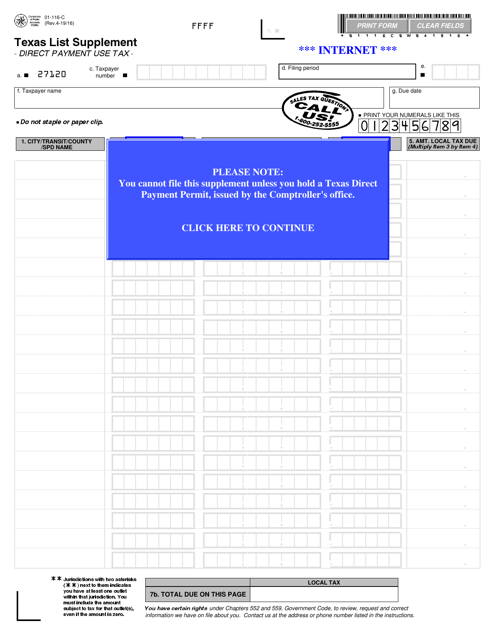

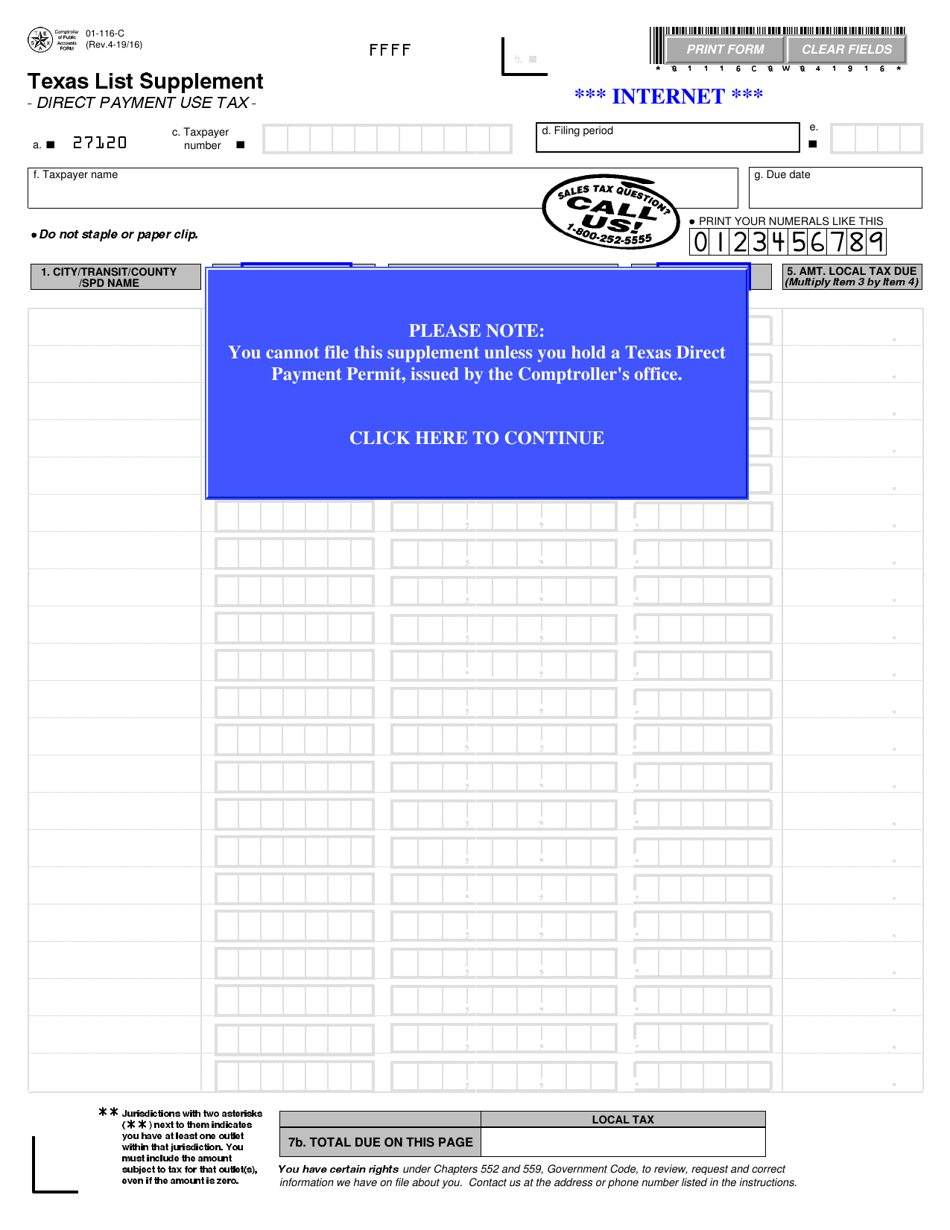

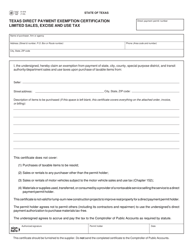

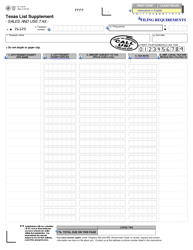

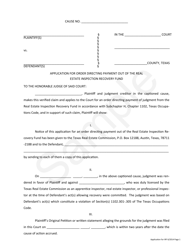

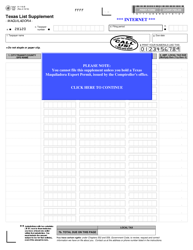

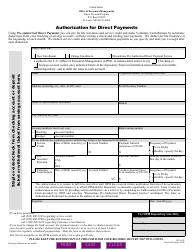

Form 01-116C Texas List Supplement - Direct Payment Use Tax - Texas

What Is Form 01-116C?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-116C?

A: Form 01-116C is the Texas List Supplement for Direct Payment Use Tax for Texas.

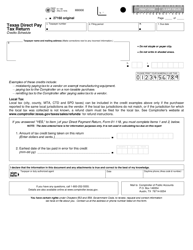

Q: What is the purpose of Form 01-116C?

A: The purpose of Form 01-116C is to report and pay use tax directly to the Texas Comptroller's office.

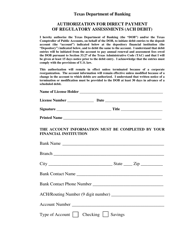

Q: Who should use Form 01-116C?

A: Entities or individuals who make taxable purchases from out-of-state sellers and are not required to pay sales tax should use Form 01-116C.

Q: What is use tax?

A: Use tax is a tax imposed on the use, consumption, or storage of tangible personal property or certain taxable services within a state where sales tax has not been paid.

Q: What is the Texas List Supplement?

A: The Texas List Supplement is a form used to report and pay use tax on purchases made from out-of-state sellers.

Q: When is Form 01-116C due?

A: Form 01-116C is due on or before the 20th day of the month following the end of the reporting period.

Q: What if I miss the deadline for submitting Form 01-116C?

A: If you miss the deadline for submitting Form 01-116C, you may be subject to penalties and interest.

Q: Is Form 01-116C required for all purchases from out-of-state sellers?

A: No, Form 01-116C is only required for taxable purchases where sales tax has not been paid.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-116C by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.