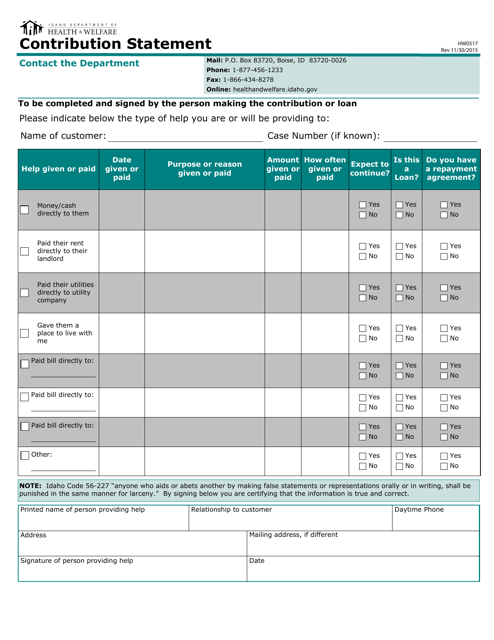

Form HW0517 Contribution Statement - Idaho

What Is Form HW0517?

This is a legal form that was released by the Idaho Department of Health and Welfare - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form HW0517 Contribution Statement?

A: The Form HW0517 Contribution Statement is a document that reports the wages and contributions made by an employer for their employees in the state of Idaho.

Q: Who needs to file a Form HW0517 Contribution Statement?

A: Employers in Idaho who have paid wages to one or more employees during the tax year need to file a Form HW0517 Contribution Statement.

Q: What information is included in a Form HW0517 Contribution Statement?

A: A Form HW0517 Contribution Statement includes the employer's information, employee's information, wages paid, and contributions made towards state unemployment insurance.

Q: When is the deadline for filing a Form HW0517 Contribution Statement?

A: The deadline for filing a Form HW0517 Contribution Statement is January 31st of the year following the tax year.

Q: Is there a penalty for not filing a Form HW0517 Contribution Statement?

A: Yes, there can be penalties for not filing a Form HW0517 Contribution Statement, including late filing penalties and interest charges on unpaid contributions.

Q: Can an employer amend a filed Form HW0517 Contribution Statement?

A: Yes, if an employer needs to make changes to a filed Form HW0517 Contribution Statement, they can file an amended form with the Idaho Department of Labor.

Form Details:

- Released on November 30, 2015;

- The latest edition provided by the Idaho Department of Health and Welfare;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW0517 by clicking the link below or browse more documents and templates provided by the Idaho Department of Health and Welfare.