This version of the form is not currently in use and is provided for reference only. Download this version of

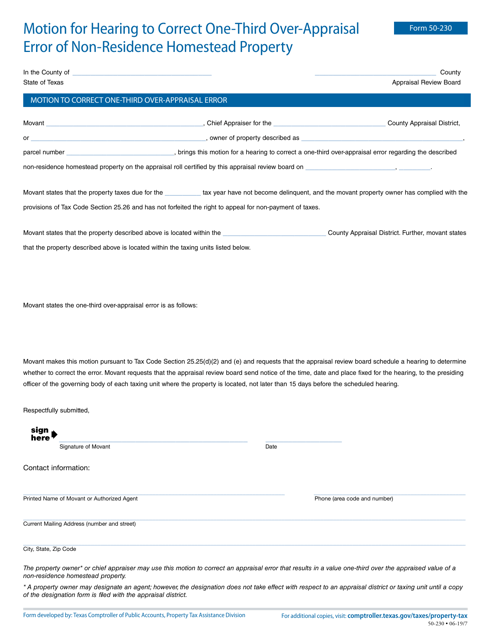

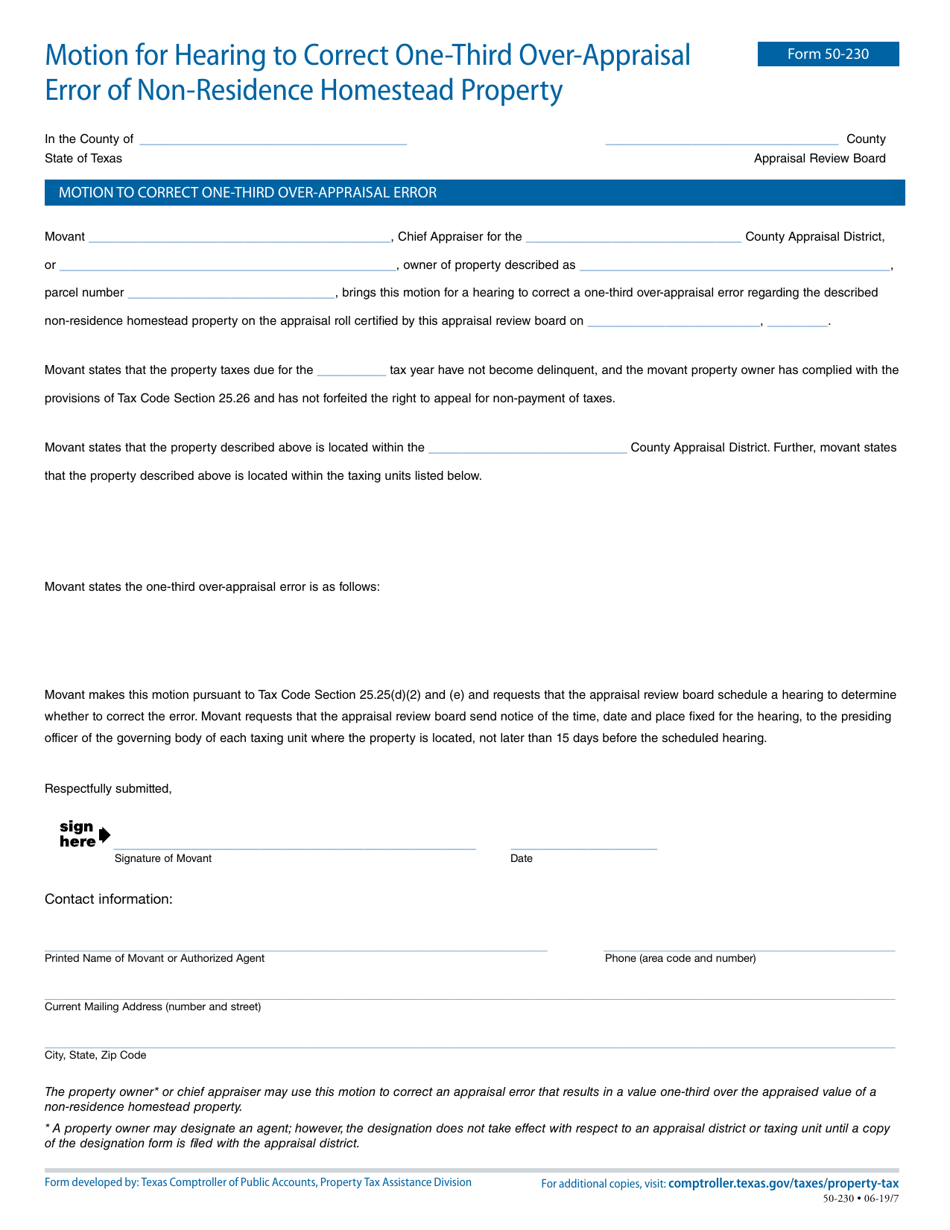

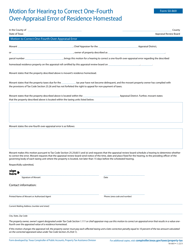

Form 50-230

for the current year.

Form 50-230 Motion for Hearing to Correct One-Third Over-appraisal Error of Non-residence Homestead Property - Texas

What Is Form 50-230?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

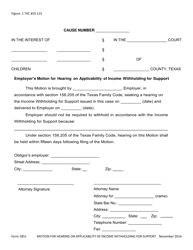

Q: What is Form 50-230 Motion?

A: Form 50-230 Motion is a legal document used in Texas to request a hearing to correct an over-appraisal error for non-residential homestead property.

Q: What is an over-appraisal error?

A: An over-appraisal error occurs when a property is assessed at a value that is higher than its actual market value.

Q: Who can use Form 50-230 Motion?

A: Form 50-230 Motion can be used by owners of non-residential homestead property in Texas who believe their property has been over-appraised.

Q: What is non-residential homestead property?

A: Non-residential homestead property refers to properties that are not used as a primary residence, such as commercial or rental properties.

Q: What is the purpose of Form 50-230 Motion?

A: The purpose of Form 50-230 Motion is to request a hearing to correct an over-appraisal error and potentially lower the property's assessed value for tax purposes.

Q: How do I fill out Form 50-230 Motion?

A: You will need to provide information about the property, the appraisal district, reasons for the over-appraisal error, and any supporting evidence.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-230 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.