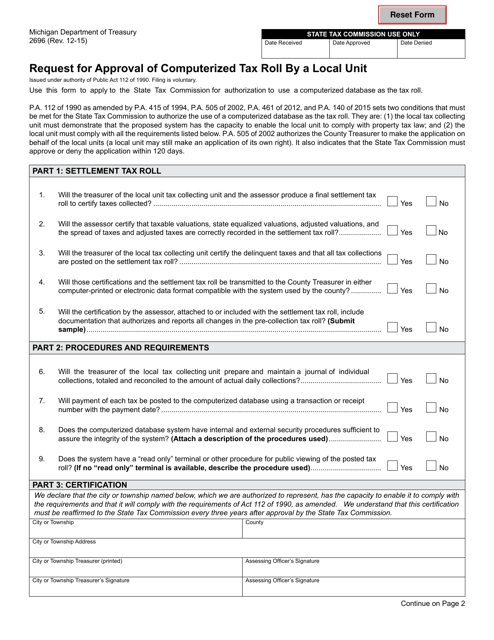

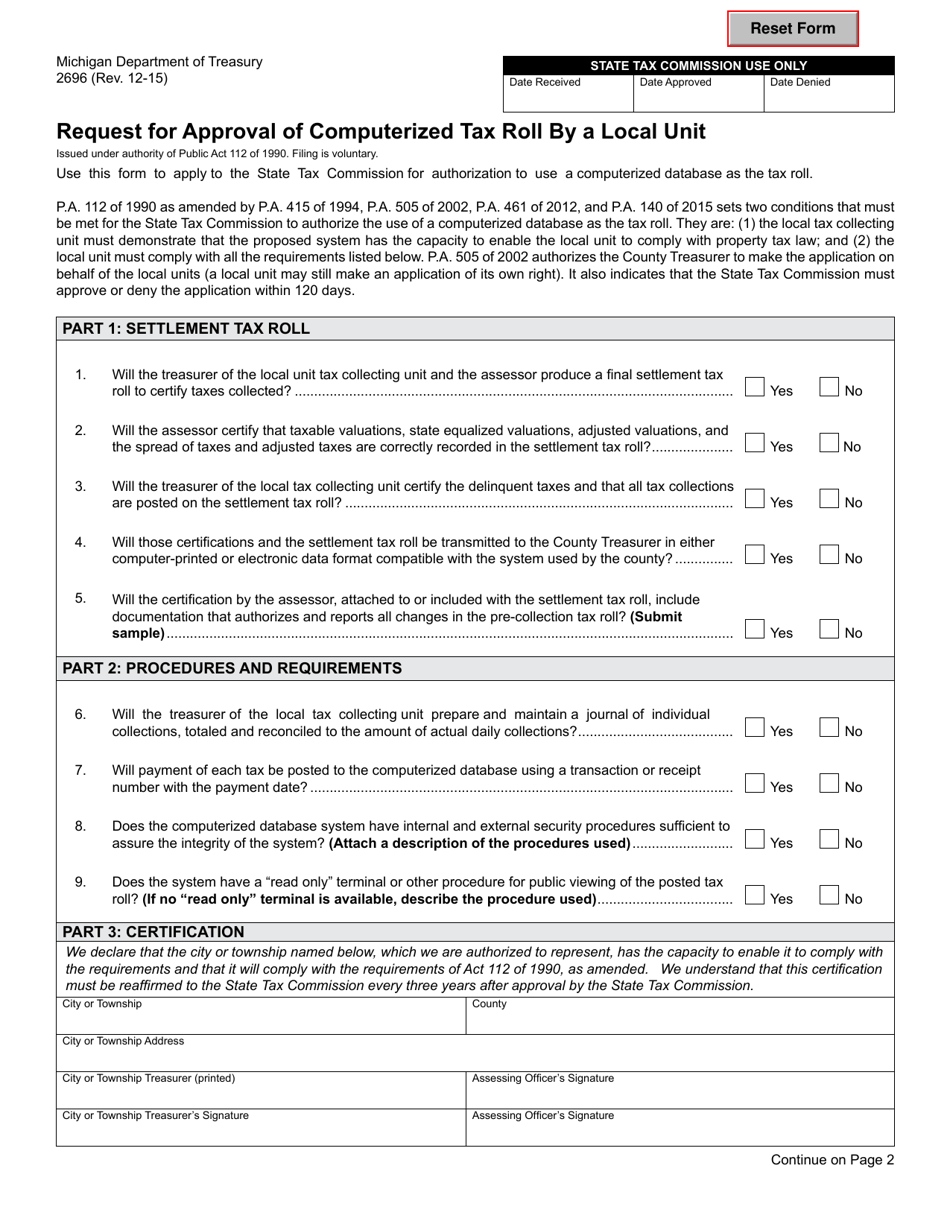

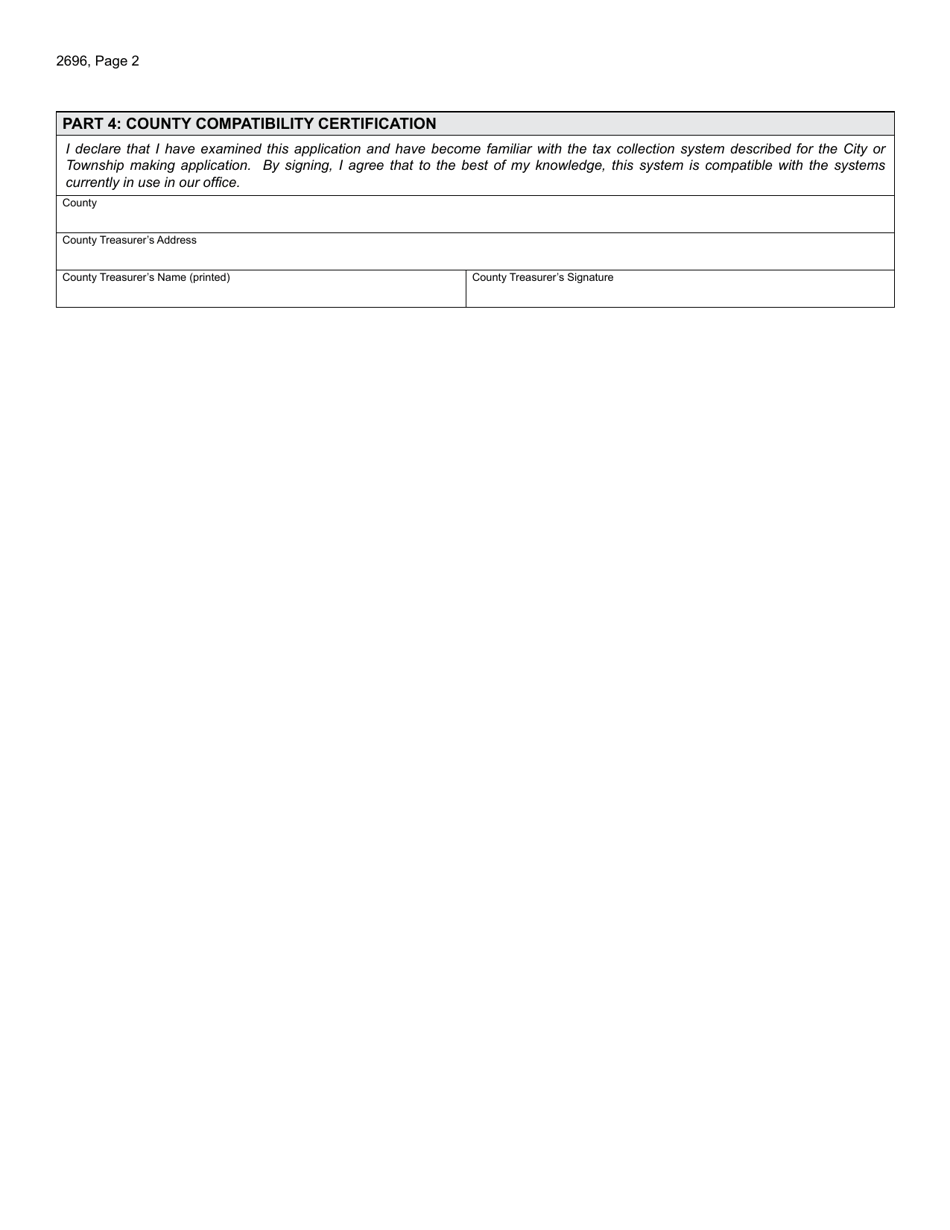

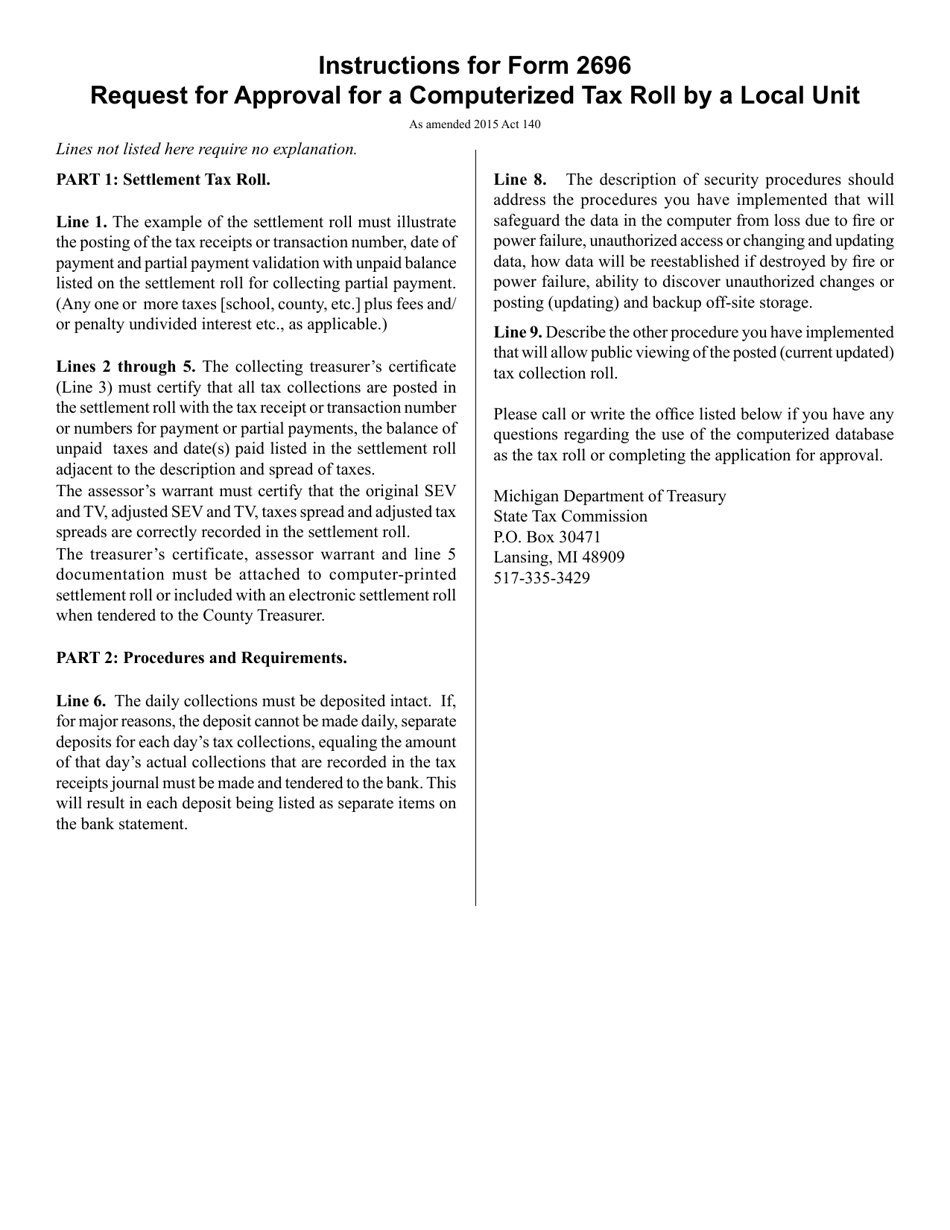

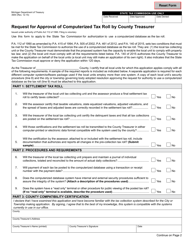

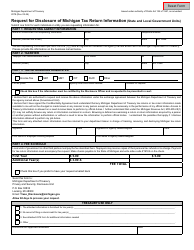

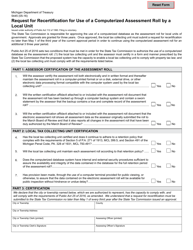

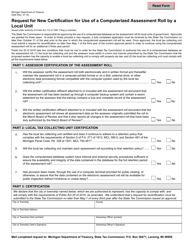

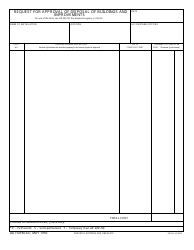

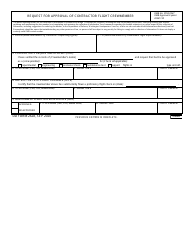

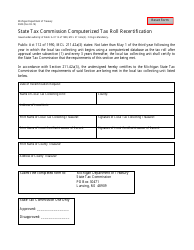

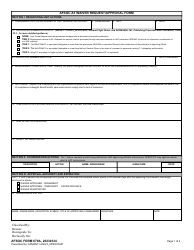

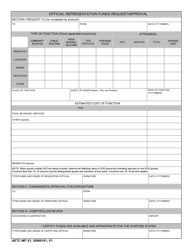

Form 2696 Request for Approval of Computerized Tax Roll by a Local Unit - Michigan

What Is Form 2696?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2696?

A: Form 2696 is a request for approval of computerized tax roll by a local unit in the state of Michigan.

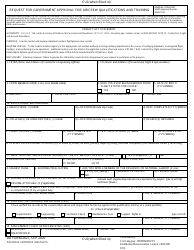

Q: Who is required to file Form 2696?

A: Local units in Michigan that use computerized tax rolls are required to file Form 2696.

Q: What is the purpose of filing Form 2696?

A: The purpose of filing Form 2696 is to obtain approval for using a computerized tax roll for property tax assessments.

Q: When should Form 2696 be filed?

A: Form 2696 should be filed at least 60 days prior to the start of the tax collection year.

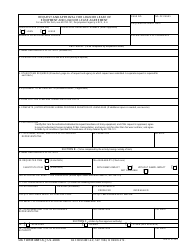

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

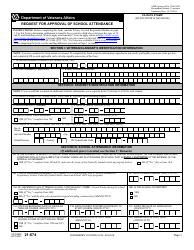

Download a fillable version of Form 2696 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.