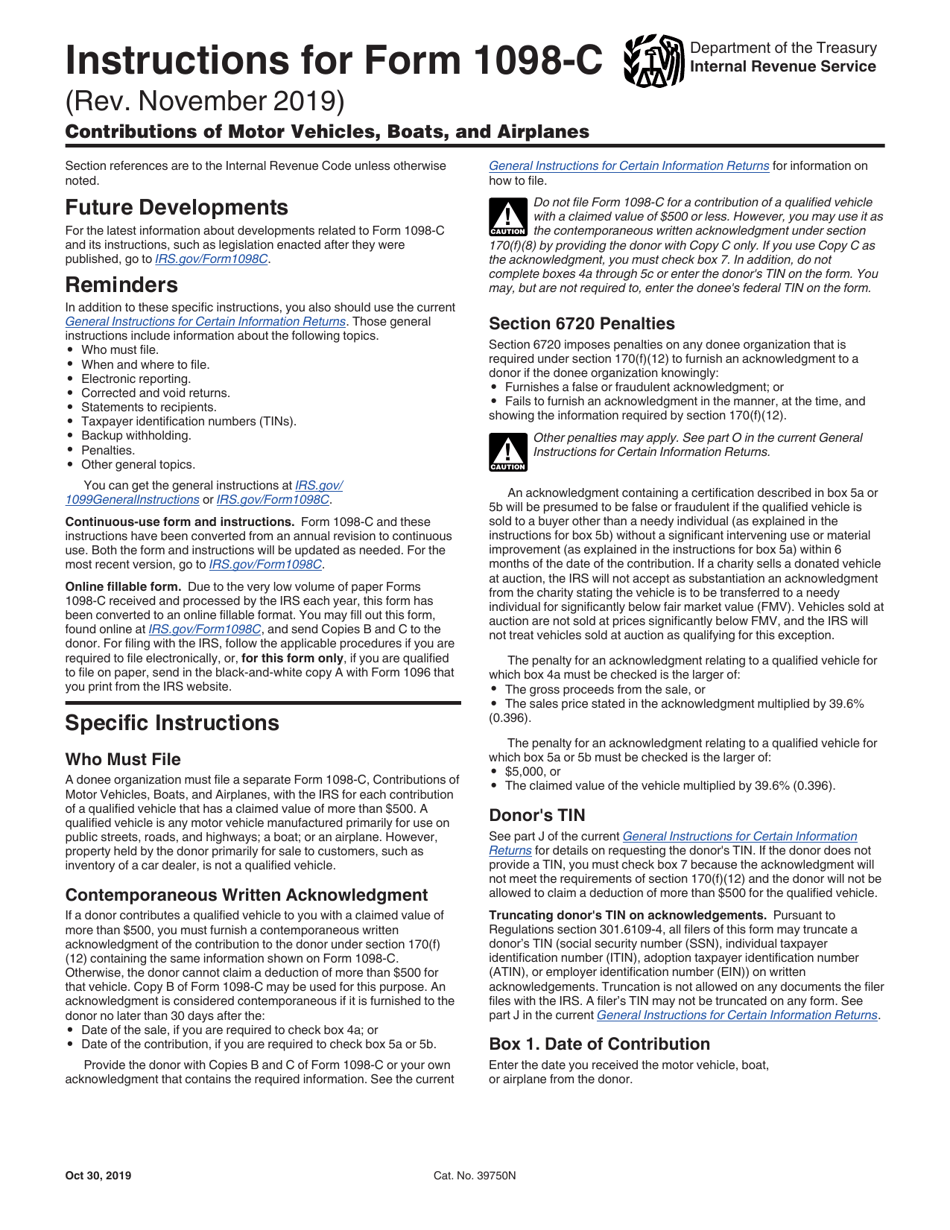

Instructions for IRS Form 1098-C Contributions of Motor Vehicles, Boats, and Airplanes

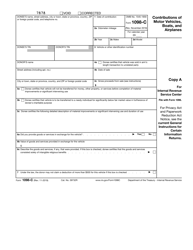

This document contains official instructions for IRS Form 1098-C , Contributions of Motor Vehicles, Boats, and Airplanes - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1098-C is available for download through this link.

FAQ

Q: What is IRS Form 1098-C?

A: IRS Form 1098-C is a form used to report contributions of motor vehicles, boats, and airplanes to charitable organizations.

Q: Who should file IRS Form 1098-C?

A: If you donated a motor vehicle, boat, or airplane to a charitable organization and received a qualified acknowledgement in return, you should file IRS Form 1098-C.

Q: What information is required on IRS Form 1098-C?

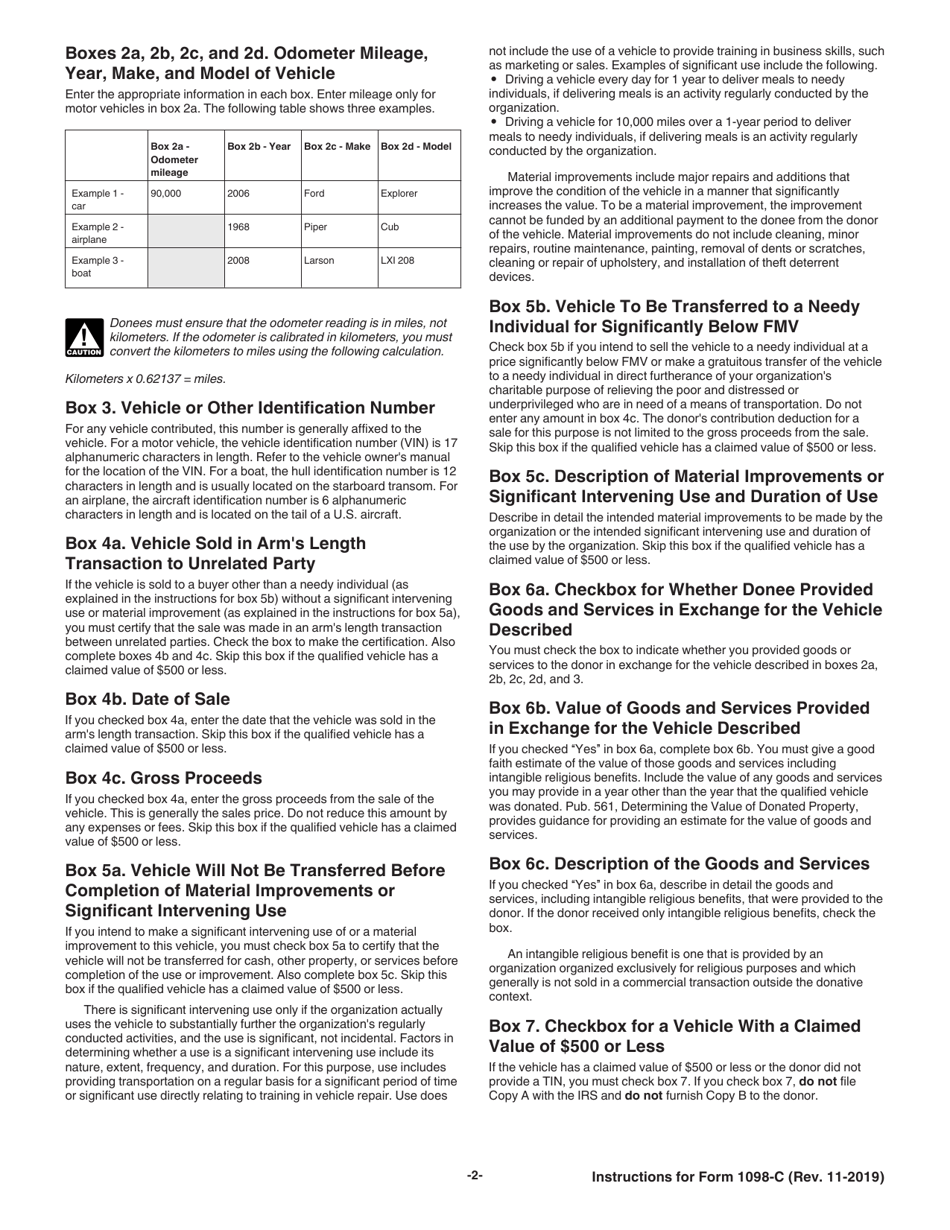

A: IRS Form 1098-C requires information about the donor, the charitable organization, and details about the contributed vehicle, boat, or airplane.

Q: When is the deadline to file IRS Form 1098-C?

A: IRS Form 1098-C should be filed by the 28th day of the month following the month of the contribution.

Q: Are there any exceptions or special rules for filing IRS Form 1098-C?

A: Yes, there are exceptions and special rules for filing IRS Form 1098-C. It is recommended to consult the instructions or a tax professional for guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.