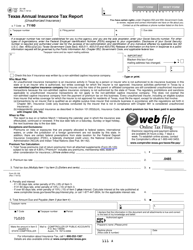

This version of the form is not currently in use and is provided for reference only. Download this version of

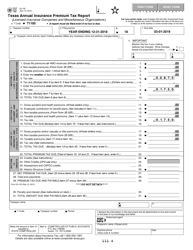

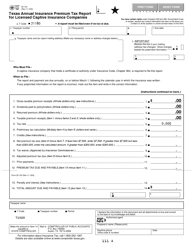

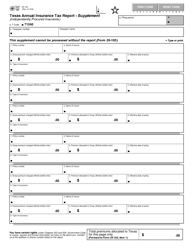

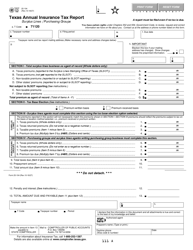

Form 25-101

for the current year.

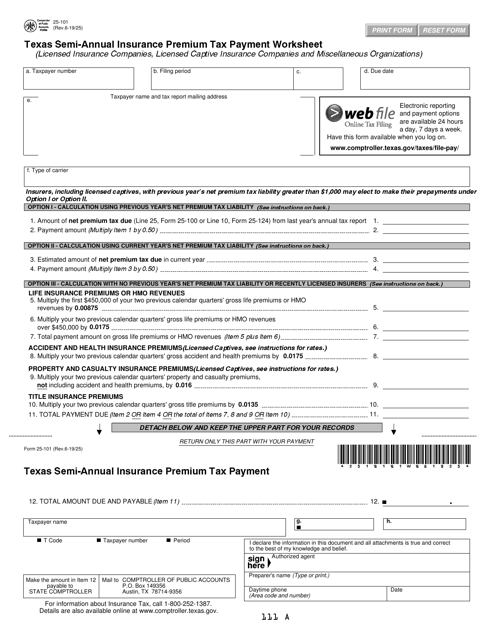

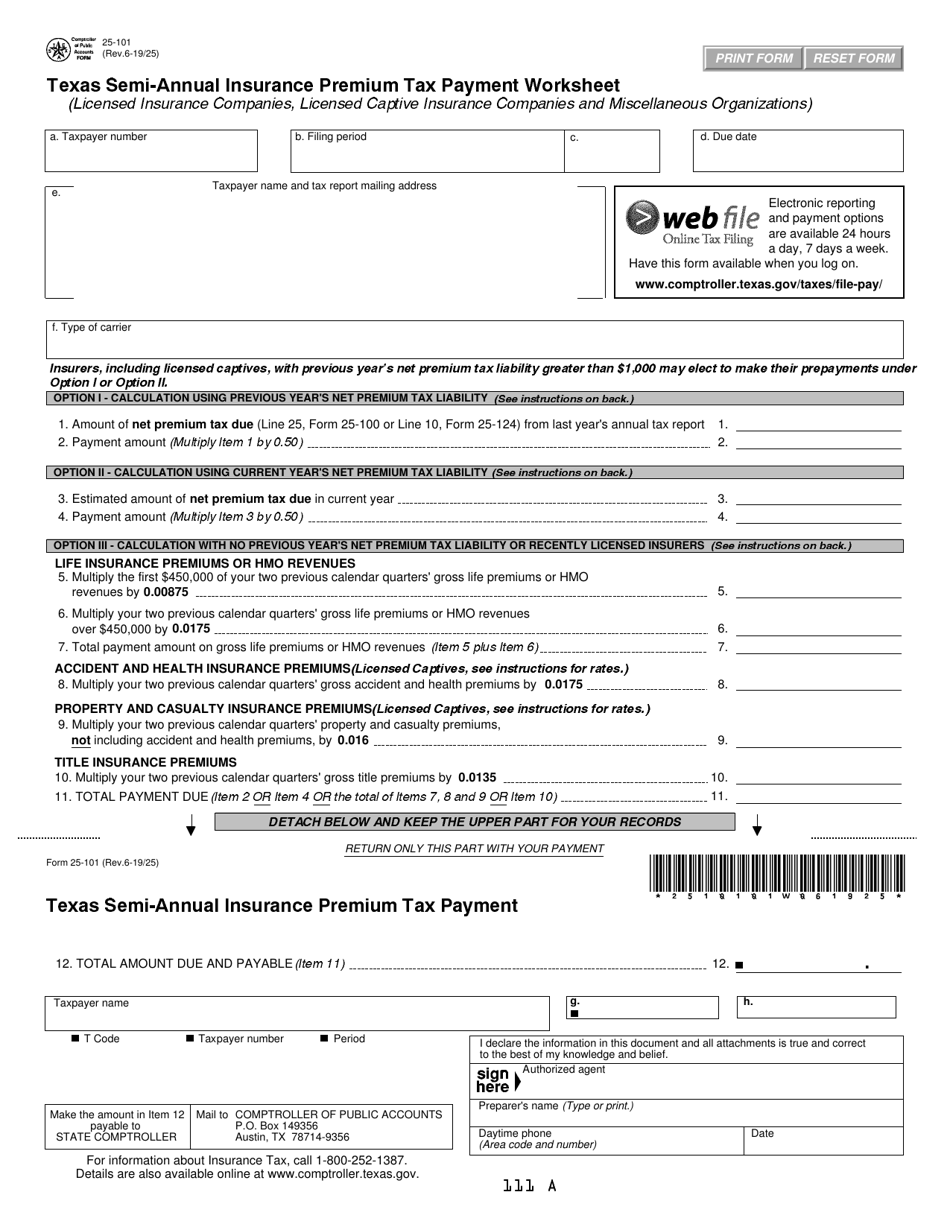

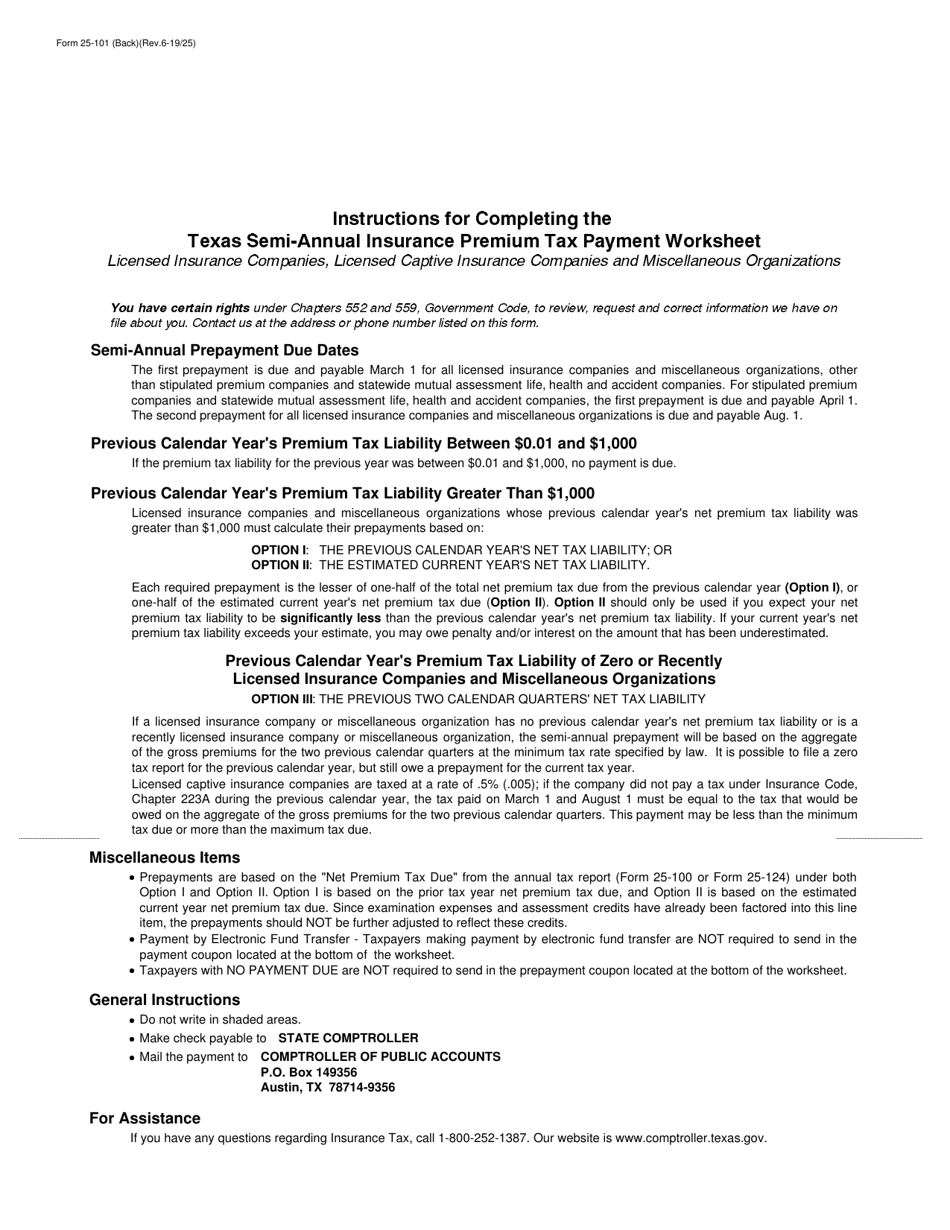

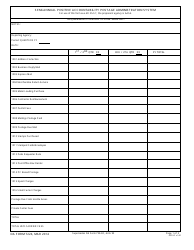

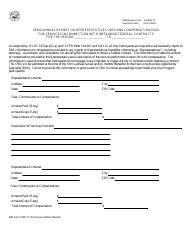

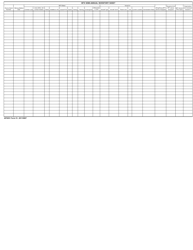

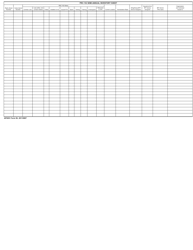

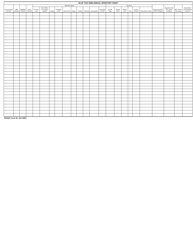

Form 25-101 Texas Semi-annual Insurance Premium Tax Payment Worksheet - Texas

What Is Form 25-101?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25-101?

A: Form 25-101 is the Texas Semi-annual Insurance Premium Tax Payment Worksheet.

Q: Who needs to file Form 25-101?

A: Insurance companies in Texas need to file Form 25-101.

Q: What is the purpose of Form 25-101?

A: Form 25-101 is used to calculate and report the semi-annual insurance premium tax owed by insurance companies in Texas.

Q: When is Form 25-101 due?

A: Form 25-101 is due by the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form 25-101?

A: Yes, there are penalties for late filing of Form 25-101. It is important to file the form on time to avoid penalties and interest charges.

Q: What if I have questions about Form 25-101?

A: If you have questions about Form 25-101 or need assistance, you can contact the Texas Comptroller of Public Accounts.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25-101 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.