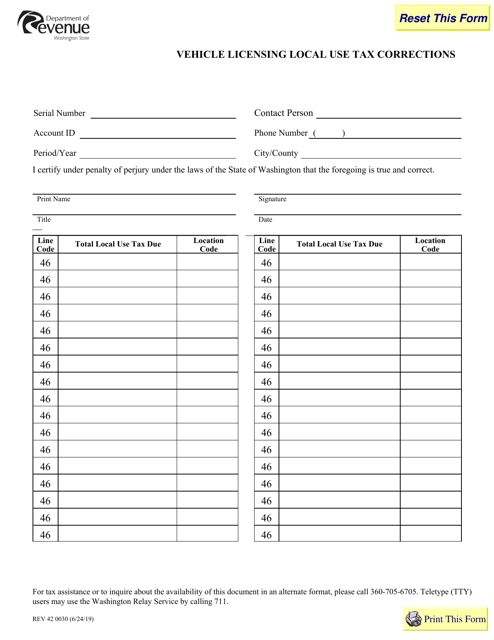

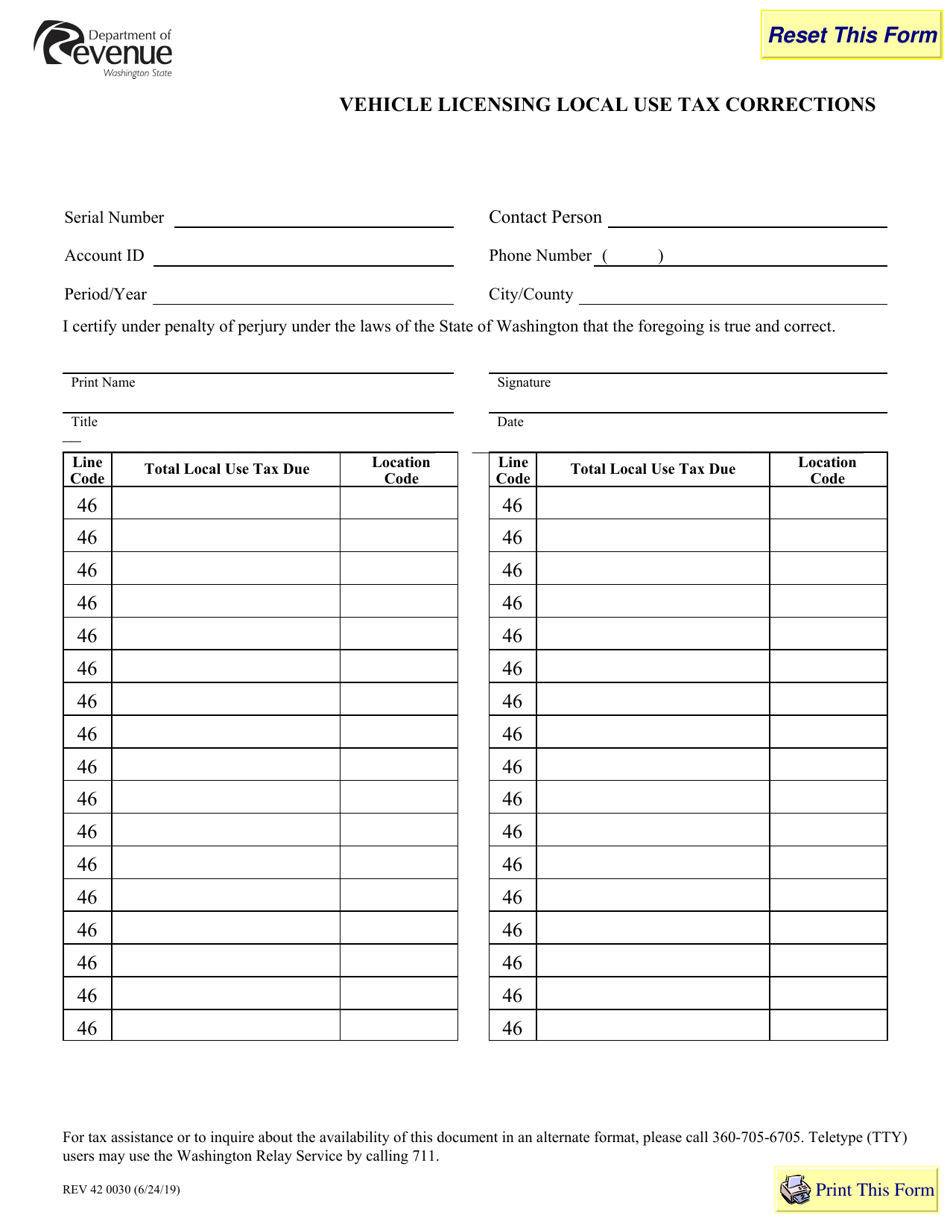

Form REV42 0030 Vehicle Licensing Local Use Tax Corrections - Washington

What Is Form REV42 0030?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REV42 0030?

A: REV42 0030 is a form used for correcting Vehicle Licensing Local Use Tax in Washington.

Q: What is Vehicle Licensing Local Use Tax?

A: Vehicle Licensing Local Use Tax is a tax imposed on vehicles used in a local jurisdiction in Washington.

Q: When is REV42 0030 used?

A: REV42 0030 is used when there is an error or discrepancy in the Vehicle Licensing Local Use Tax paid for a vehicle in Washington.

Q: Who uses REV42 0030?

A: REV42 0030 is used by individuals, businesses, or organizations that need to correct Vehicle Licensing Local Use Tax.

Q: Are there any fees for using REV42 0030?

A: There may be fees associated with using REV42 0030 for correcting Vehicle Licensing Local Use Tax in Washington. The exact fees depend on the specific situation.

Q: What information is required on REV42 0030?

A: REV42 0030 requires information such as the vehicle details, the original tax amount, the correction needed, and the reason for the correction.

Form Details:

- Released on June 24, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV42 0030 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.