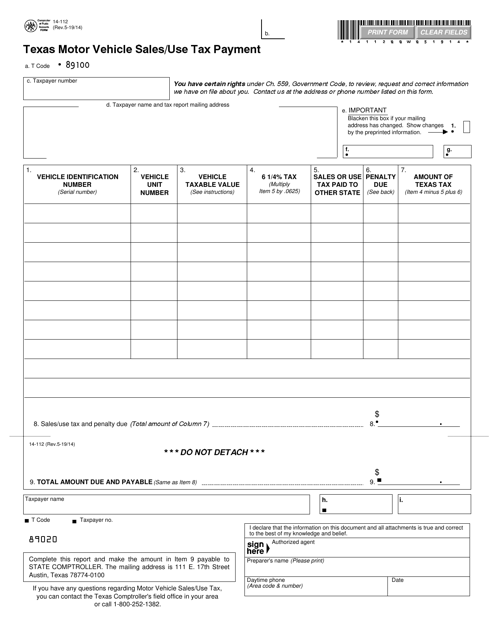

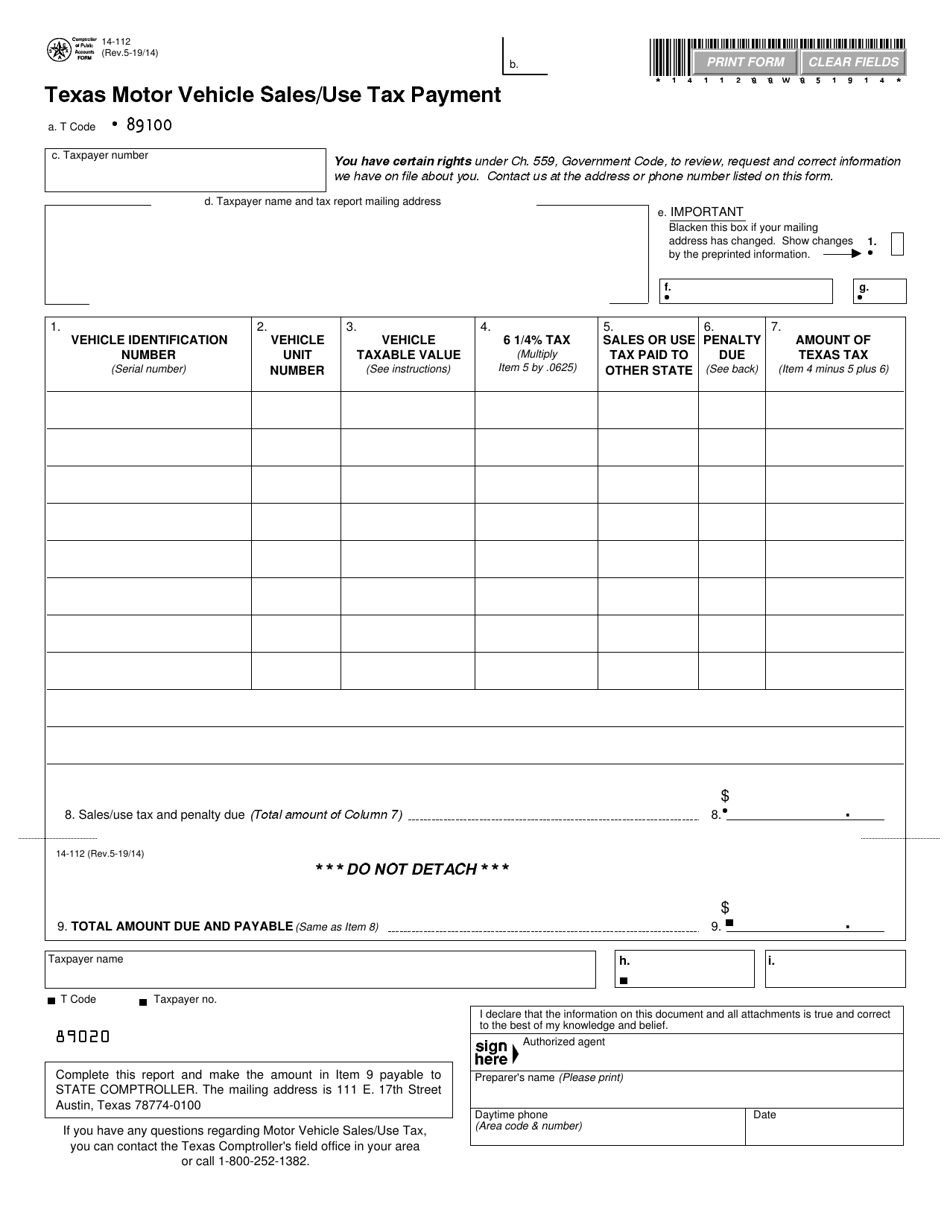

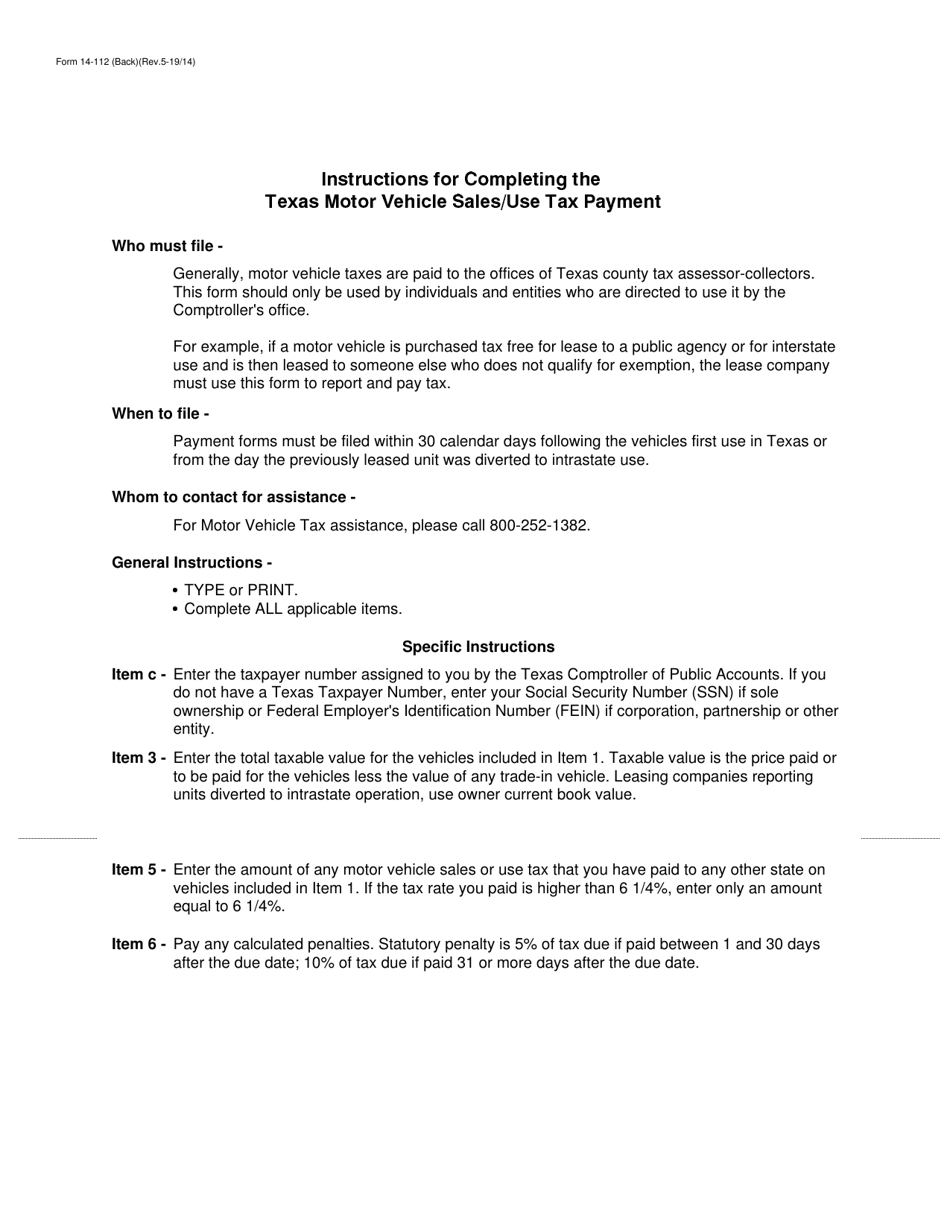

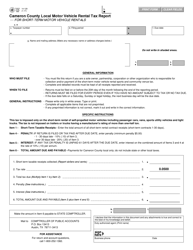

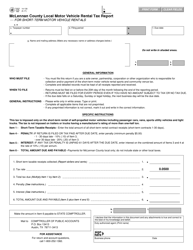

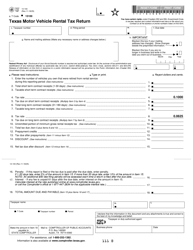

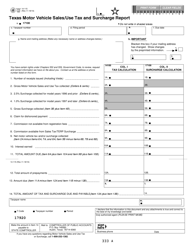

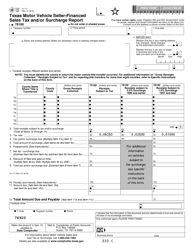

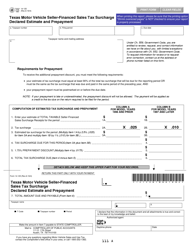

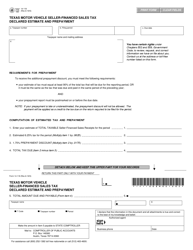

Form 14-112 Texas Motor Vehicle Sales / Use Tax Payment - Texas

What Is Form 14-112?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-112?

A: Form 14-112 is a Texas Motor Vehicle Sales/Use Tax Payment form.

Q: What is the purpose of Form 14-112?

A: Form 14-112 is used to report and pay motor vehiclesales and use tax in Texas.

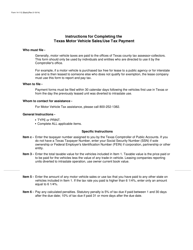

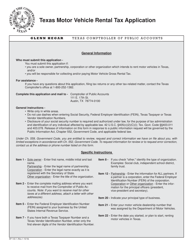

Q: Who needs to file Form 14-112?

A: Anyone who sells or uses a motor vehicle in Texas may need to file Form 14-112.

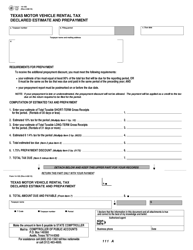

Q: When is Form 14-112 due?

A: Form 14-112 is due on the 20th day of the month following the reporting period.

Q: What information is required on Form 14-112?

A: Form 14-112 requires information such as the vehicle identification number (VIN), sales price, and buyer's information.

Q: How do I pay the tax on Form 14-112?

A: You can pay the tax on Form 14-112 by including a check or money order with your filing, or by paying electronically.

Q: Are there any penalties for late filing of Form 14-112?

A: Yes, there may be penalties for late filing of Form 14-112, including interest charges on unpaid tax.

Q: What should I do if I have questions about Form 14-112?

A: If you have questions about Form 14-112, you can contact the Texas Comptroller of Public Accounts for assistance.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-112 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.