This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule J

for the current year.

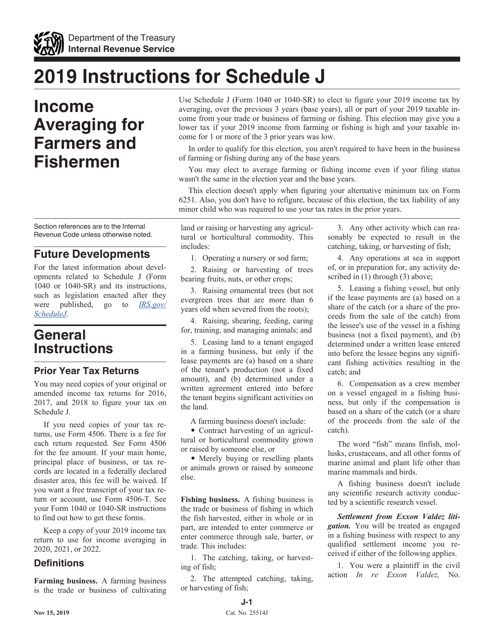

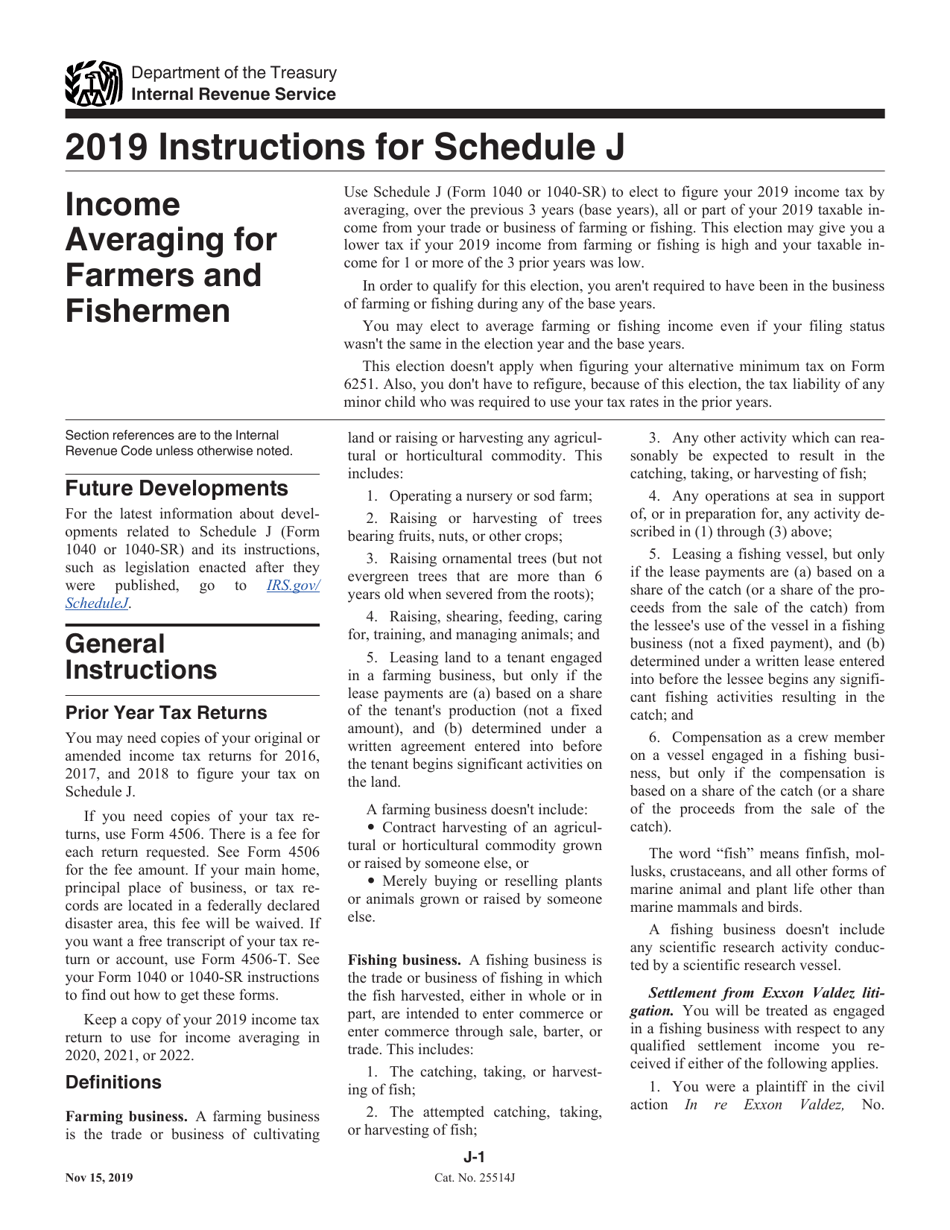

Instructions for IRS Form 1040 Schedule J Income Averaging for Farmers and Fishermen

This document contains official instructions for IRS Form 1040 Schedule J, Income Averaging for Farmers and Fishermen - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule J is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule J?

A: IRS Form 1040 Schedule J is a tax form used for income averaging by farmers and fishermen.

Q: Who can use IRS Form 1040 Schedule J?

A: Farmers and fishermen who meet specific criteria can use IRS Form 1040 Schedule J.

Q: What is income averaging?

A: Income averaging is a method that allows farmers and fishermen to spread their income over multiple years, potentially reducing their tax liability.

Q: Why would a farmer or fisherman want to use income averaging?

A: Farmers and fishermen often have fluctuating incomes from year to year. Income averaging can help smooth out their tax liability and potentially lower their tax bill.

Q: What are the criteria for using income averaging?

A: To use income averaging, a farmer or fisherman must have at least two consecutive years of farming or fishing income, and the current year's income must be less than the base year's income.

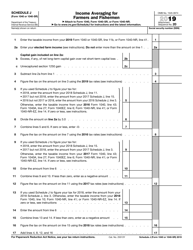

Q: How does income averaging work?

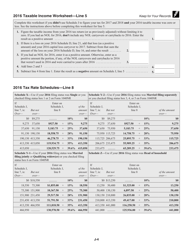

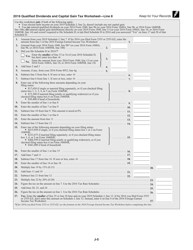

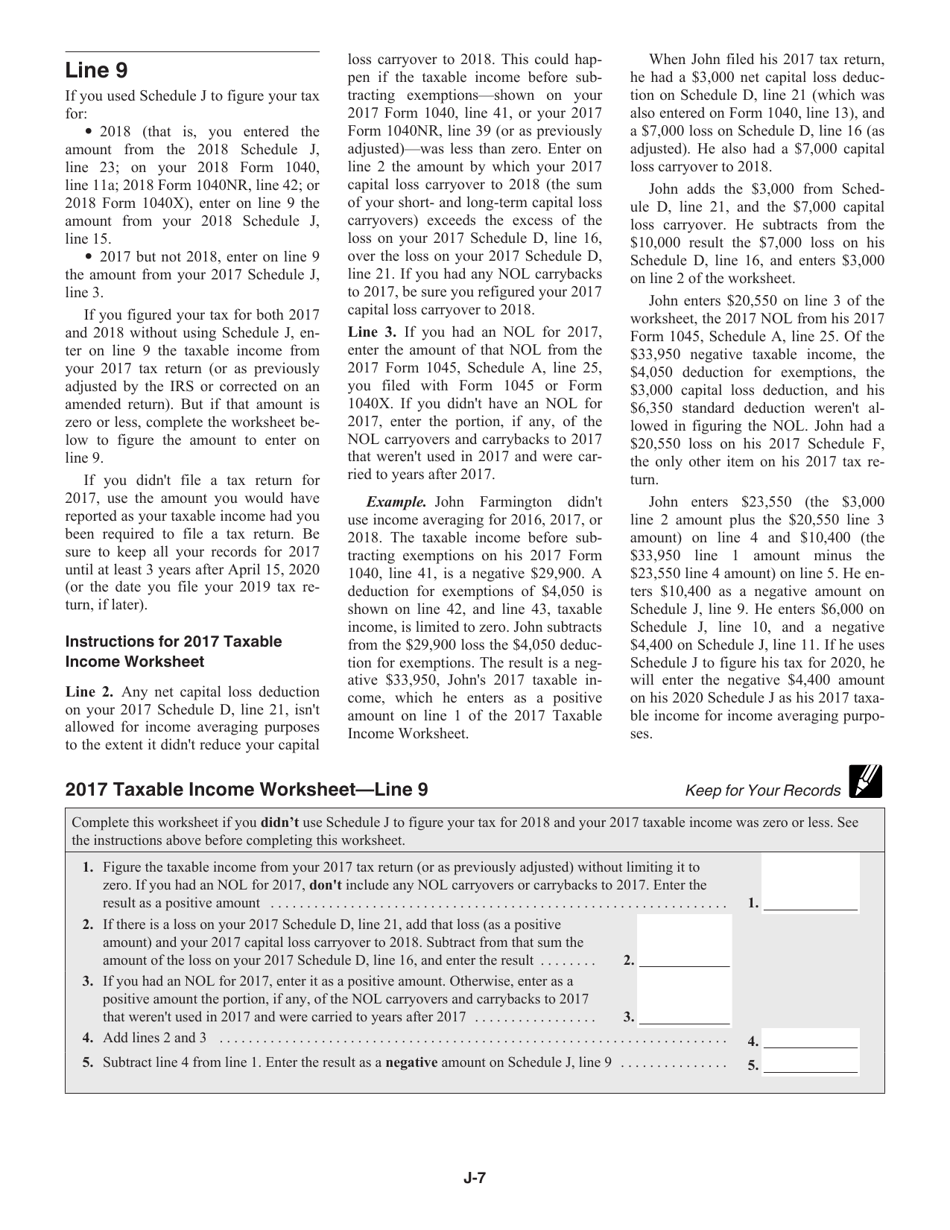

A: Income averaging works by calculating the tax based on the average of the current year's income and the previous three years' income.

Q: How do I fill out IRS Form 1040 Schedule J?

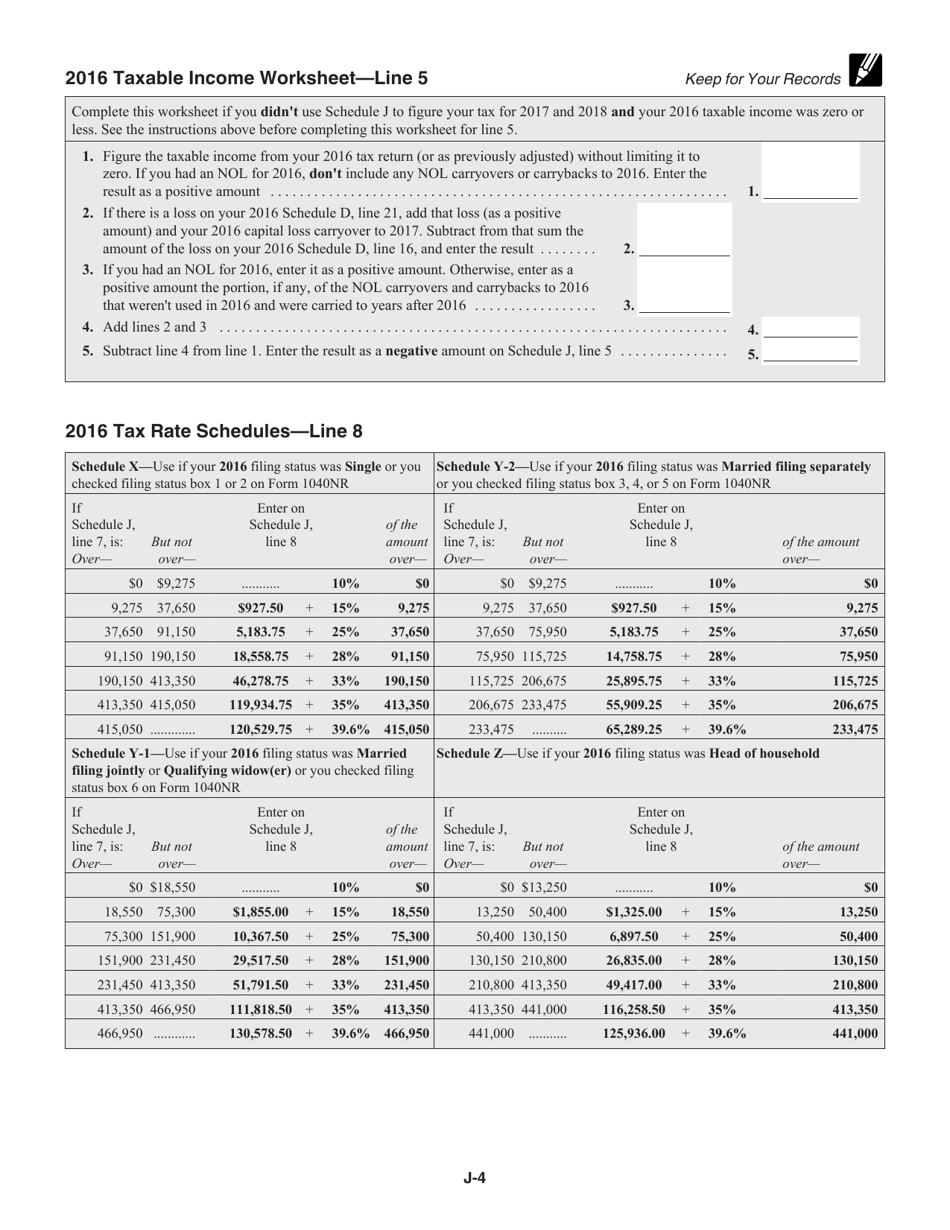

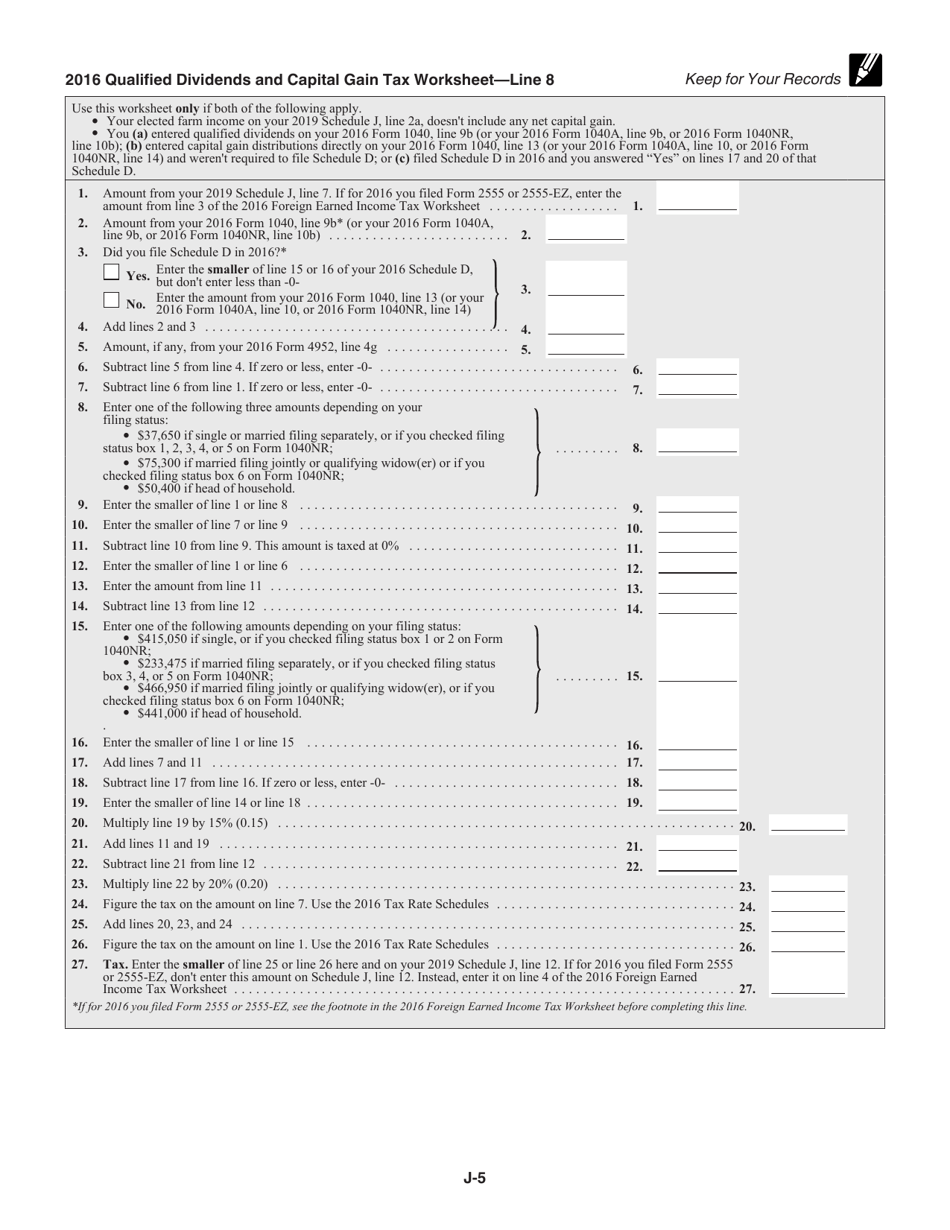

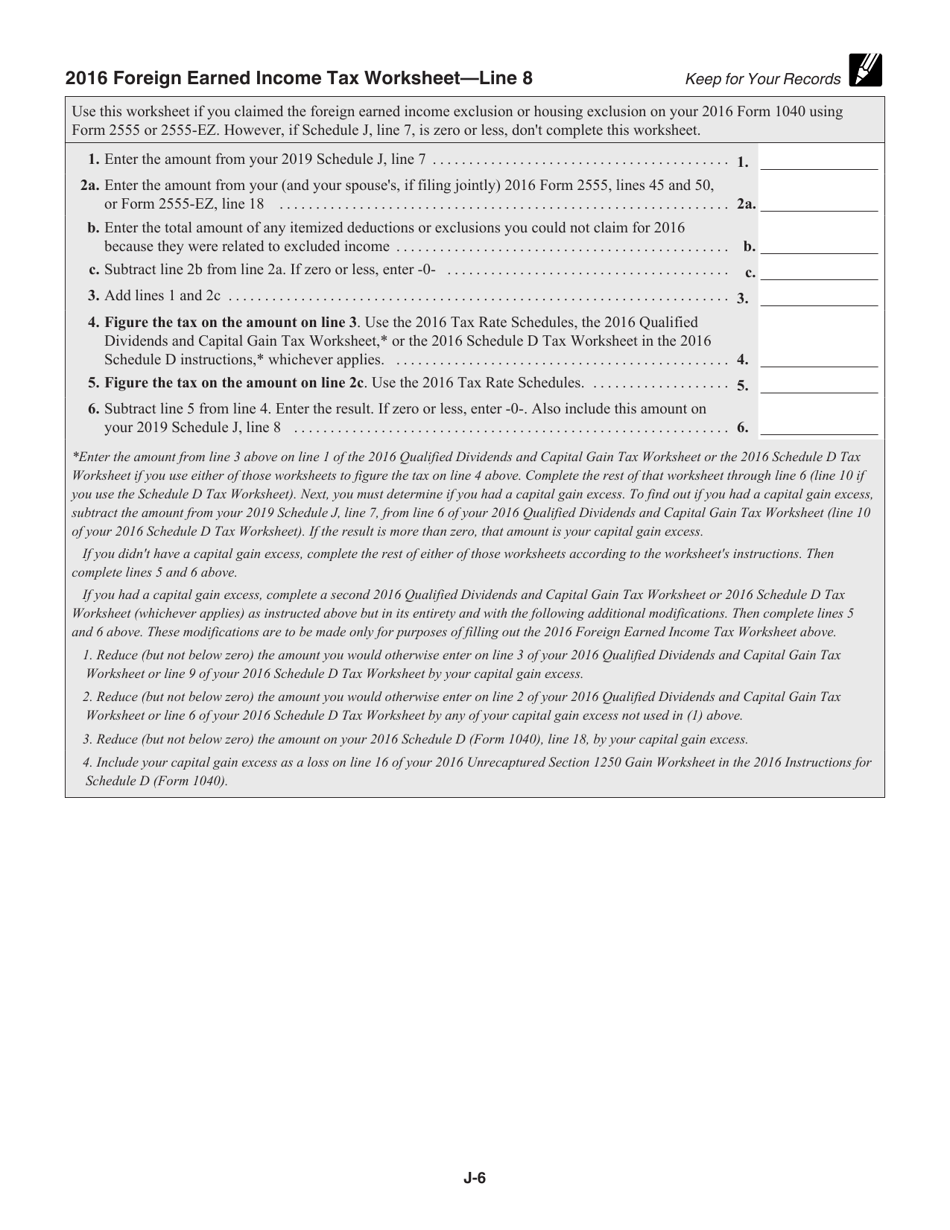

A: To fill out IRS Form 1040 Schedule J, you will need to follow the instructions on the form. It requires information about your farming or fishing income for the current year and the previous three years.

Q: When is IRS Form 1040 Schedule J due?

A: IRS Form 1040 Schedule J is due on the same date as your individual income tax return, which is generally April 15th.

Q: Can I e-file IRS Form 1040 Schedule J?

A: Yes, you can e-file IRS Form 1040 Schedule J along with your individual income tax return.

Instruction Details:

- This 14-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.