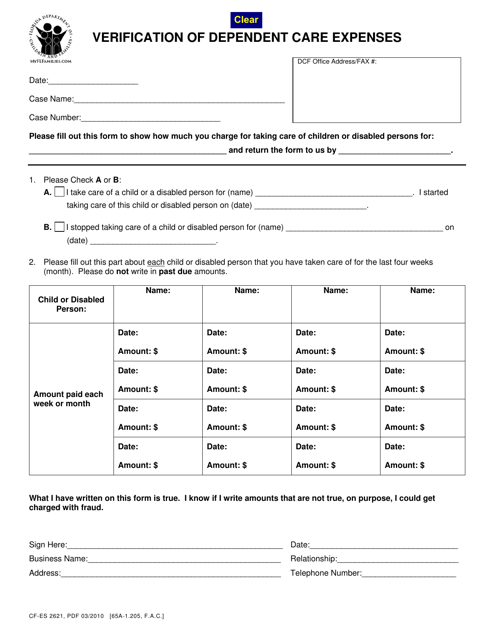

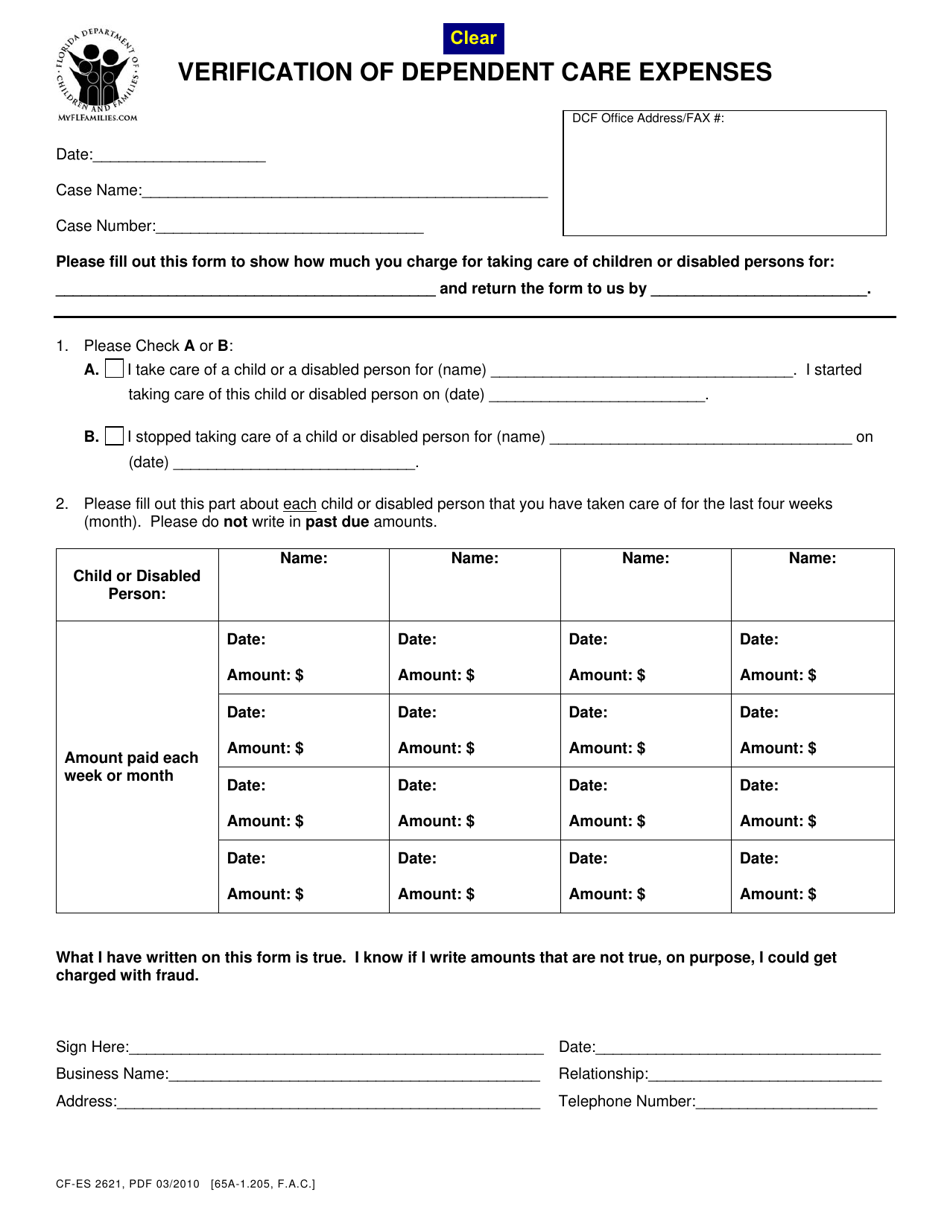

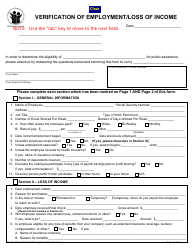

Form CF-ES2621 Verification of Dependent Care Expenses - Florida

What Is Form CF-ES2621?

This is a legal form that was released by the Florida Department of Children and Families - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CF-ES2621 Verification of Dependent Care Expenses?

A: Form CF-ES2621 is a form used in Florida to verify dependent care expenses.

Q: Who needs to fill out Form CF-ES2621?

A: Any individual who has incurred dependent care expenses in Florida may need to fill out Form CF-ES2621.

Q: What is the purpose of Form CF-ES2621?

A: The purpose of Form CF-ES2621 is to provide documentation of dependent care expenses for tax or benefit purposes.

Q: What information is required on Form CF-ES2621?

A: Form CF-ES2621 requires information such as the taxpayer's name, dependent's information, care provider's information, and details of the expenses incurred.

Q: Is there a deadline for submitting Form CF-ES2621?

A: The deadline for submitting Form CF-ES2621 may vary depending on the purpose for which it is being used. It is advisable to check the specific deadline requirements.

Q: Are there any supporting documents required with Form CF-ES2621?

A: Yes, depending on the circumstances, supporting documents such as receipts or invoices for dependent care expenses may need to be submitted along with Form CF-ES2621.

Q: What should I do if I have questions about Form CF-ES2621?

A: If you have any questions about Form CF-ES2621, you can contact the Florida Department of Children and Families or consult with a tax professional.

Form Details:

- Released on March 1, 2010;

- The latest edition provided by the Florida Department of Children and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CF-ES2621 by clicking the link below or browse more documents and templates provided by the Florida Department of Children and Families.