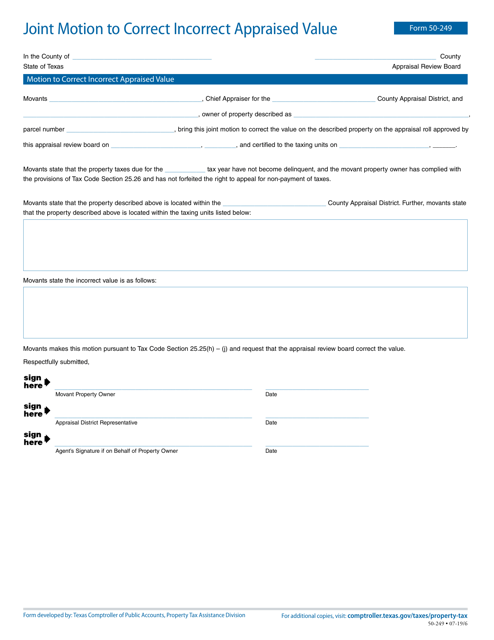

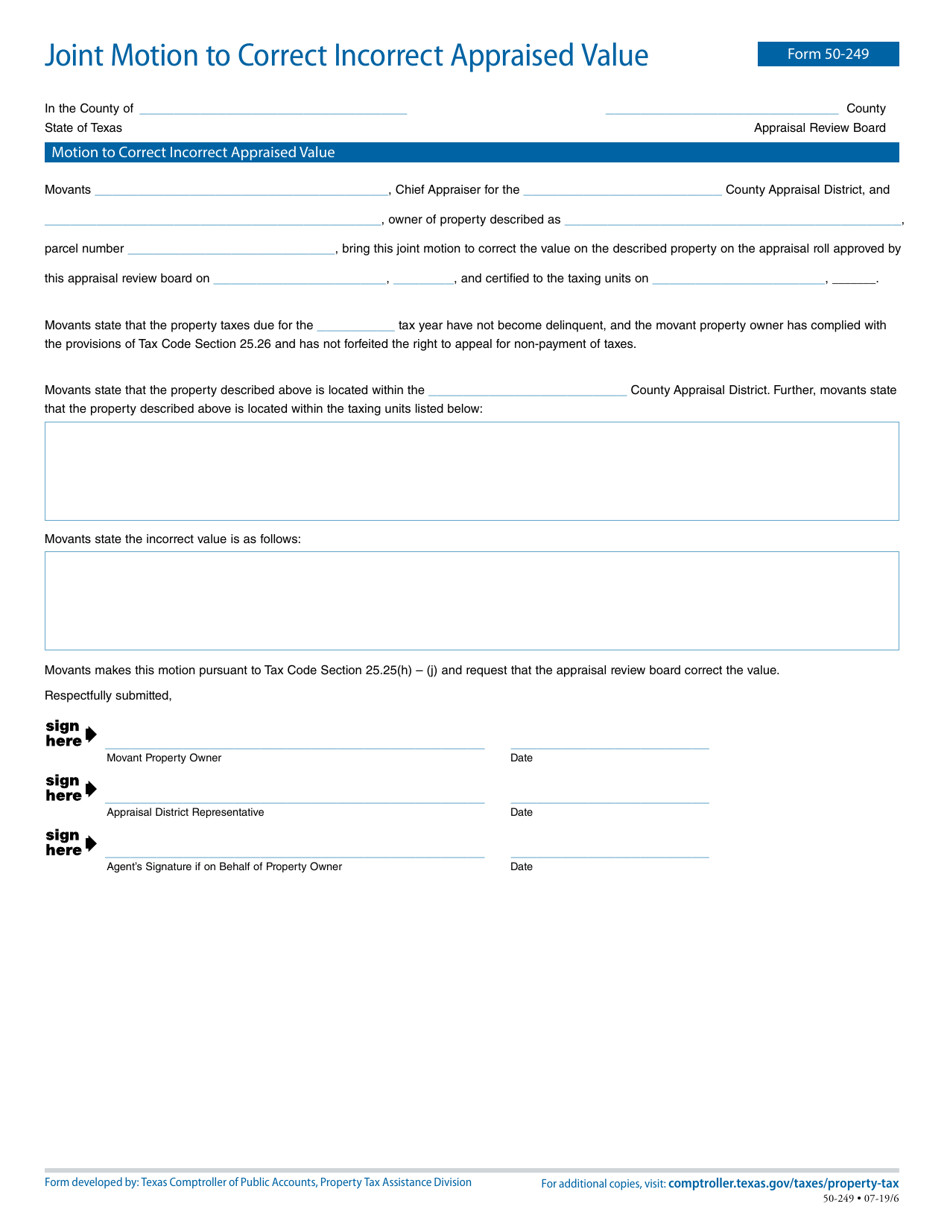

Form 50-249 Joint Motion to Correct Incorrect Appraised Value - Texas

What Is Form 50-249?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-249?

A: Form 50-249 is a Joint Motion to Correct Incorrect Appraised Value in Texas.

Q: Who can use Form 50-249?

A: Form 50-249 can be used by property owners, appraisal districts, and taxing units in Texas.

Q: What is the purpose of Form 50-249?

A: The purpose of Form 50-249 is to request a correction to an incorrect appraised value of a property in Texas.

Q: What information is required on Form 50-249?

A: Form 50-249 requires information such as the property owner's name and contact information, the property's legal description, the reason for the incorrect appraised value, and the requested correction.

Q: How should Form 50-249 be submitted?

A: Form 50-249 should be submitted to the appropriate appraisal district in Texas.

Q: Is there a deadline for submitting Form 50-249?

A: Yes, there is a deadline for submitting Form 50-249. It should be submitted within 2 years from the date the appraisal roll was certified, or within 60 days from the date of the notice of appraised value, whichever is later.

Q: What happens after submitting Form 50-249?

A: After submitting Form 50-249, the appraisal district will review the request and make a determination on whether to correct the appraised value.

Q: Can Form 50-249 be used for other purposes?

A: No, Form 50-249 is specifically designed for correcting an incorrect appraised value in Texas and should not be used for any other purposes.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-249 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.