This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990, 990-EZ Schedule C

for the current year.

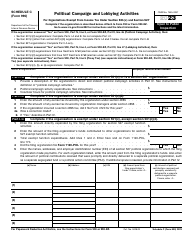

Instructions for IRS Form 990, 990-EZ Schedule C Political Campaign and Lobbying Activities

This document contains official instructions for IRS Form 990 Schedule C and IRS Form 990-EZ Schedule C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax form used by tax-exempt organizations to report their financial information to the Internal Revenue Service (IRS).

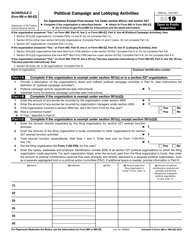

Q: What is the purpose of Form 990-EZ Schedule C?

A: Form 990-EZ Schedule C is used to report political campaign and lobbying activities of tax-exempt organizations.

Q: Who needs to file Form 990?

A: Most tax-exempt organizations with gross receipts of $200,000 or assets of $500,000 or more are required to file Form 990.

Q: What are political campaign activities?

A: Political campaign activities refer to activities that support or oppose candidates for public office, such as endorsing candidates or making contributions to their campaigns.

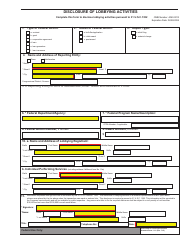

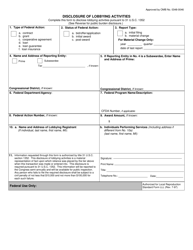

Q: What are lobbying activities?

A: Lobbying activities involve attempting to influence legislation or government officials, typically regarding specific policies or laws.

Q: Are there any exceptions to filing Form 990?

A: Certain types of tax-exempt organizations, such as churches and government entities, may be exempt from filing Form 990.

Q: Can Form 990 be filed electronically?

A: Yes, Form 990 can be filed electronically using the IRS e-file system or through authorized tax software providers.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.