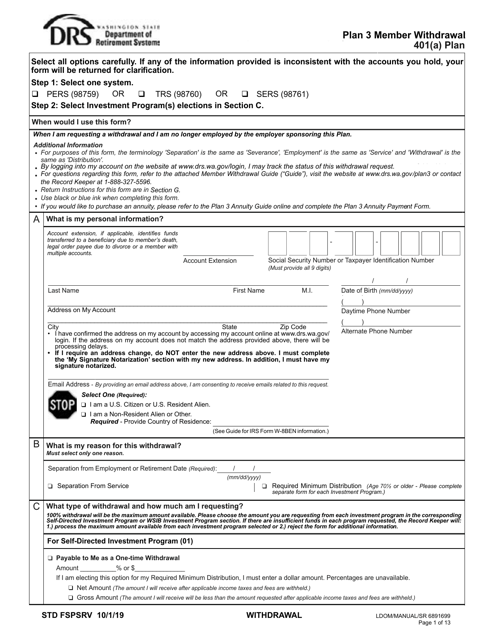

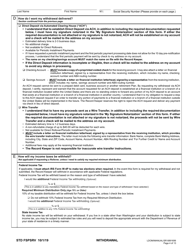

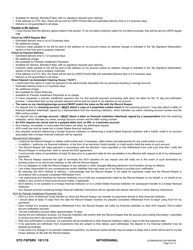

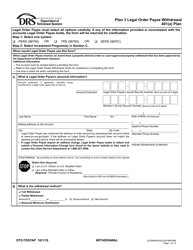

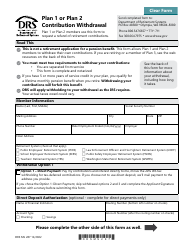

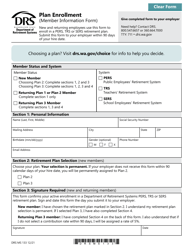

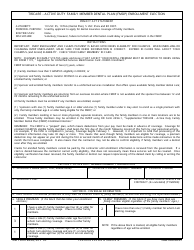

Plan 3 Member Withdrawal 401(A) Plan - Washington

Plan 3 Member Withdrawal 401(A) Plan is a legal document that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington.

FAQ

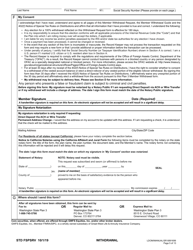

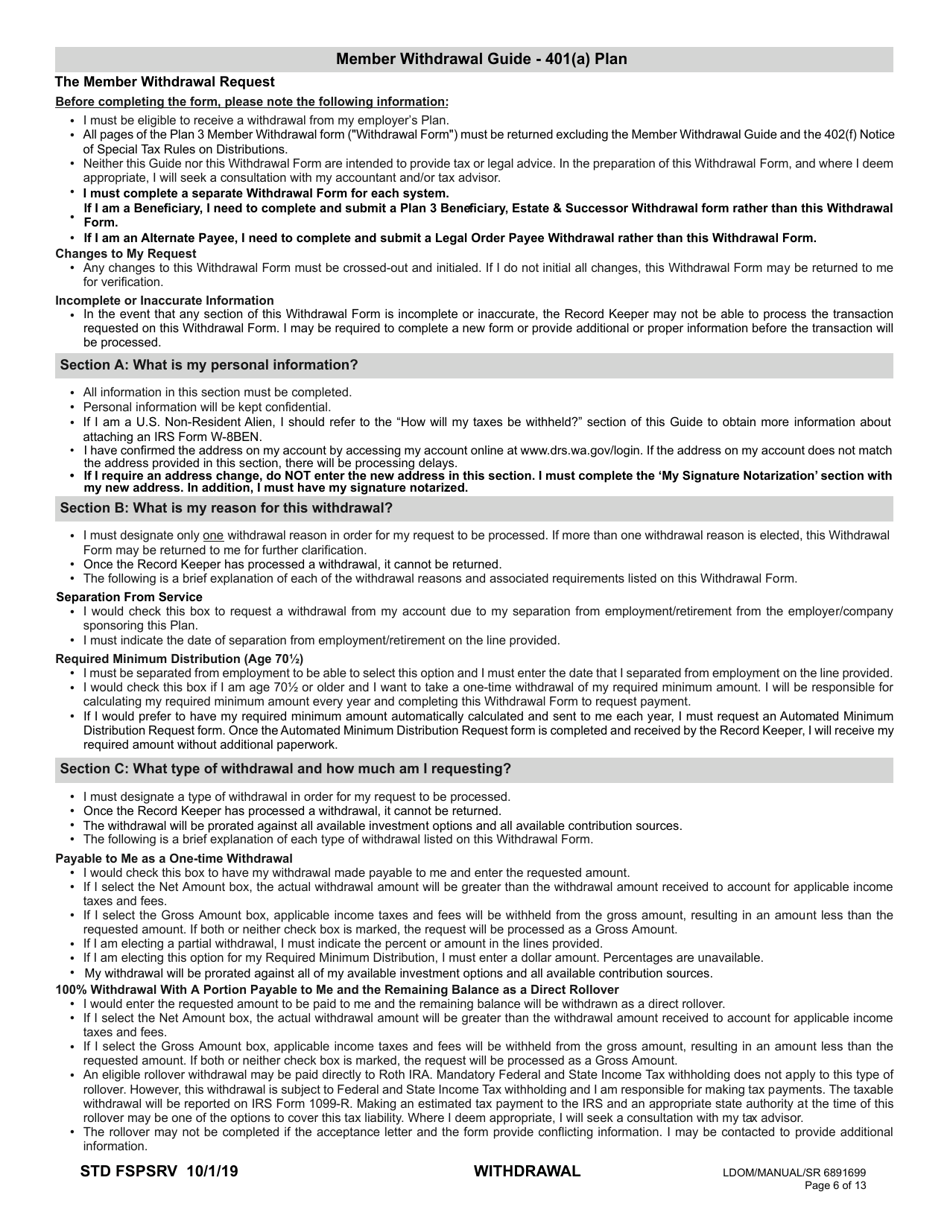

Q: What is a 401(a) plan?

A: A 401(a) plan is a type of employer-sponsored retirement plan.

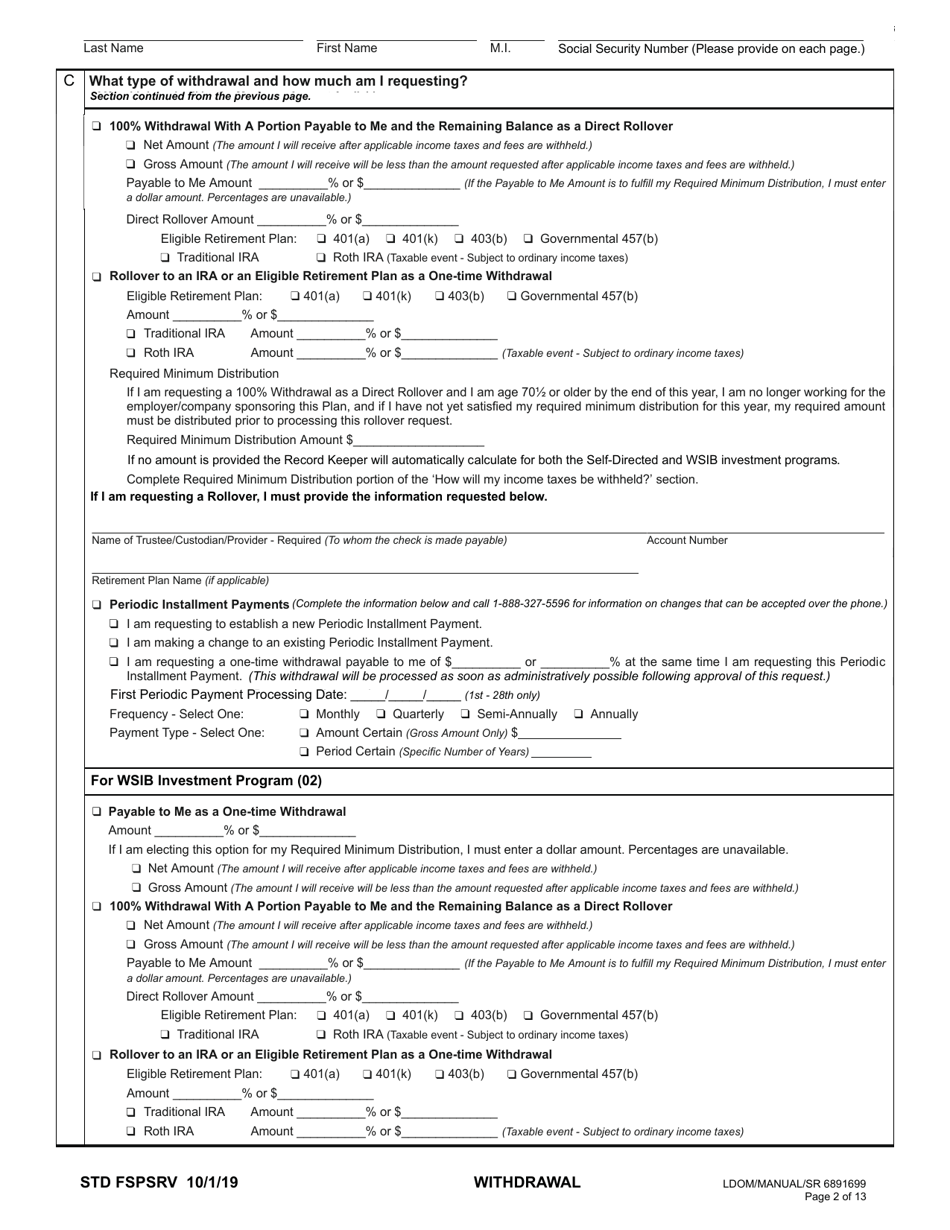

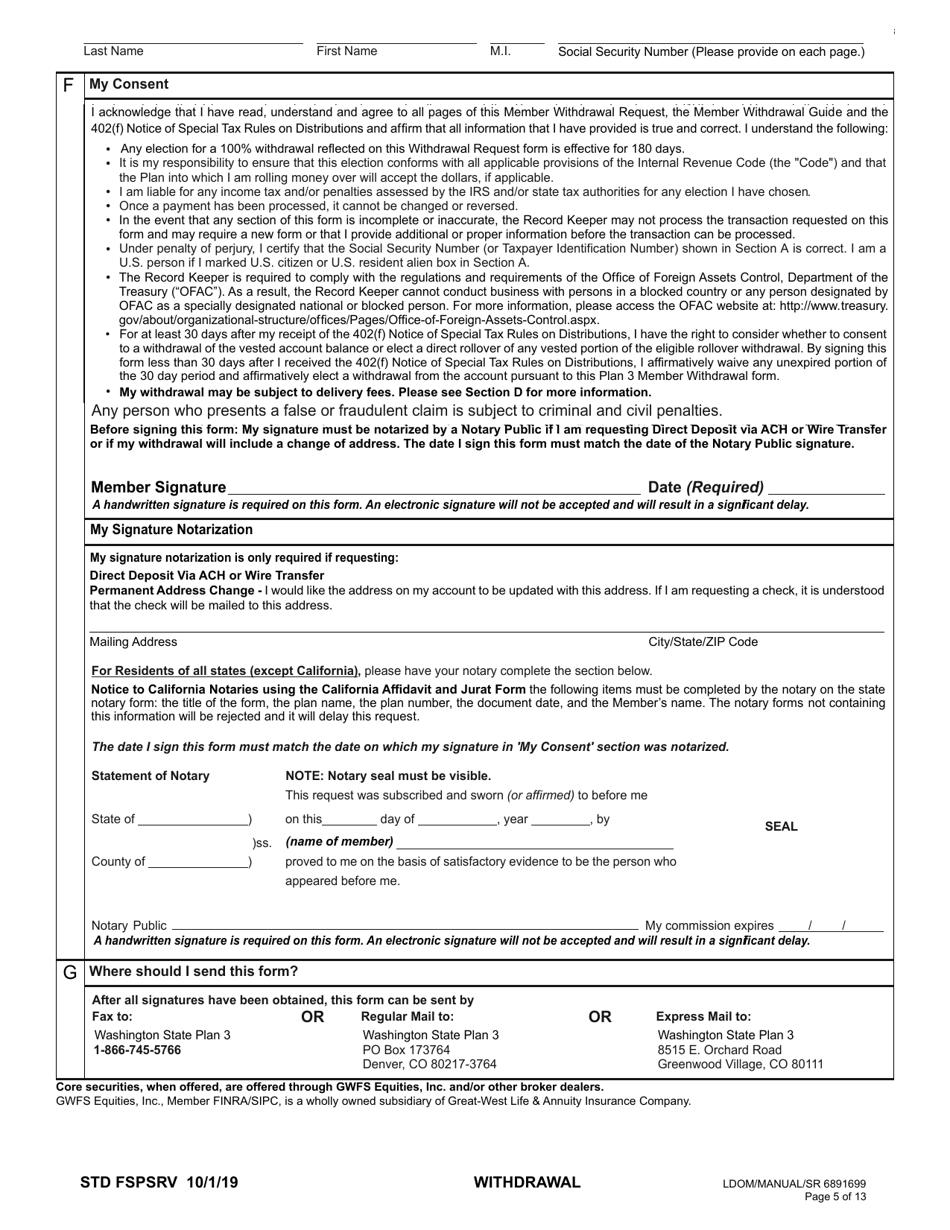

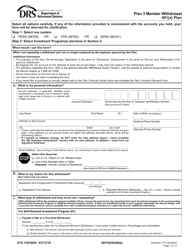

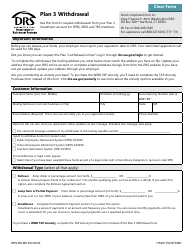

Q: What is Plan 3 Member Withdrawal?

A: Plan 3 Member Withdrawal is a specific type of withdrawal option available to participants in the 401(a) Plan in Washington.

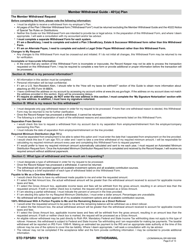

Q: Who is eligible for Plan 3 Member Withdrawal?

A: Participants in the 401(a) Plan in Washington who meet the eligibility criteria are eligible for Plan 3 Member Withdrawal.

Q: What are the eligibility criteria for Plan 3 Member Withdrawal?

A: The eligibility criteria for Plan 3 Member Withdrawal are determined by the Washington State Department of Retirement Systems. It is recommended to contact them directly for specific details.

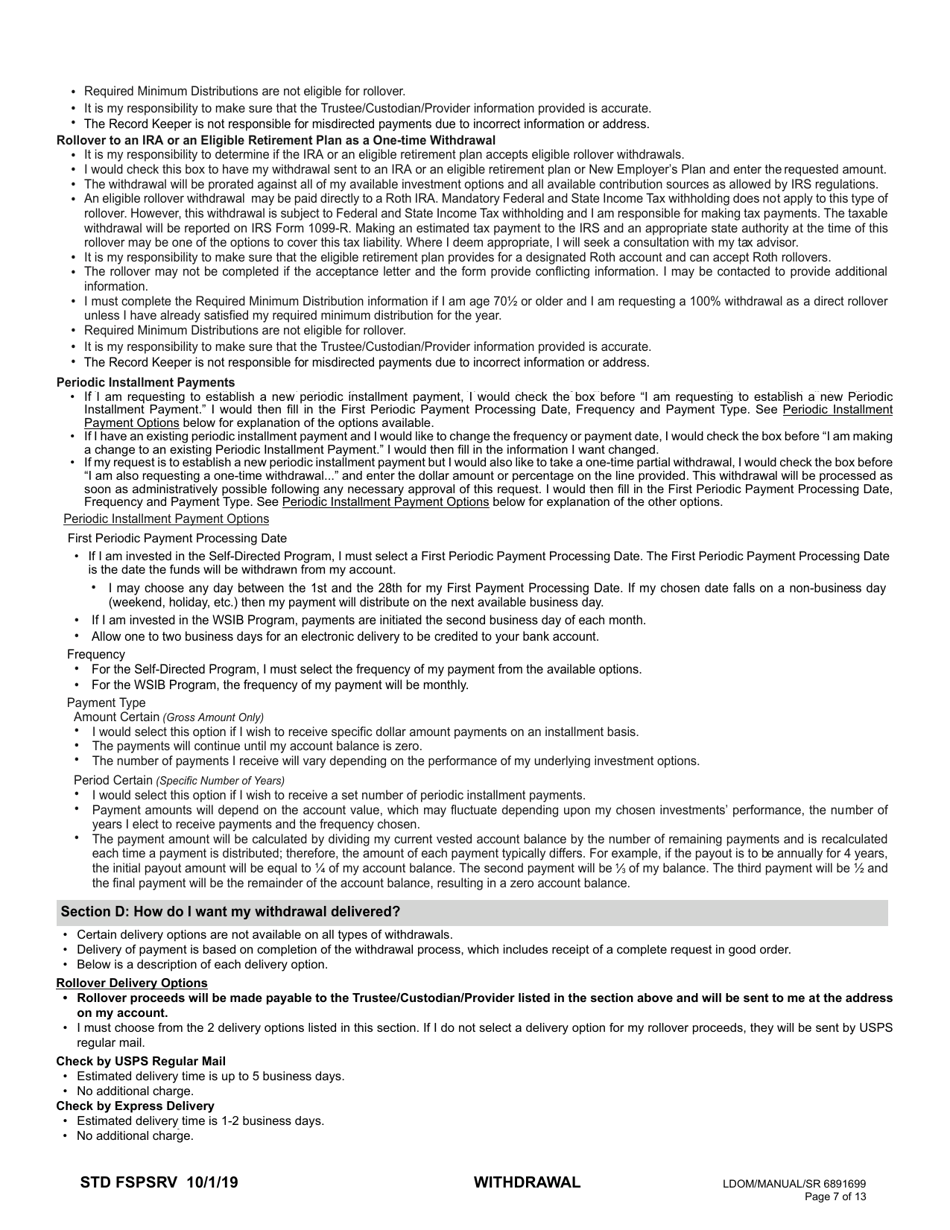

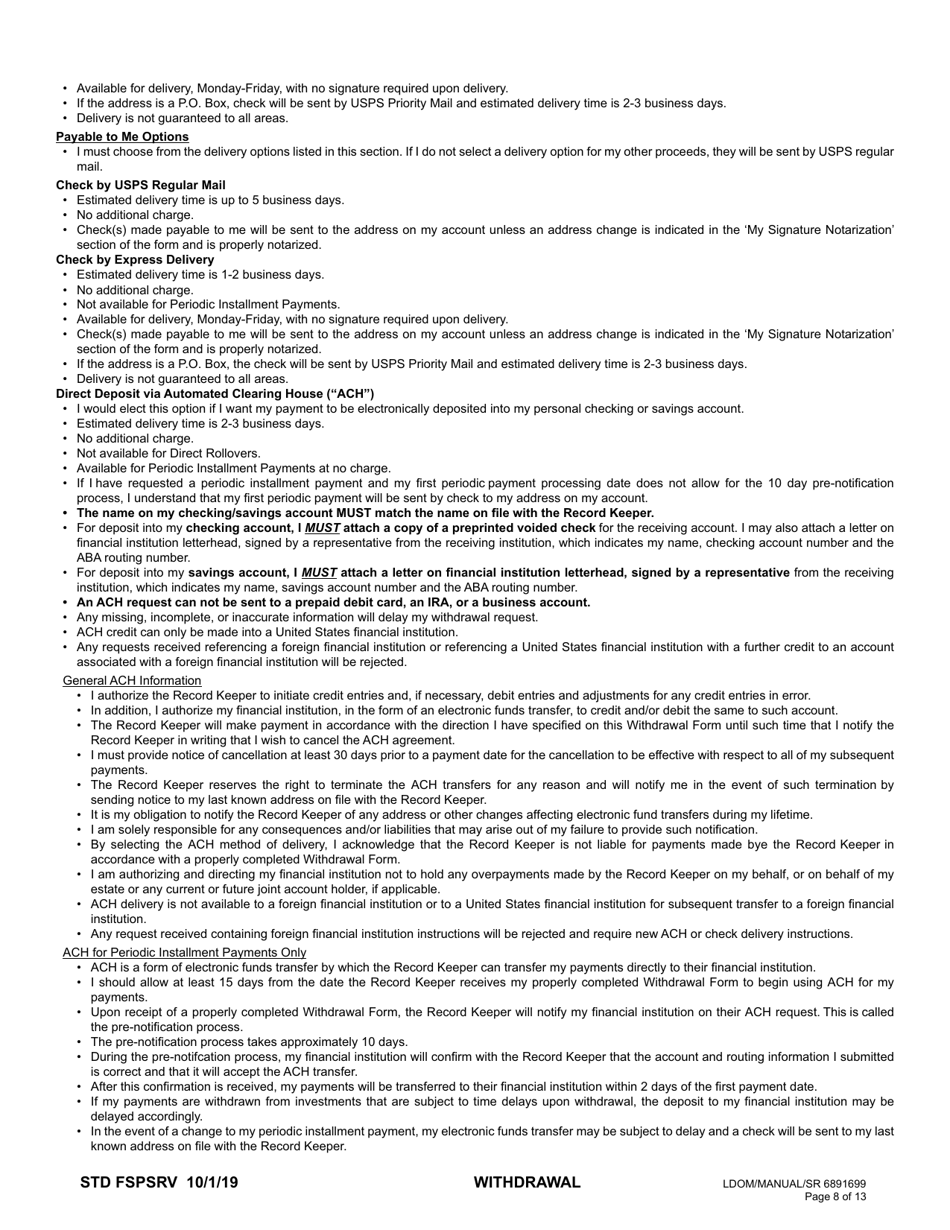

Q: How does Plan 3 Member Withdrawal work?

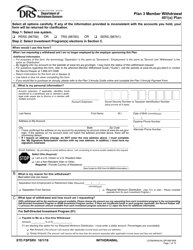

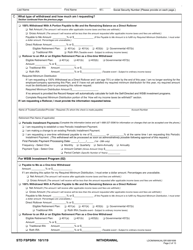

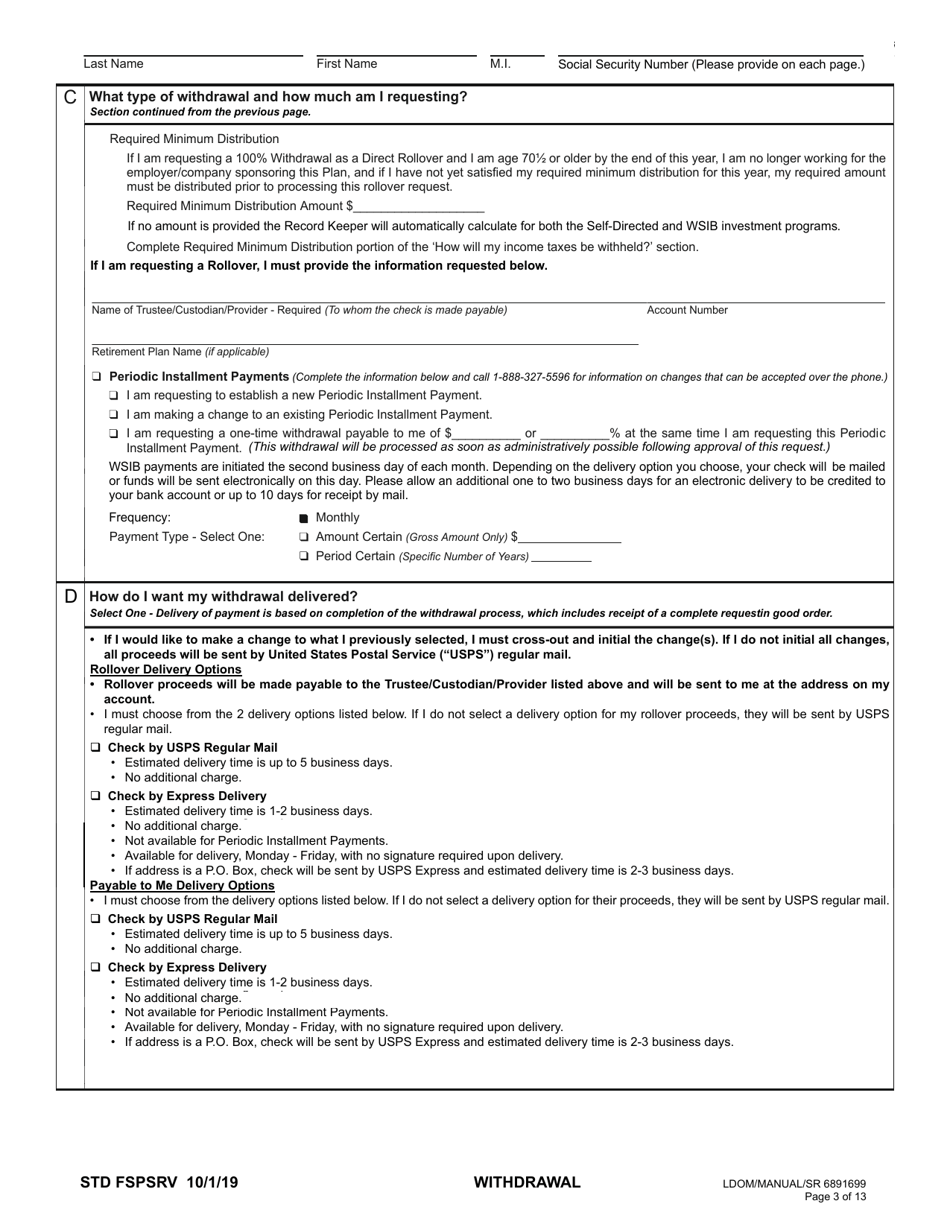

A: Plan 3 Member Withdrawal allows participants to withdraw funds from their 401(a) Plan account under certain circumstances, such as termination of employment or retirement.

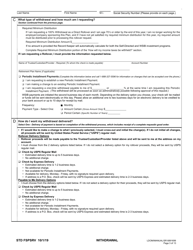

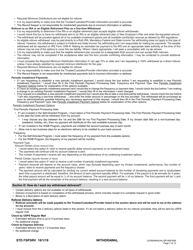

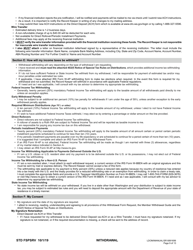

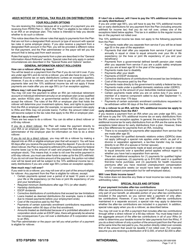

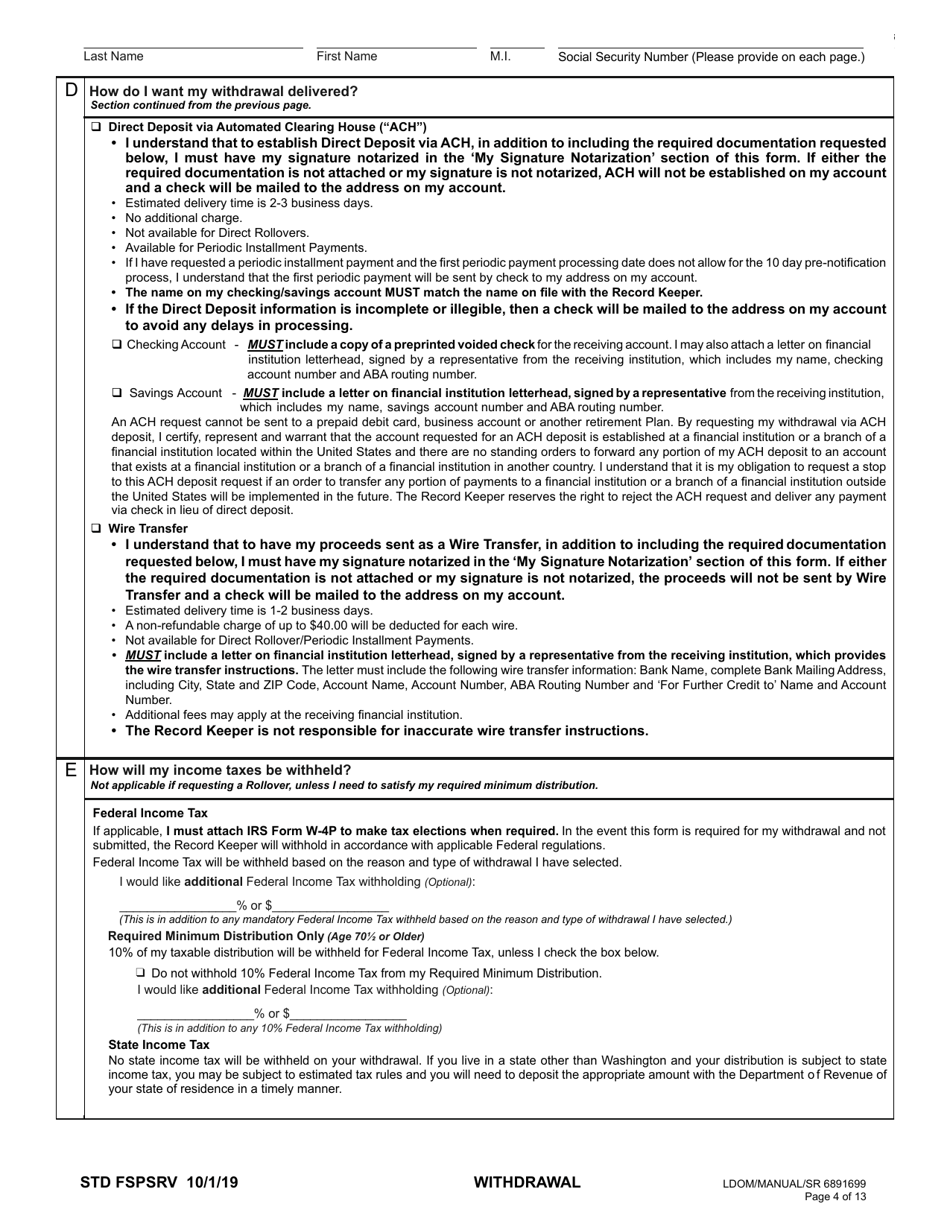

Q: Are there any tax implications for Plan 3 Member Withdrawal?

A: Yes, there may be tax implications for Plan 3 Member Withdrawal. It is advisable to consult a tax professional for specific guidance.

Q: Can I roll over the funds from Plan 3 Member Withdrawal to another retirement account?

A: Yes, it may be possible to roll over the funds from Plan 3 Member Withdrawal to another eligible retirement account. Contact the Washington State Department of Retirement Systems for more information.

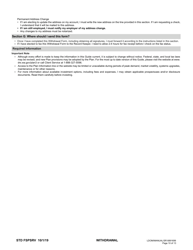

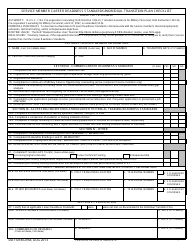

Form Details:

- Released on October 1, 2019;

- The latest edition currently provided by the Washington State Department of Retirement Systems;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.