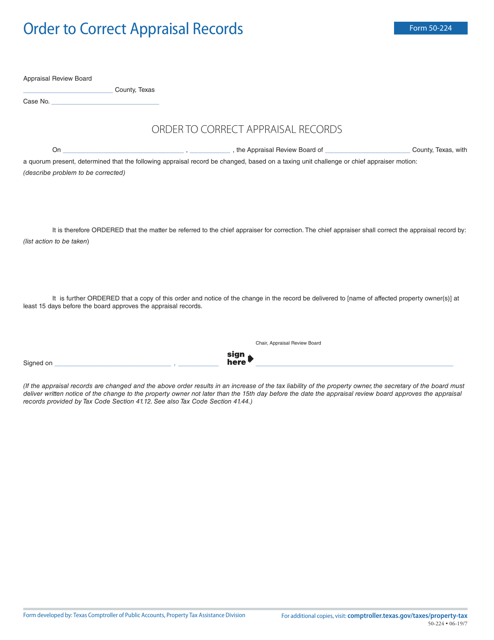

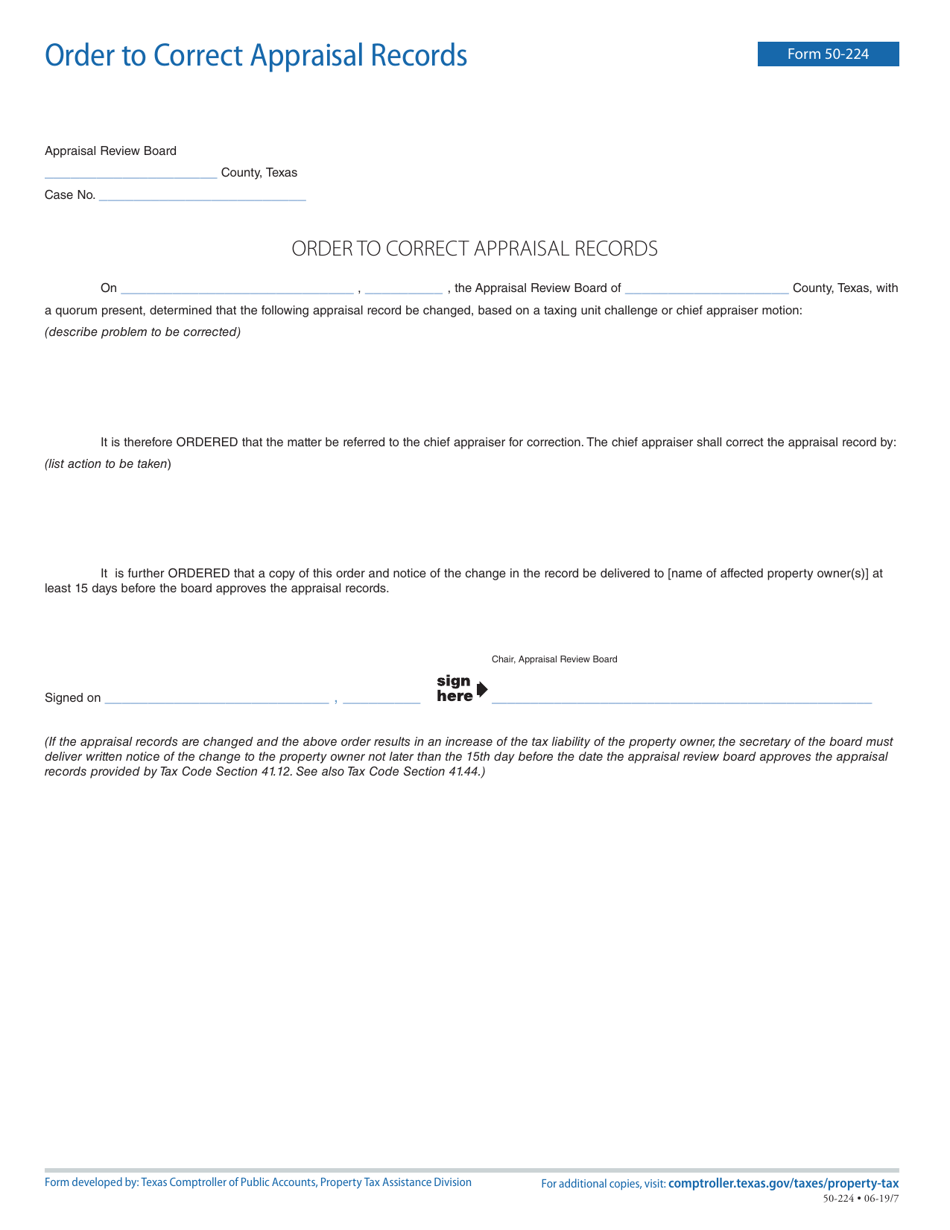

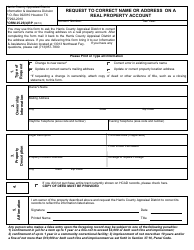

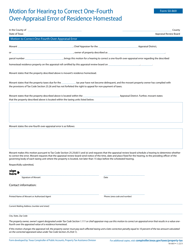

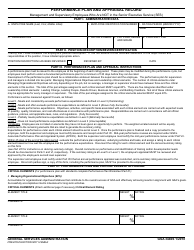

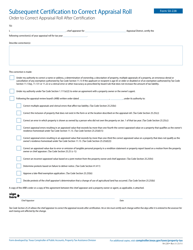

Form 50-224 Order to Correct Appraisal Records - Texas

What Is Form 50-224?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-224?

A: Form 50-224 is the Order to Correct Appraisal Records in Texas.

Q: What is the purpose of Form 50-224?

A: The purpose of Form 50-224 is to correct any errors in the appraisal records.

Q: Who can use Form 50-224?

A: This form can be used by property owners, appraisal districts, or appraisal review boards.

Q: How can Form 50-224 be submitted?

A: Form 50-224 can be submitted electronically or by mail.

Q: What information is required on Form 50-224?

A: Form 50-224 requires information such as property details, reason for correction, and supporting documentation.

Q: Is there a fee for submitting Form 50-224?

A: No, there is no fee for submitting Form 50-224.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-224 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.