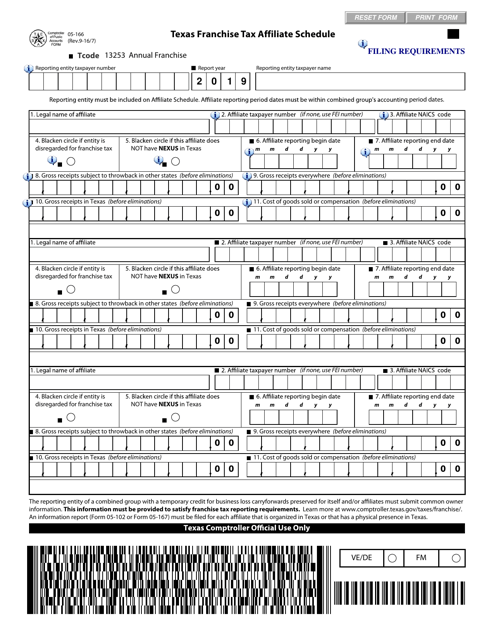

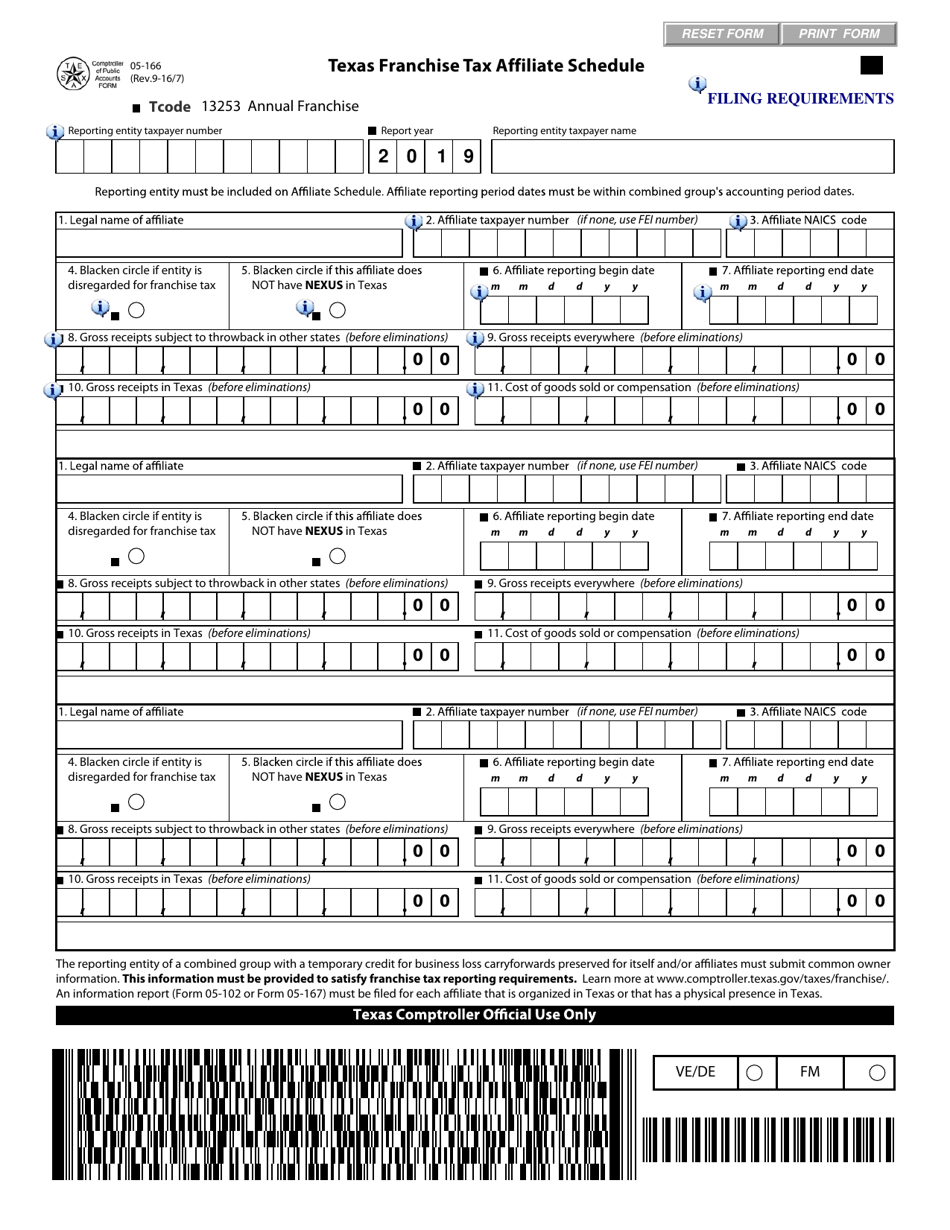

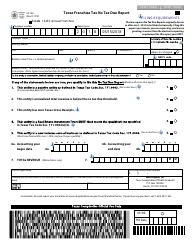

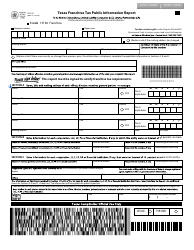

Form 05-166 Texas Franchise Tax Affiliate Schedule - Texas

What Is Form 05-166?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 05-166?

A: Form 05-166 is the Texas Franchise Tax Affiliate Schedule.

Q: What is the purpose of Form 05-166?

A: The purpose of Form 05-166 is to provide information about the affiliates of a taxpayer for the Texas Franchise Tax.

Q: Who needs to file Form 05-166?

A: Taxpayers who are subject to the Texas Franchise Tax and have affiliates need to file Form 05-166.

Q: What information is required on Form 05-166?

A: Form 05-166 requires information about the taxpayer's affiliates, including their names, addresses, and ownership percentages.

Q: When is Form 05-166 due?

A: Form 05-166 is due on the same date as the taxpayer's Texas Franchise Tax report.

Q: Are there any penalties for not filing Form 05-166?

A: Yes, there may be penalties for not filing Form 05-166, including a $50 penalty for each day the report is late, up to a maximum of $500.

Q: What if I need help with Form 05-166?

A: If you need assistance with Form 05-166, you can contact the Texas Comptroller of Public Accounts for guidance.

Form Details:

- Released on September 16, 2007;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 05-166 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.