Instructions for IRS Form 1098-Q Qualifying Longevity Annuity Contract Information

This document contains official instructions for IRS Form 1098-Q , Qualifying Longevity Annuity Contract Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1098-Q is available for download through this link.

FAQ

Q: What is Form 1098-Q?

A: Form 1098-Q is a form used to report information about qualifying longevity annuity contracts.

Q: What is a qualifying longevity annuity contract?

A: A qualifying longevity annuity contract is a type of annuity contract that provides future income payments, usually starting at an advanced age.

Q: Who needs to file Form 1098-Q?

A: Insurance companies or persons responsible for issuing qualifying longevity annuity contracts need to file Form 1098-Q.

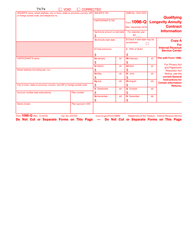

Q: What information is reported on Form 1098-Q?

A: Form 1098-Q reports information such as the contract owner's name, address, and taxpayer identification number.

Q: When is Form 1098-Q due?

A: Form 1098-Q is typically due to the recipient and the IRS by January 31st of the year following the calendar year in which the contract was issued.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.