This version of the form is not currently in use and is provided for reference only. Download this version of

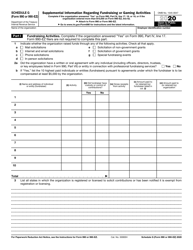

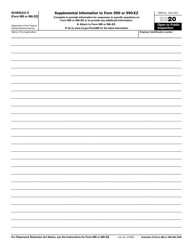

Instructions for IRS Form 990 Schedule D

for the current year.

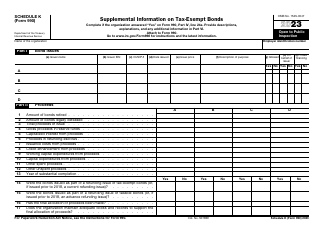

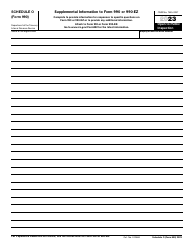

Instructions for IRS Form 990 Schedule D Supplemental Financial Statements

This document contains official instructions for IRS Form 990 Schedule D, Supplemental Financial Statements - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is the annual information return that certain tax-exempt organizations in the United States are required to file with the Internal Revenue Service (IRS).

Q: What is Schedule D?

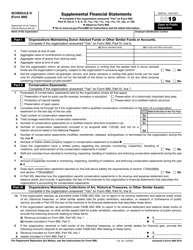

A: Schedule D is a supplemental form that must be filed along with Form 990. It is used to provide additional financial information about the organization.

Q: What are Supplemental Financial Statements?

A: Supplemental financial statements are additional financial disclosures that an organization may need to provide to the IRS. These statements provide further details about the organization's revenue, expenses, assets, and liabilities.

Q: Who needs to file Schedule D Supplemental Financial Statements?

A: Certain tax-exempt organizations, such as public charities, private foundations, and certain other exempt organizations, are required to file Schedule D if they meet certain financial thresholds.

Q: What information is required in Schedule D?

A: Schedule D requires the organization to provide information about their investments, including stocks, bonds, and other securities, as well as any income or losses related to these investments.

Q: When is the deadline to file Form 990 and Schedule D?

A: The deadline to file Form 990 and Schedule D is the 15th day of the 5th month after the organization's fiscal year ends.

Q: What happens if an organization fails to file Form 990 or Schedule D?

A: Failure to file Form 990 or Schedule D can result in penalties and may lead to the loss of tax-exempt status for the organization.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.