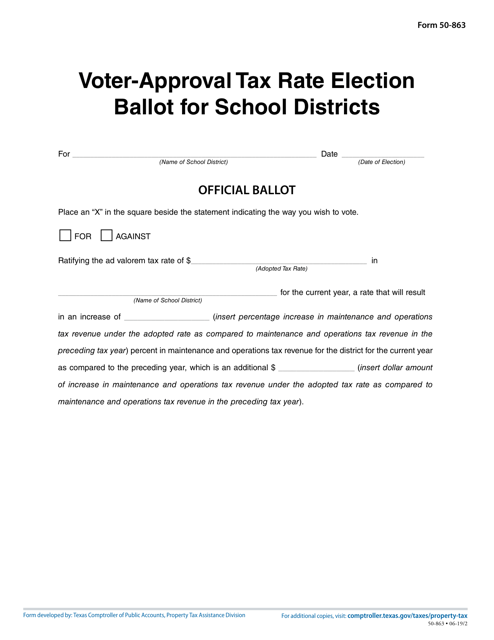

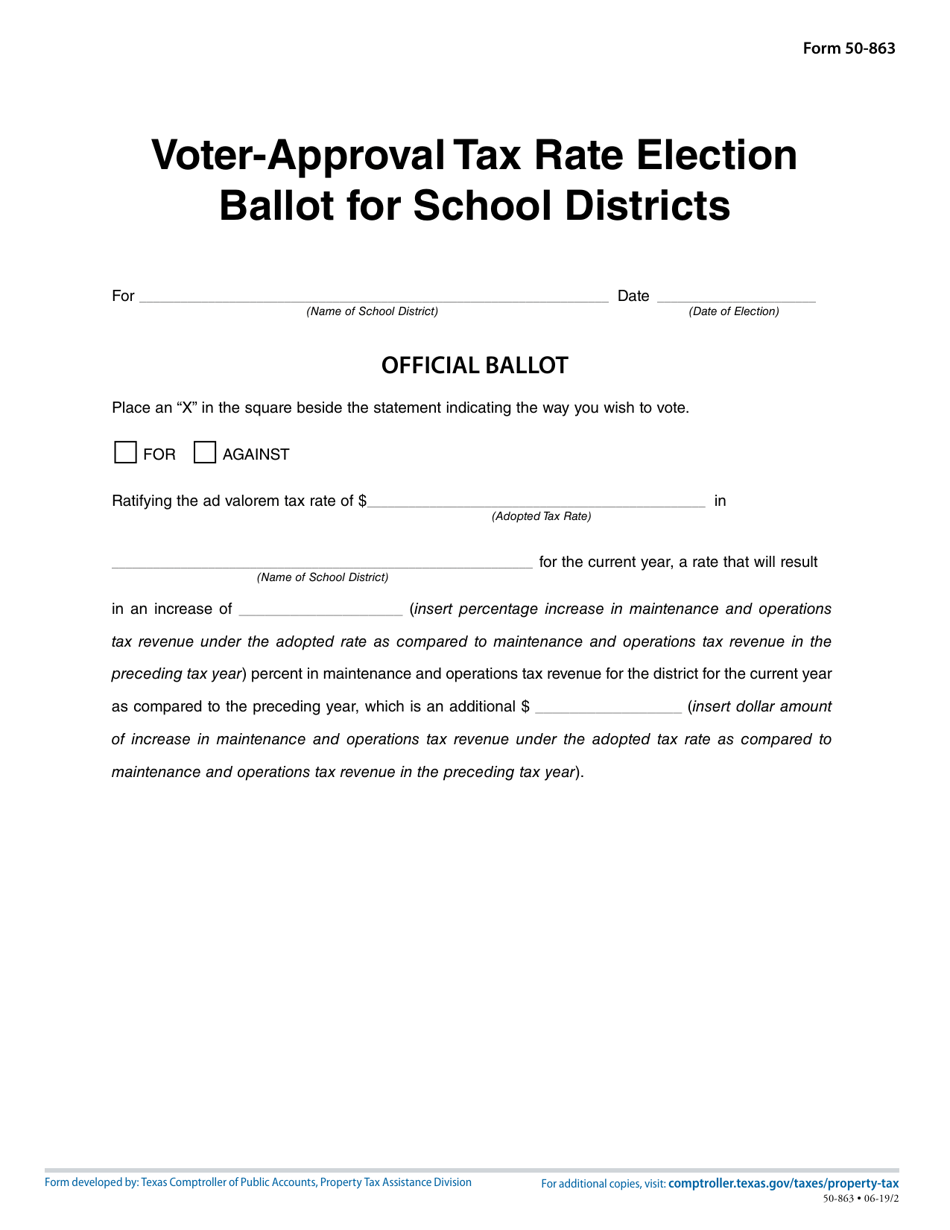

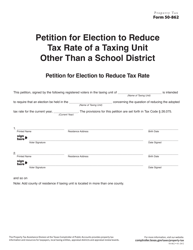

Form 50-863 Voter-Approval Tax Rate Election Ballot for School Districts - Texas

What Is Form 50-863?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-863?

A: Form 50-863 is a Voter-Approval Tax Rate Election Ballot for school districts in Texas.

Q: Who uses Form 50-863?

A: School districts in Texas use Form 50-863 for Voter-Approval Tax Rate Elections.

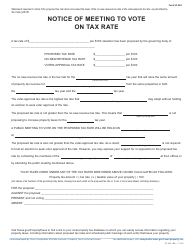

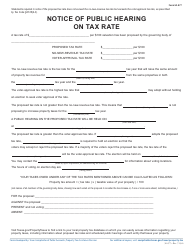

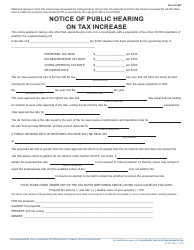

Q: What is the purpose of Form 50-863?

A: The purpose of Form 50-863 is to seek voter approval for any proposed tax rate increases in school districts.

Q: What is a Voter-Approval Tax Rate Election?

A: A Voter-Approval Tax Rate Election is a process where voters decide whether to approve a proposed tax rate increase.

Q: Why do school districts in Texas need voter approval for tax rate increases?

A: School districts in Texas require voter approval for tax rate increases to ensure transparency and accountability for the use of taxpayer funds.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-863 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.