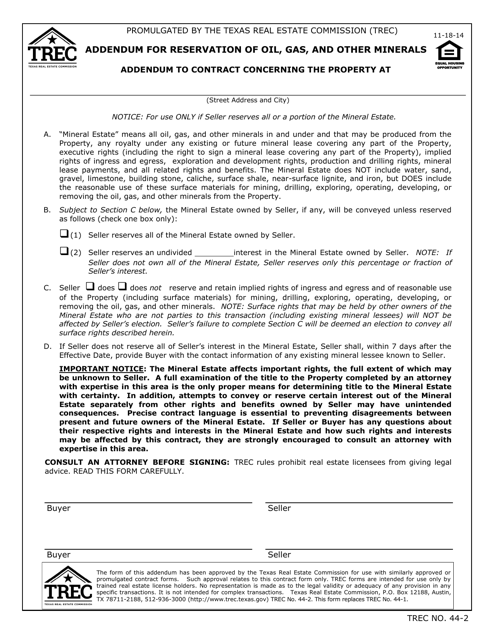

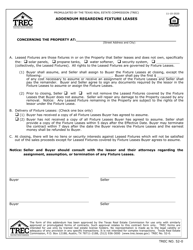

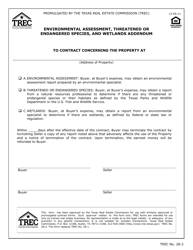

TREC Form 44-2 Addendum for Reservation of Oil, Gas and Other Minerals - Texas

What Is TREC Form 44-2?

This is a legal form that was released by the Texas Real Estate Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TREC Form 44-2?

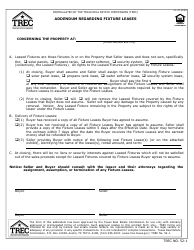

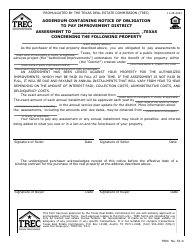

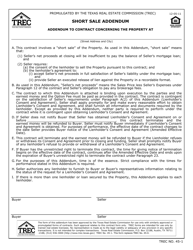

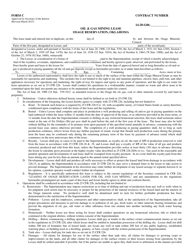

A: TREC Form 44-2 is an addendum used in Texas for reserving oil, gas, and other minerals in a real estate transaction.

Q: What is the purpose of TREC Form 44-2?

A: The purpose of TREC Form 44-2 is to provide a legally binding document that allows the seller to reserve oil, gas, and other mineral rights when selling a property in Texas.

Q: Who uses TREC Form 44-2?

A: TREC Form 44-2 is used by sellers and buyers of real estate in Texas who wish to reserve or exclude oil, gas, and other mineral rights from the sale.

Q: What does TREC stand for?

A: TREC stands for Texas Real Estate Commission, the governing body that regulates real estate practices in Texas.

Q: Can TREC Form 44-2 be used in other states?

A: No, TREC Form 44-2 is specific to Texas and is not applicable in other states.

Q: Is TREC Form 44-2 legally binding?

A: Yes, TREC Form 44-2 is a legally binding document when properly executed according to Texas real estate laws.

Form Details:

- Released on November 18, 2014;

- The latest edition provided by the Texas Real Estate Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TREC Form 44-2 by clicking the link below or browse more documents and templates provided by the Texas Real Estate Commission.