital Structure

This document contains official instructions for IRS Form 1099-CAP , Changes in Corporate Control and Capital Structure - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-CAP is available for download through this link.

FAQ

Q: What is IRS Form 1099-CAP?

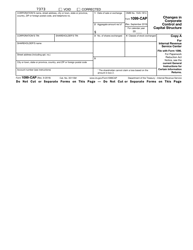

A: IRS Form 1099-CAP is a tax form used to report changes in corporate control and capital structure.

Q: Who needs to file IRS Form 1099-CAP?

A: Any corporation that has gone through a change in corporate control or capital structure during the year needs to file IRS Form 1099-CAP.

Q: What changes in corporate control or capital structure should be reported on IRS Form 1099-CAP?

A: Changes such as acquisitions, mergers, exchanges of stock or securities, and other similar transactions should be reported on IRS Form 1099-CAP.

Q: When is the deadline to file IRS Form 1099-CAP?

A: The deadline to file IRS Form 1099-CAP is January 31st of the year following the year of the corporate control or capital structure change.

Q: What happens if I don't file IRS Form 1099-CAP?

A: Failure to file IRS Form 1099-CAP or filing it late may result in penalties imposed by the IRS.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.