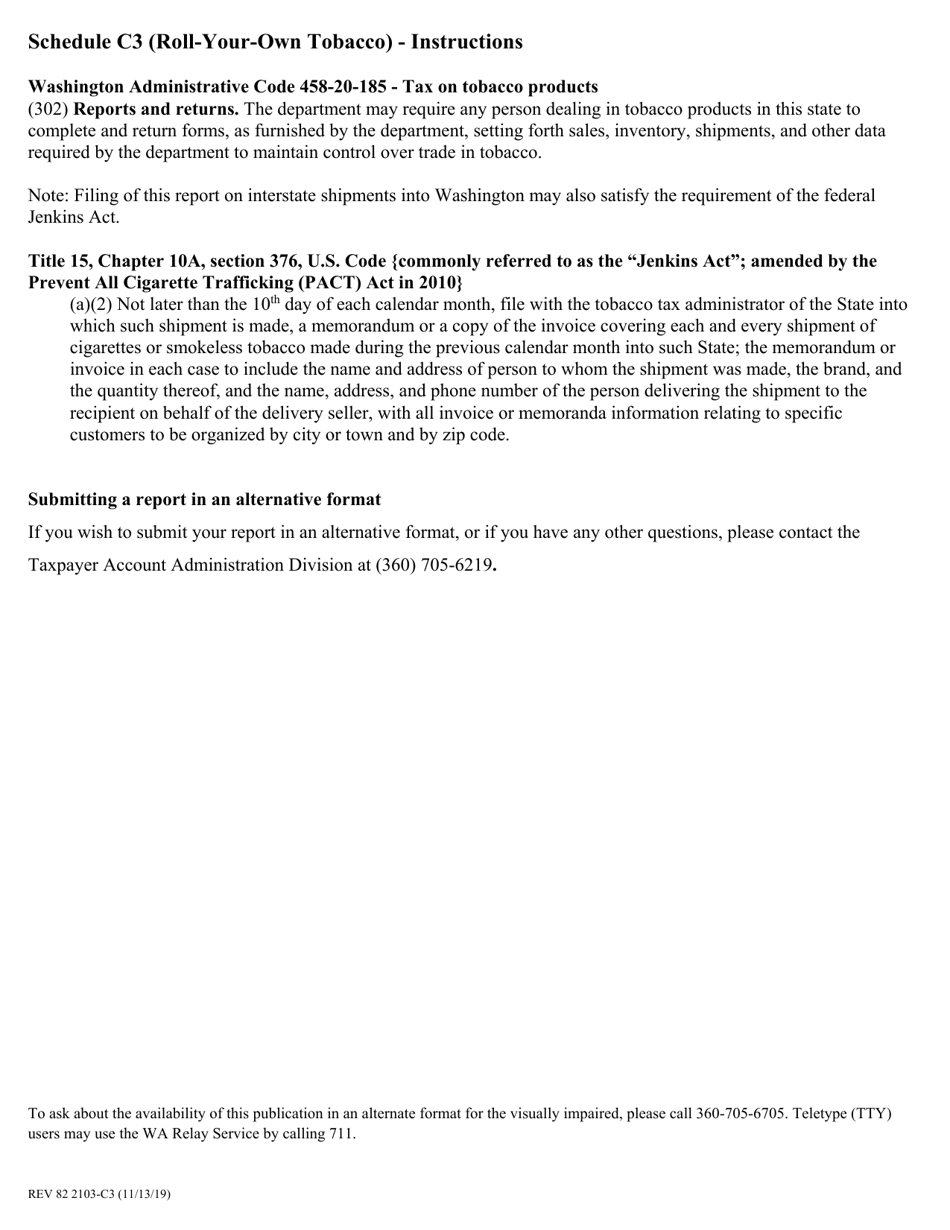

This version of the form is not currently in use and is provided for reference only. Download this version of

Form REV82 2103-C3 Schedule C3

for the current year.

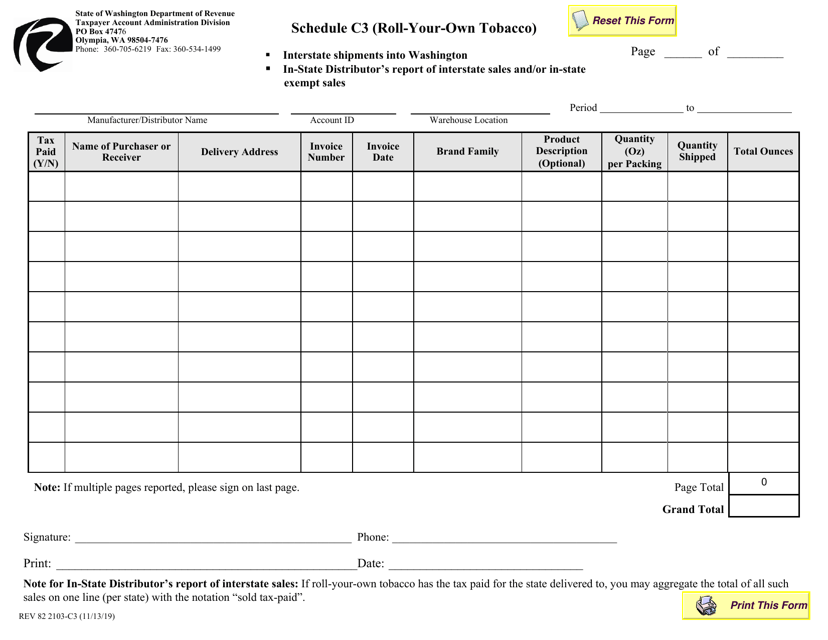

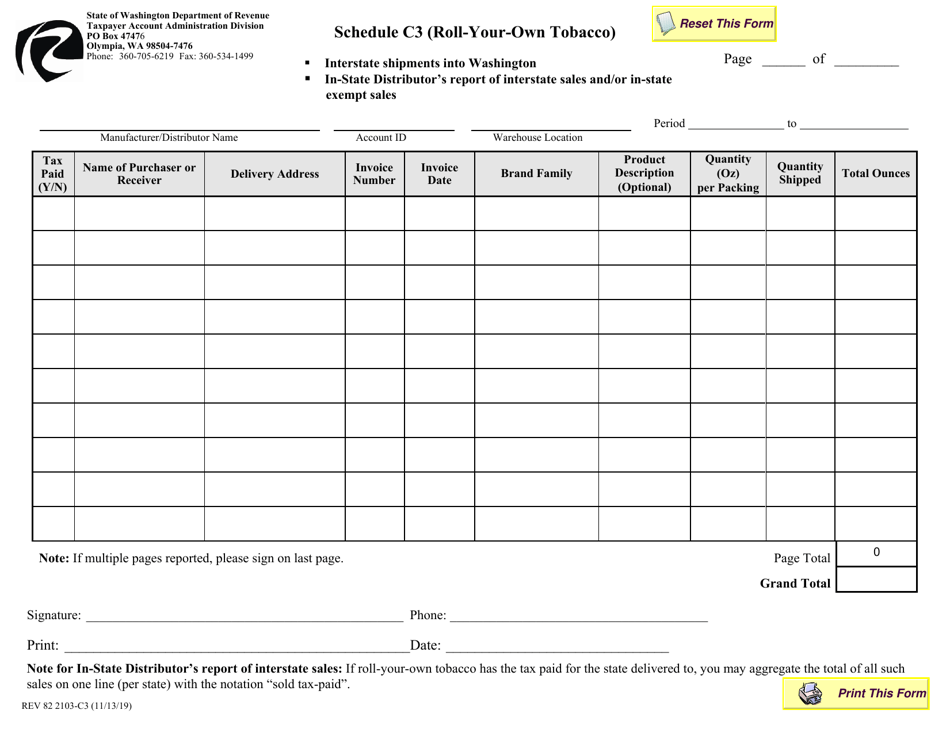

Form REV82 2103-C3 Schedule C3 Roll-Your-Own Tobacco - Washington

What Is Form REV82 2103-C3 Schedule C3?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV82 2103-C3 Schedule C3?

A: Form REV82 2103-C3 Schedule C3 is a tax form used for reporting and paying taxes on roll-your-own tobacco in the state of Washington.

Q: Who needs to file Form REV82 2103-C3 Schedule C3?

A: Any individual or business that manufactures or sells roll-your-own tobacco in Washington needs to file Form REV82 2103-C3 Schedule C3.

Q: What is roll-your-own tobacco?

A: Roll-your-own tobacco refers to tobacco that is sold in loose form and is meant to be used for self-rolling cigarettes.

Q: What information is required on Form REV82 2103-C3 Schedule C3?

A: Form REV82 2103-C3 Schedule C3 requires information such as the quantity of roll-your-own tobacco produced or sold, the amount of tax due, and the reporting period.

Q: When is the deadline for filing Form REV82 2103-C3 Schedule C3?

A: The deadline for filing Form REV82 2103-C3 Schedule C3 and paying the associated taxes is typically the 25th day of the month following the reporting period.

Form Details:

- Released on November 13, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV82 2103-C3 Schedule C3 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.