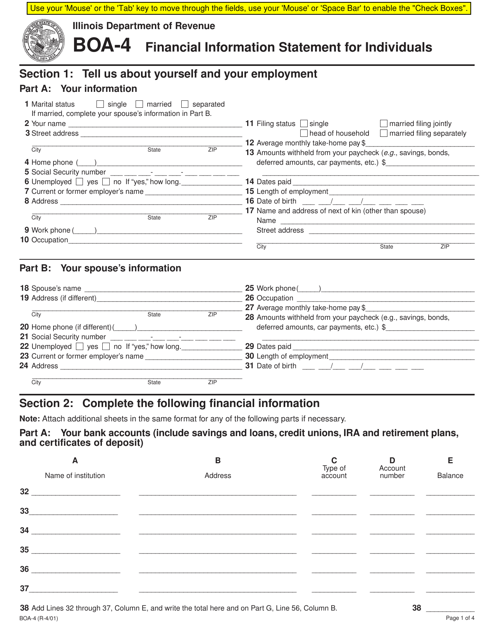

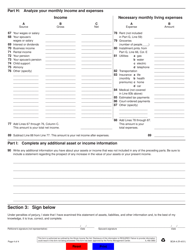

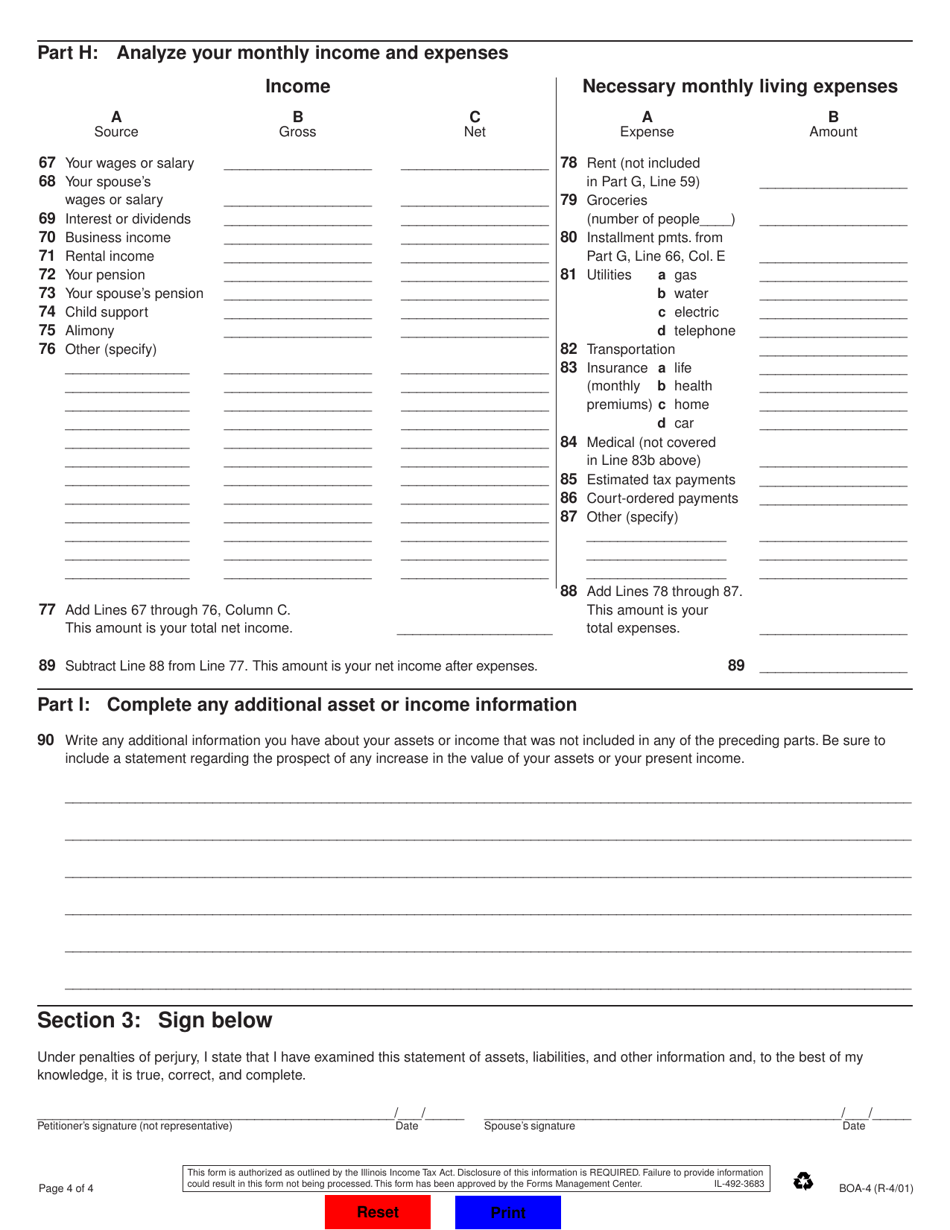

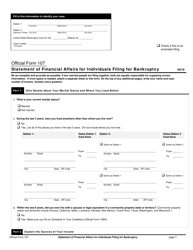

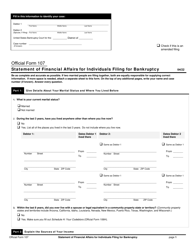

Form BOA-4 Financial Information Statement for Individuals - Illinois

What Is Form BOA-4?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BOA-4 form?

A: The BOA-4 form is the Financial Information Statement for Individuals in Illinois.

Q: Who needs to fill out the BOA-4 form?

A: Individuals in Illinois who are involved in legal proceedings related to financial matters may need to fill out the BOA-4 form.

Q: What is the purpose of the BOA-4 form?

A: The BOA-4 form is used to gather financial information from individuals in legal proceedings to assess their financial situation.

Q: Are there any filing fees for the BOA-4 form?

A: The filing fees for the BOA-4 form may vary depending on the court where the form is filed. It is advisable to check with the specific court for the applicable fees.

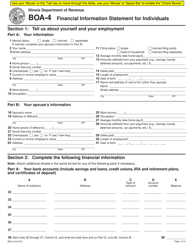

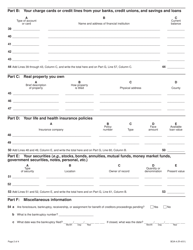

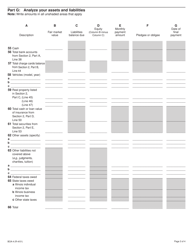

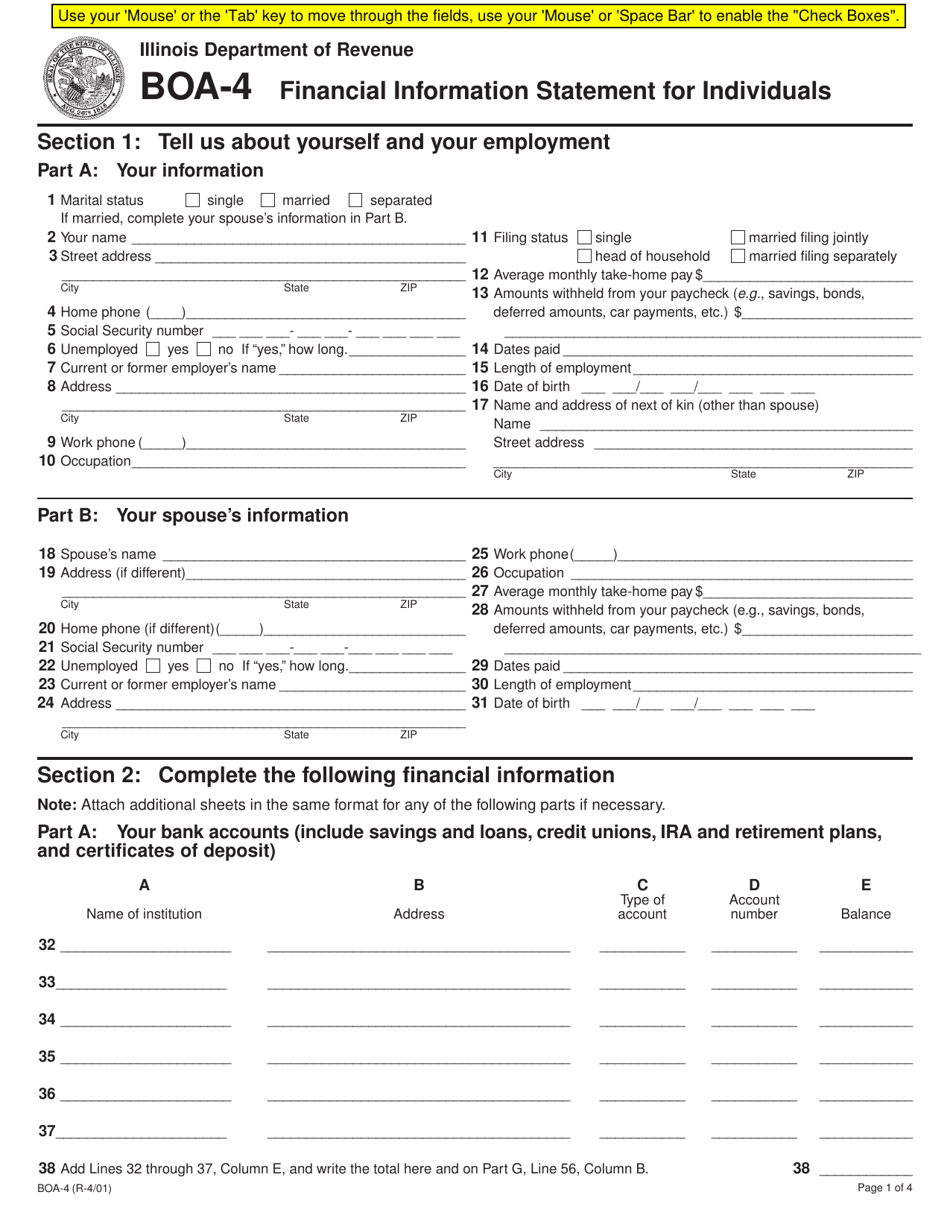

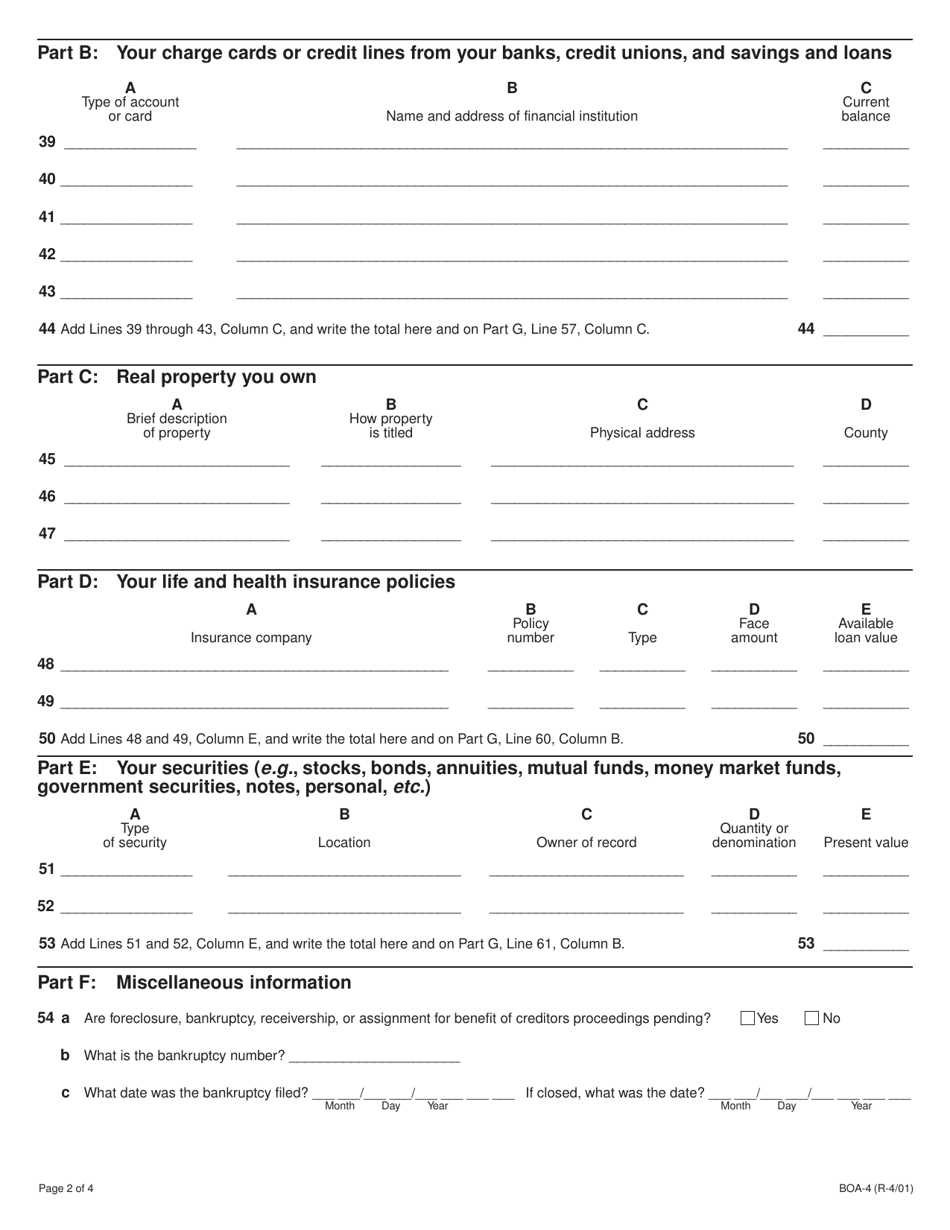

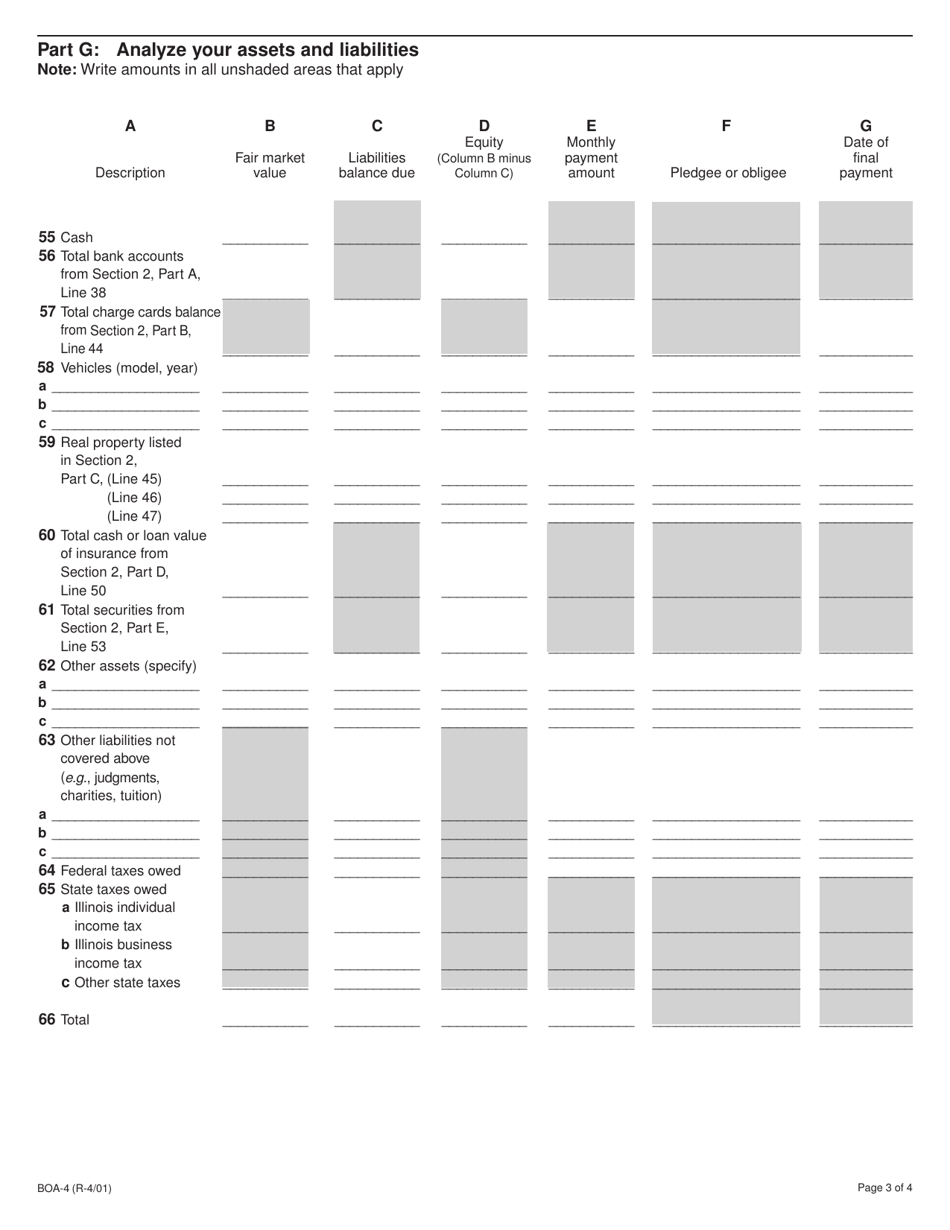

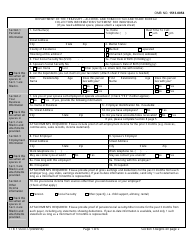

Q: What type of information is required on the BOA-4 form?

A: The BOA-4 form requires individuals to provide information about their income, assets, debts, and expenses.

Q: Is the information provided on the BOA-4 form confidential?

A: The information provided on the BOA-4 form may be subject to confidentiality rules and protected by the court. However, it is recommended to consult with a legal professional for specific advice regarding confidentiality.

Q: What should I do if I have trouble filling out the BOA-4 form?

A: If you have difficulty completing the BOA-4 form, it is recommended to seek assistance from a legal professional.

Q: Is the BOA-4 form specific to Illinois?

A: Yes, the BOA-4 form is specific to individuals involved in legal proceedings in Illinois.

Form Details:

- Released on April 1, 2001;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOA-4 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.