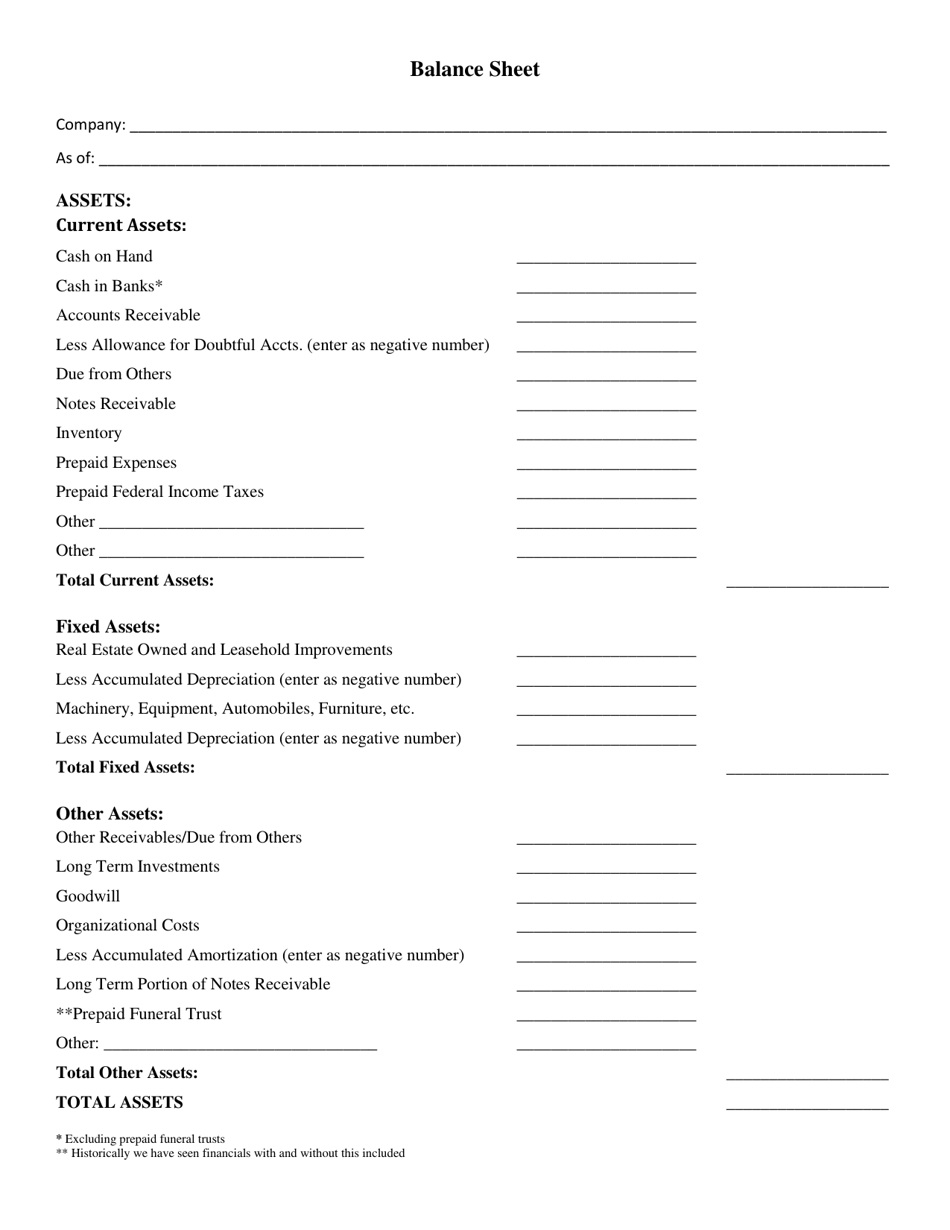

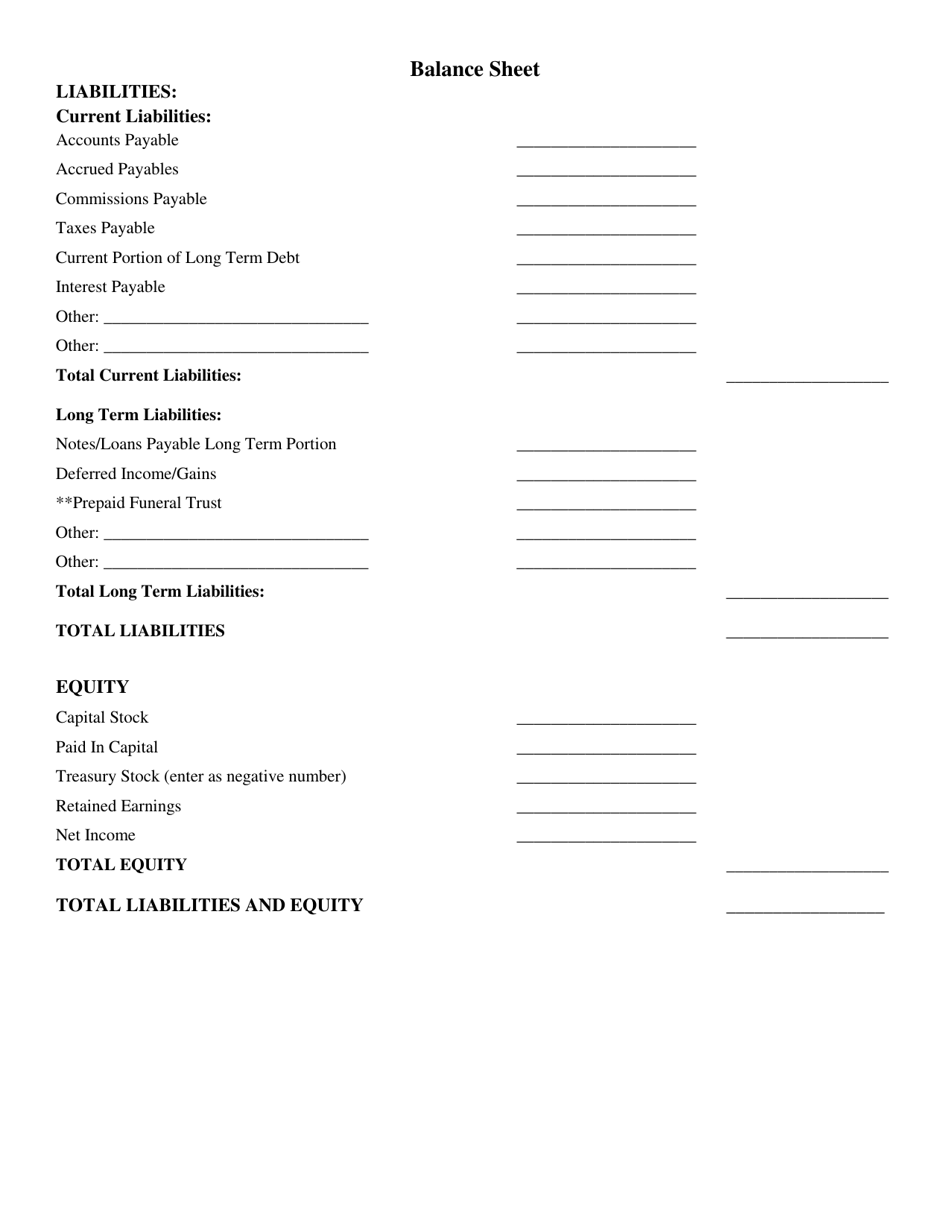

Balance Sheet - Texas

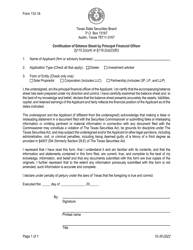

Balance Sheet is a legal document that was released by the Texas Department of Banking - a government authority operating within Texas.

FAQ

Q: What is a balance sheet?

A: A balance sheet is a financial statement that shows a company's assets, liabilities, and shareholders' equity at a specific point in time.

Q: Why is a balance sheet important?

A: A balance sheet provides a snapshot of a company's financial health and helps investors, creditors, and analysts assess its financial position.

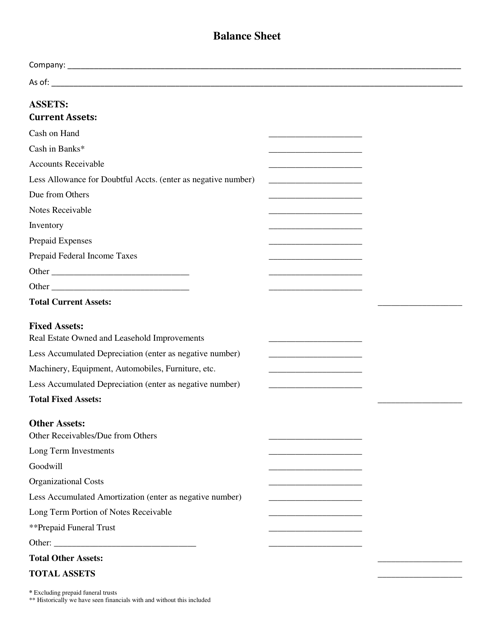

Q: What does 'assets' mean on a balance sheet?

A: Assets represent the resources owned by a company, such as cash, accounts receivable, inventory, and property.

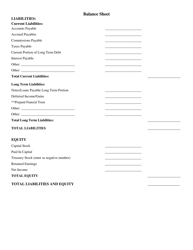

Q: What are 'liabilities' on a balance sheet?

A: Liabilities are the debts and obligations that a company owes to creditors, such as loans, accounts payable, and accrued expenses.

Q: What is 'shareholders' equity' on a balance sheet?

A: Shareholders' equity, also known as net worth or book value, represents the residual interest in the assets of a company after deducting liabilities.

Q: How is a balance sheet structured?

A: A balance sheet is structured into three sections: assets, liabilities, and shareholders' equity. Assets are listed first, followed by liabilities, and then shareholders' equity.

Q: What is the formula for calculating shareholders' equity?

A: Shareholders' equity is calculated as the difference between a company's total assets and total liabilities: Shareholders' Equity = Total Assets - Total Liabilities.

Q: Can a balance sheet change over time?

A: Yes, a balance sheet can change over time as a company's assets, liabilities, and shareholders' equity fluctuate due to business activities and financial transactions.

Q: How often is a balance sheet prepared?

A: A balance sheet is typically prepared at the end of each accounting period, such as monthly, quarterly, or annually.

Form Details:

- The latest edition currently provided by the Texas Department of Banking;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.