This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990, 990-EZ Schedule L

for the current year.

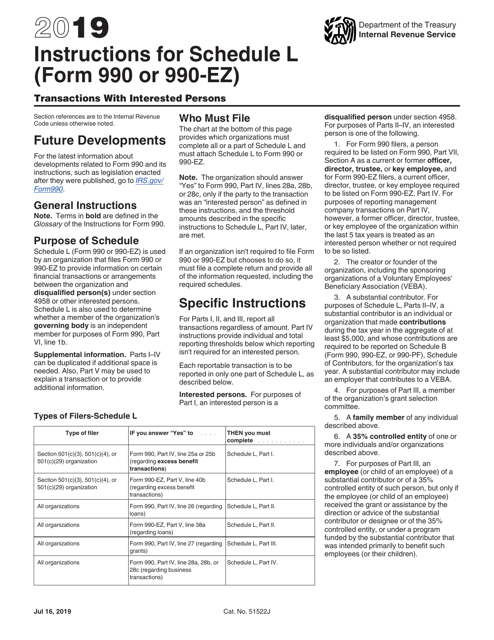

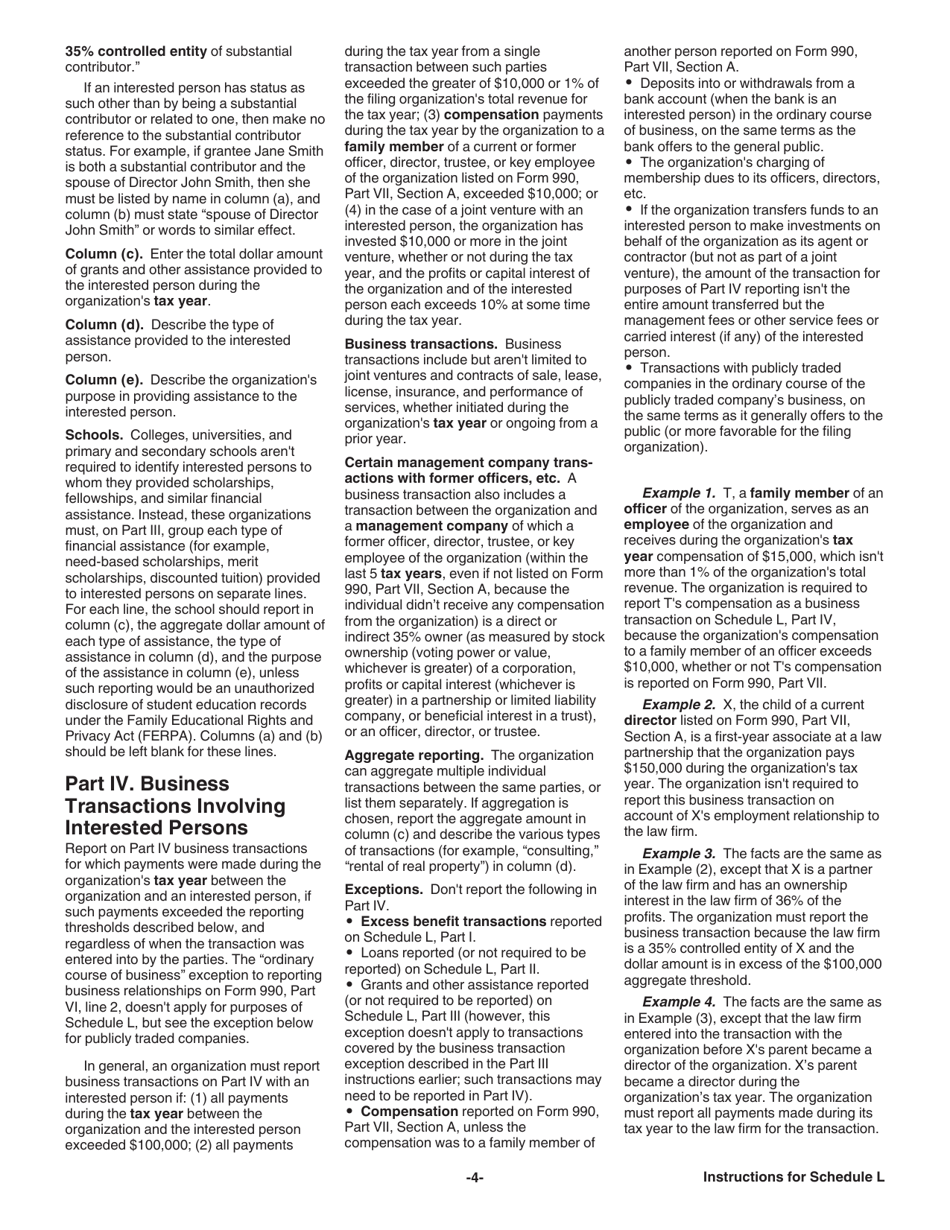

Instructions for IRS Form 990, 990-EZ Schedule L Transactions With Interested Persons

This document contains official instructions for IRS Form 990 Schedule L and IRS Form 990-EZ Schedule L . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule L is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is the annual information return filed by tax-exempt organizations in the United States.

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of Form 990, designed for smaller tax-exempt organizations.

Q: What is Schedule L?

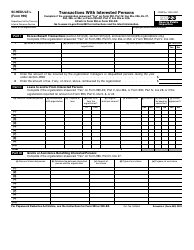

A: Schedule L is a section of Form 990 and 990-EZ that requires disclosure of certain transactions with interested persons.

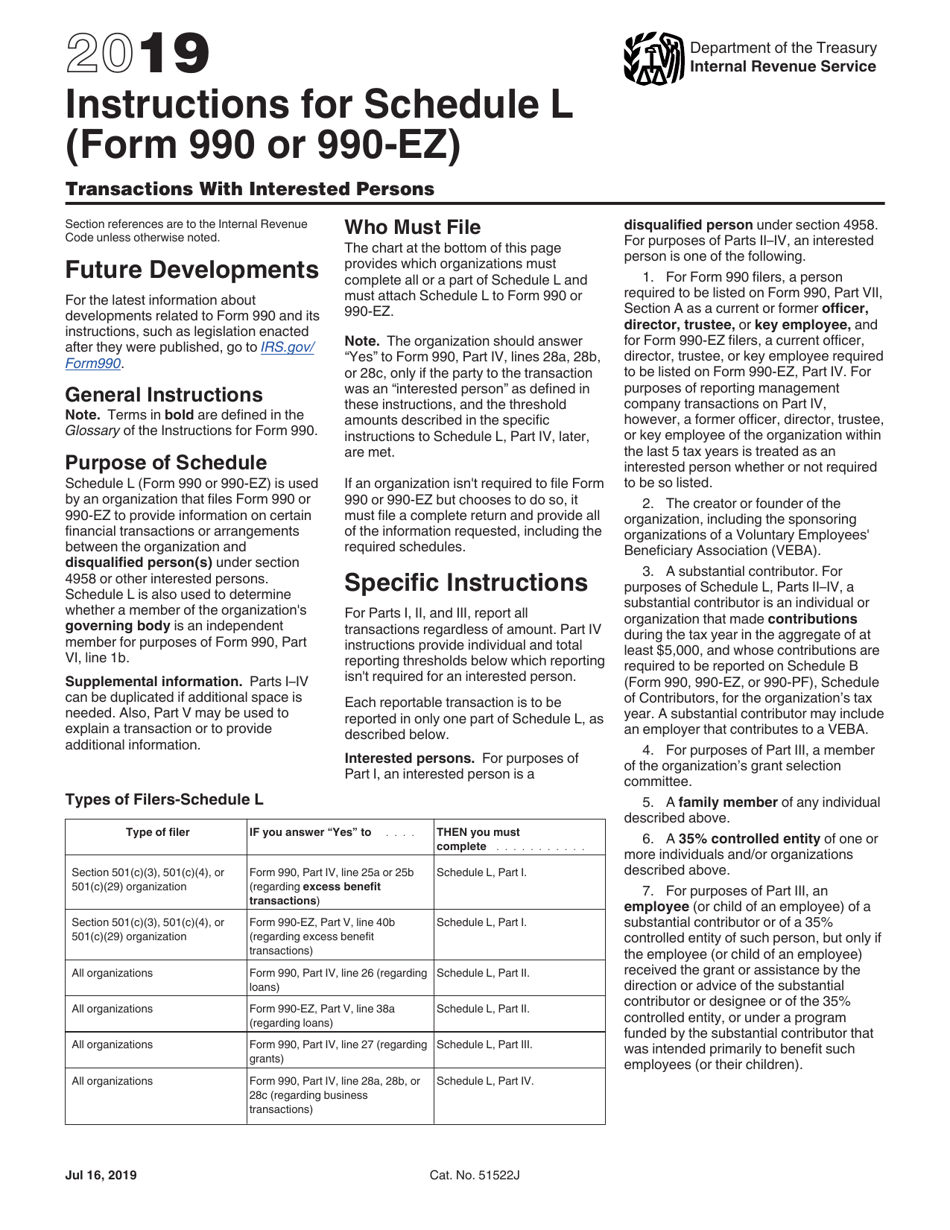

Q: Who are considered interested persons?

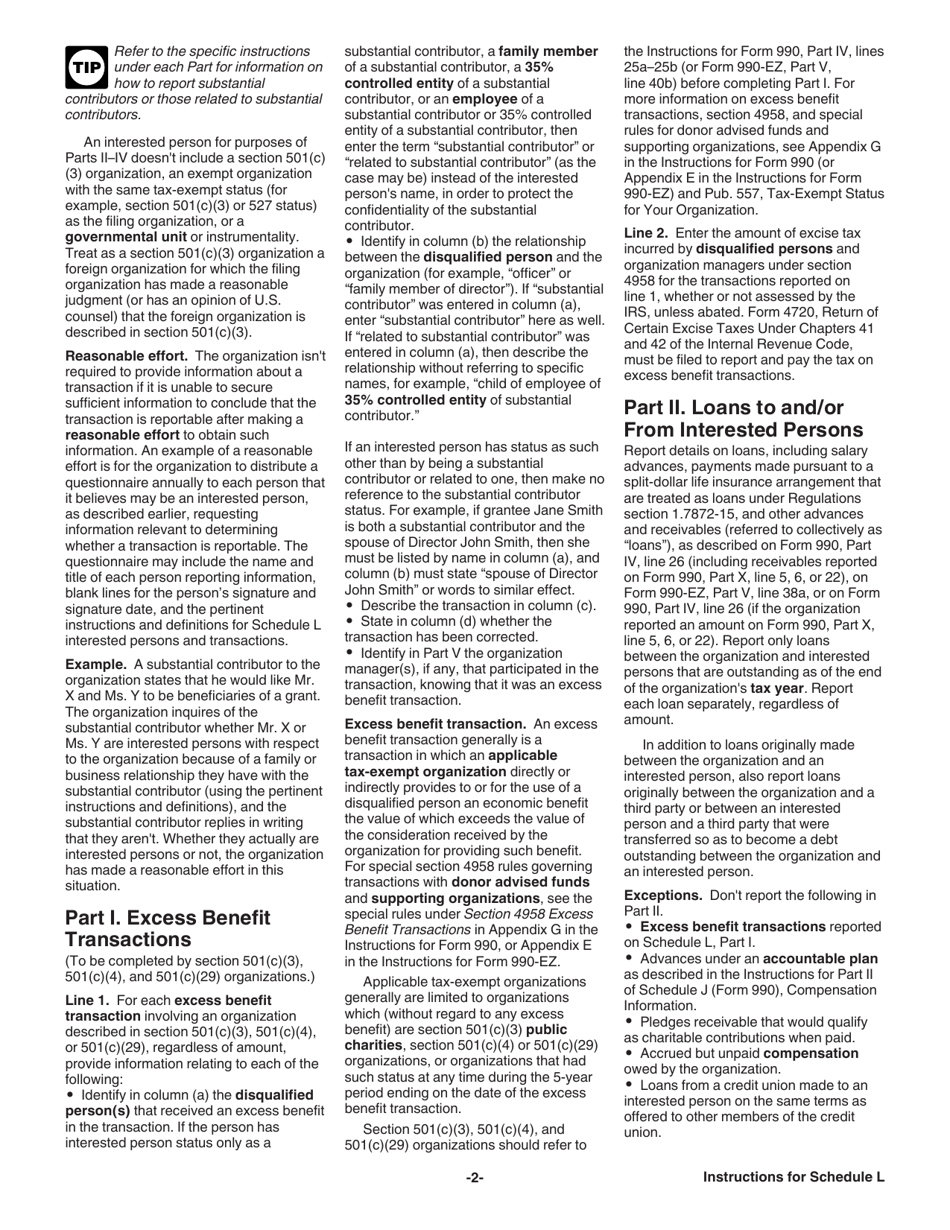

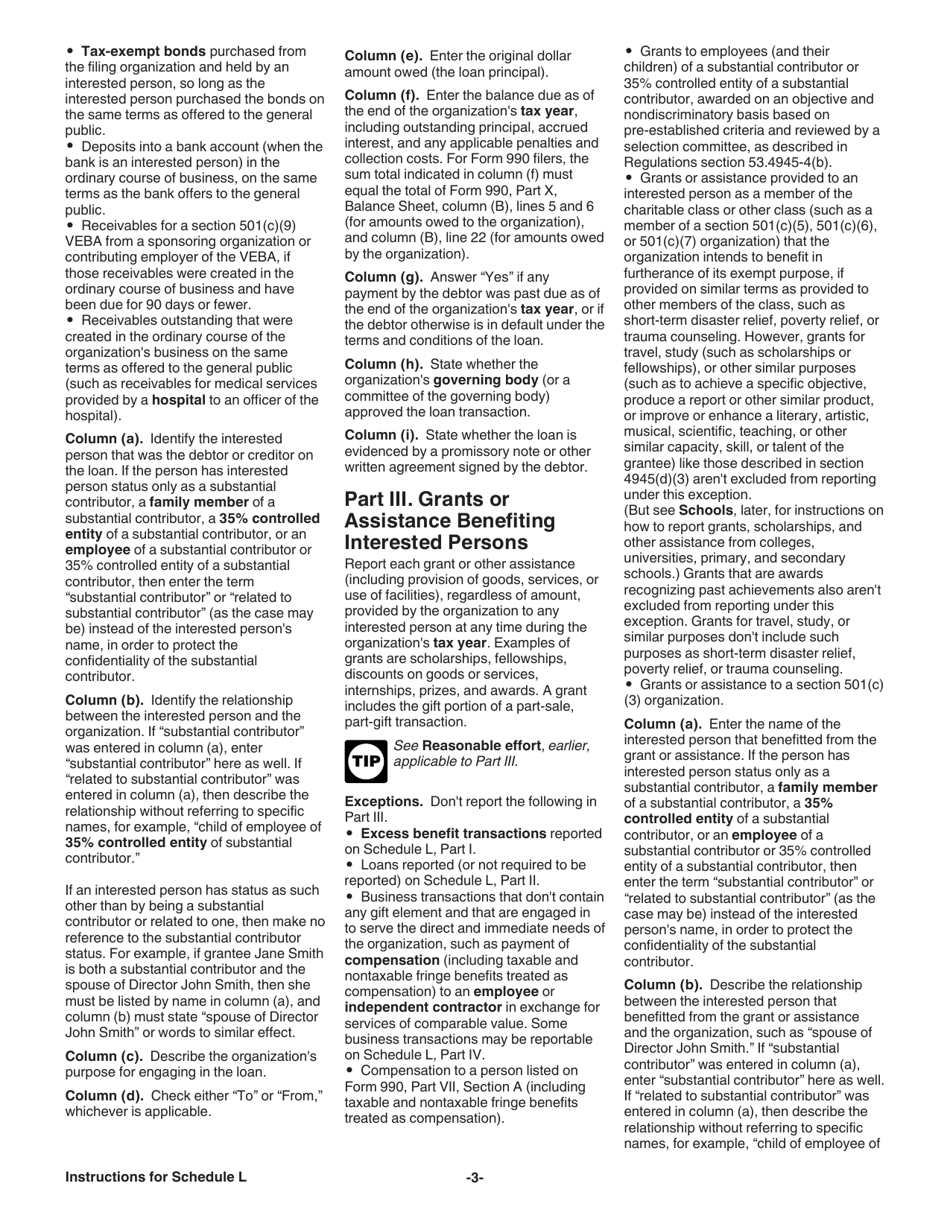

A: Interested persons include individuals or organizations with a substantial influence over the organization's affairs, such as officers, key employees, and substantial contributors.

Q: What types of transactions are reported on Schedule L?

A: Schedule L requires reporting of loans, grants, business transactions, and certain contracts between the organization and interested persons.

Q: Why are transactions with interested persons disclosed?

A: Transparency and prevention of conflicts of interest are important for maintaining the public's trust in tax-exempt organizations.

Q: Are all transactions with interested persons prohibited?

A: No, not all transactions are prohibited, but they must be properly disclosed to avoid conflicts of interest.

Q: Is there a deadline for filing Form 990?

A: Yes, tax-exempt organizations must file Form 990 by the 15th day of the 5th month after the end of their fiscal year.

Q: What happens if a tax-exempt organization fails to file Form 990?

A: Failure to file Form 990 may result in penalties and the loss of tax-exempt status.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.