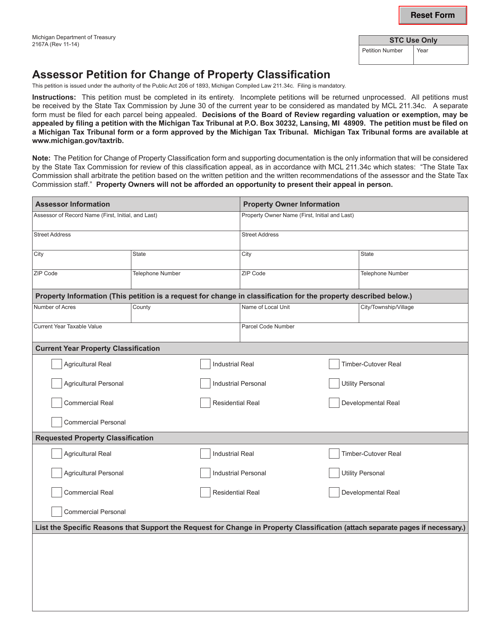

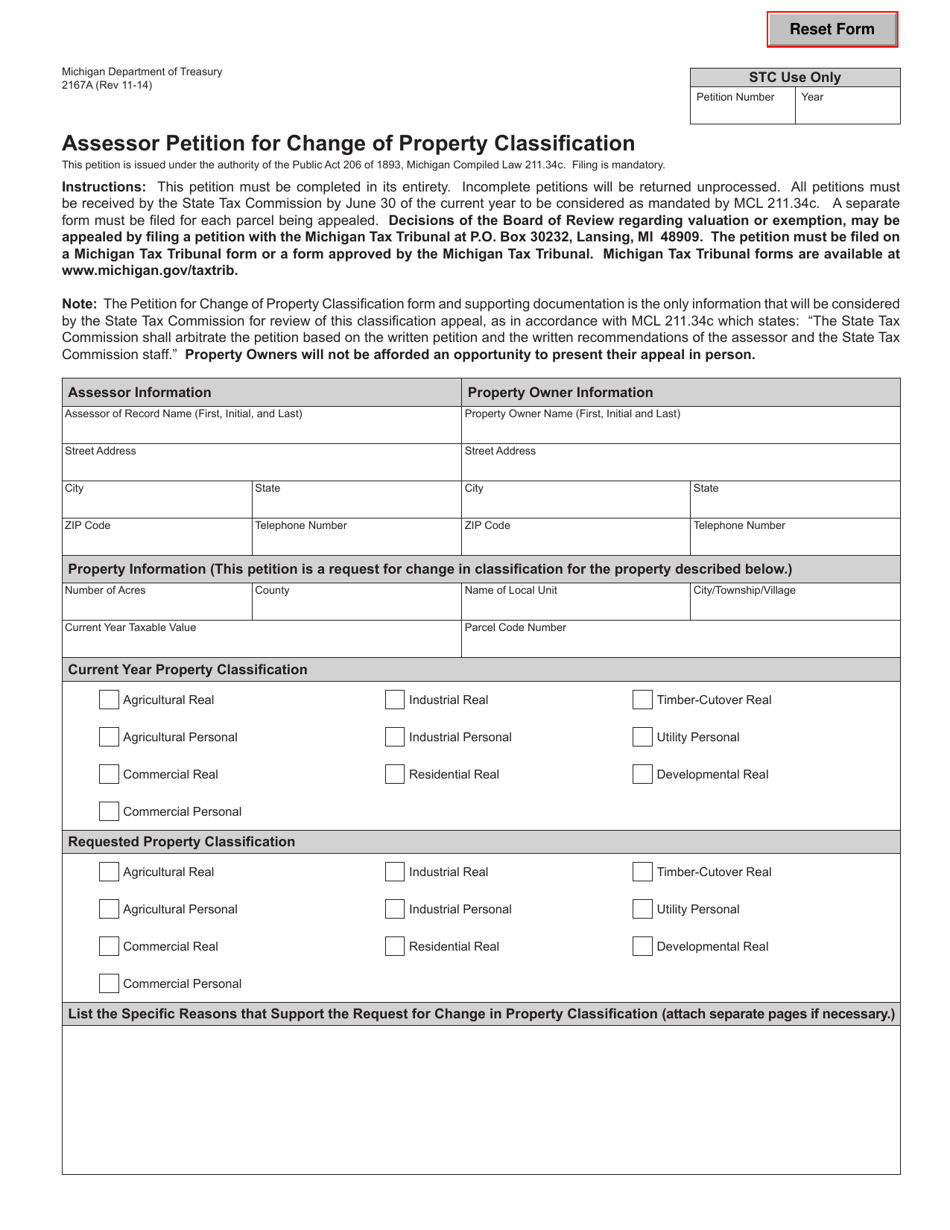

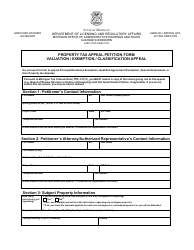

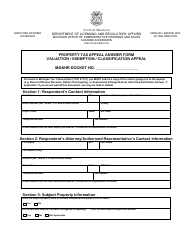

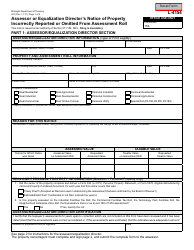

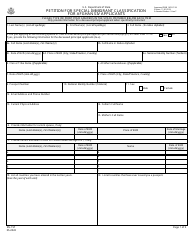

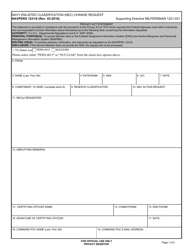

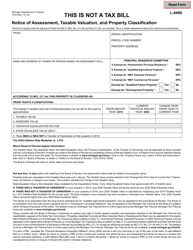

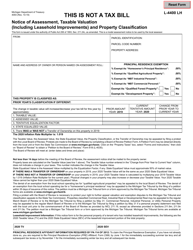

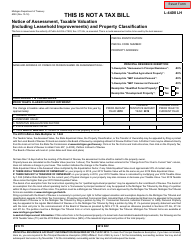

Form 2167A Assessor Petition for Change of Property Classification - Michigan

What Is Form 2167A?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

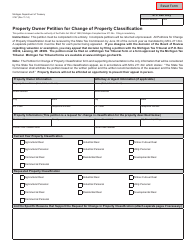

Q: What is Form 2167A?

A: Form 2167A is the Assessor Petition for Change of Property Classification in Michigan.

Q: What is the purpose of Form 2167A?

A: The purpose of Form 2167A is to request a change in property classification for assessment purposes.

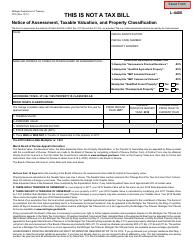

Q: Who can use Form 2167A?

A: Form 2167A can be used by property owners in Michigan who want to request a change in property classification.

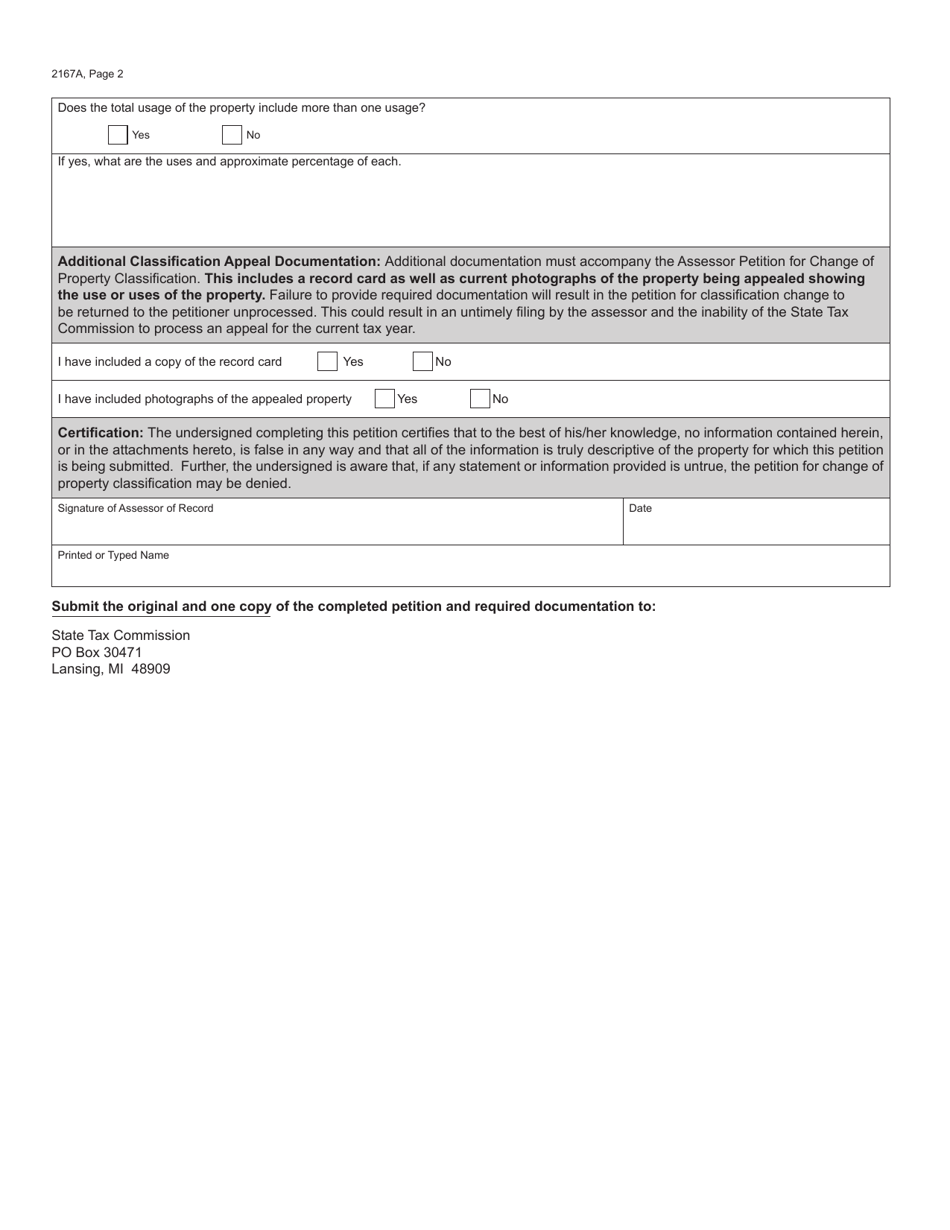

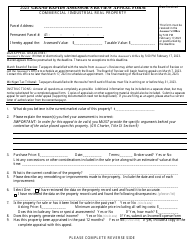

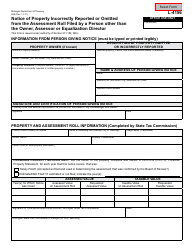

Q: What information is required on Form 2167A?

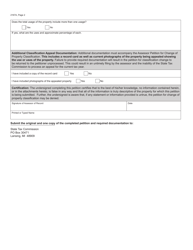

A: Form 2167A requires information such as the property description, owner's information, and detailed reasons for requesting the change in classification.

Q: Are there any fees associated with Form 2167A?

A: There may be fees associated with submitting Form 2167A. Contact your local assessor's office for information on any applicable fees.

Q: What happens after submitting Form 2167A?

A: After submitting Form 2167A, the local assessor's office will review the request and make a determination on whether to approve or deny the change in property classification.

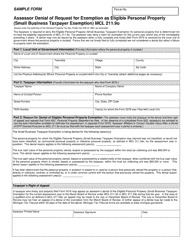

Q: Can I appeal a decision made on my Form 2167A?

A: Yes, if your request for a change in property classification is denied, you may have the option to appeal the decision through the Michigan Tax Tribunal.

Q: Are there any deadlines for submitting Form 2167A?

A: It is recommended to submit Form 2167A within 35 days of the assessment change notice. Check with your local assessor's office for any specific deadlines.

Q: Can Form 2167A be used for other purposes?

A: No, Form 2167A is specifically for requesting a change in property classification in Michigan.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2167A by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.