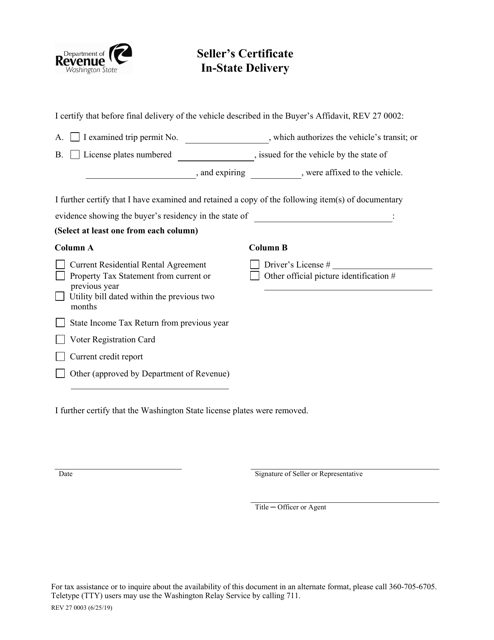

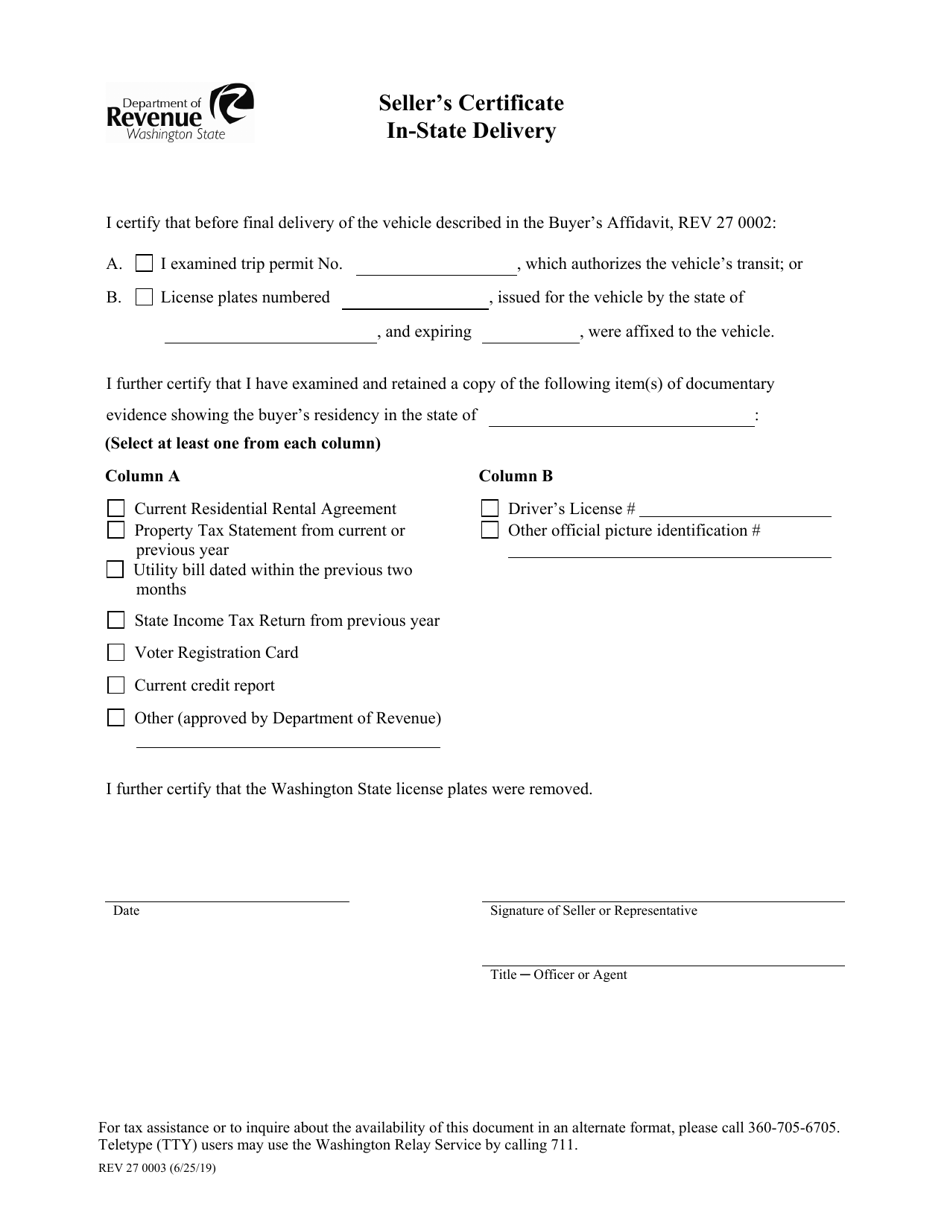

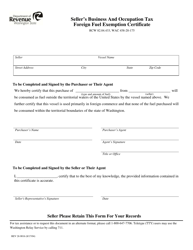

Form REV27 0003 Seller's Certificate - in-State Delivery - Washington

What Is Form REV27 0003?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV27 0003?

A: Form REV27 0003 is the Seller's Certificate for in-State Delivery in Washington.

Q: Who needs to file Form REV27 0003?

A: Sellers who make deliveries within the state of Washington need to file Form REV27 0003.

Q: What is the purpose of Form REV27 0003?

A: The purpose of Form REV27 0003 is to certify that a seller made an in-State delivery in Washington.

Q: When should Form REV27 0003 be filed?

A: Form REV27 0003 should be filed by the seller at the time of making the in-State delivery in Washington.

Q: Are there any fees associated with filing Form REV27 0003?

A: No, there are no fees associated with filing Form REV27 0003.

Q: What information is required on Form REV27 0003?

A: Form REV27 0003 requires the seller's name, address, and taxpayer identification number, as well as details about the in-State delivery.

Q: Is Form REV27 0003 specific to Washington state?

A: Yes, Form REV27 0003 is specific to in-State deliveries in Washington.

Q: What happens if I don't file Form REV27 0003?

A: Failure to file Form REV27 0003 or providing false information may result in penalties or other legal consequences.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV27 0003 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.