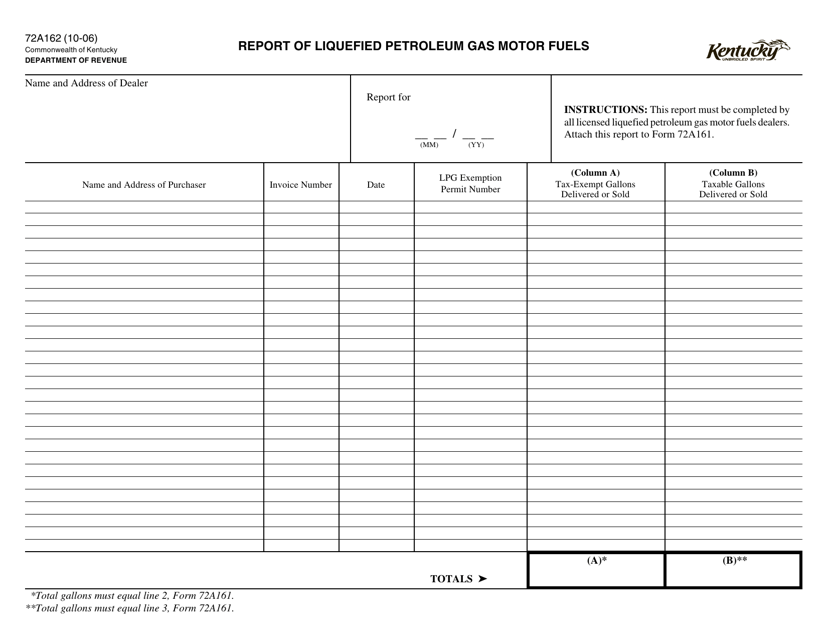

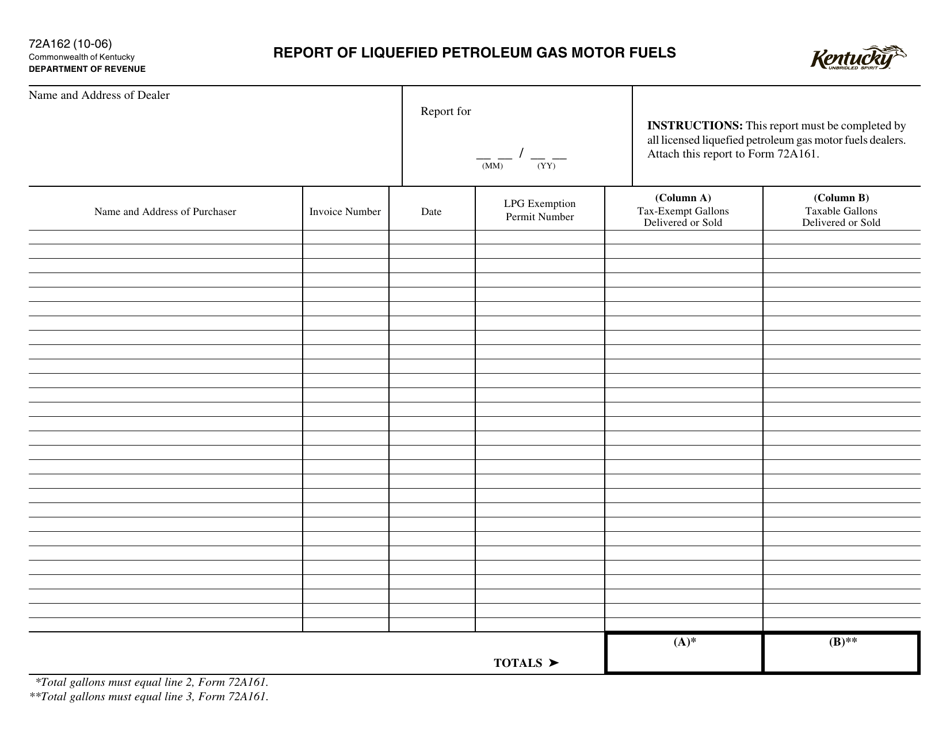

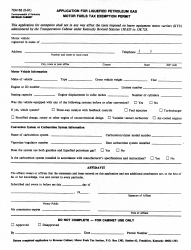

Form 72A162 Report of Liquefied Petroleum Gas Motor Fuels - Kentucky

What Is Form 72A162?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A162?

A: Form 72A162 is the Report of Liquefied Petroleum Gas Motor Fuels for the state of Kentucky.

Q: What is the purpose of Form 72A162?

A: The purpose of Form 72A162 is to report the sales and use of liquefied petroleum gasmotor fuels in Kentucky.

Q: Who needs to file Form 72A162?

A: Businesses or individuals who sell or use liquefied petroleum gas motor fuels in Kentucky need to file Form 72A162.

Q: When is Form 72A162 due?

A: Form 72A162 is due on or before the 20th day of the month following the end of the reporting period.

Q: What information is required on Form 72A162?

A: Form 72A162 requires information such as the total gallons of liquefied petroleum gas motor fuels sold or used, the total tax due, and any credits or refunds claimed.

Q: Are there any penalties for late filing of Form 72A162?

A: Yes, there are penalties for late filing of Form 72A162, including a late filing fee and interest on any unpaid tax.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A162 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.