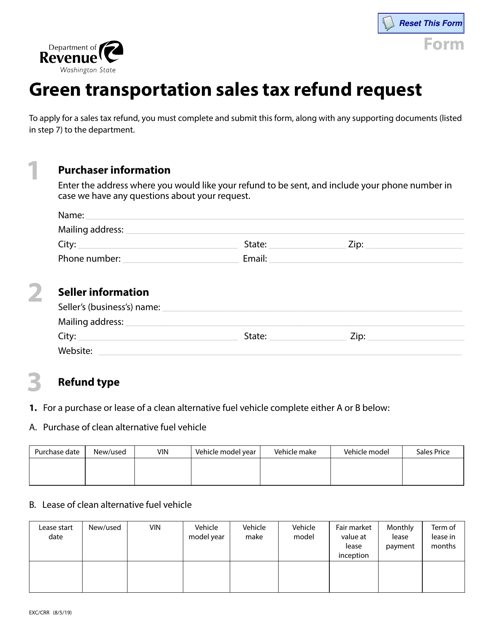

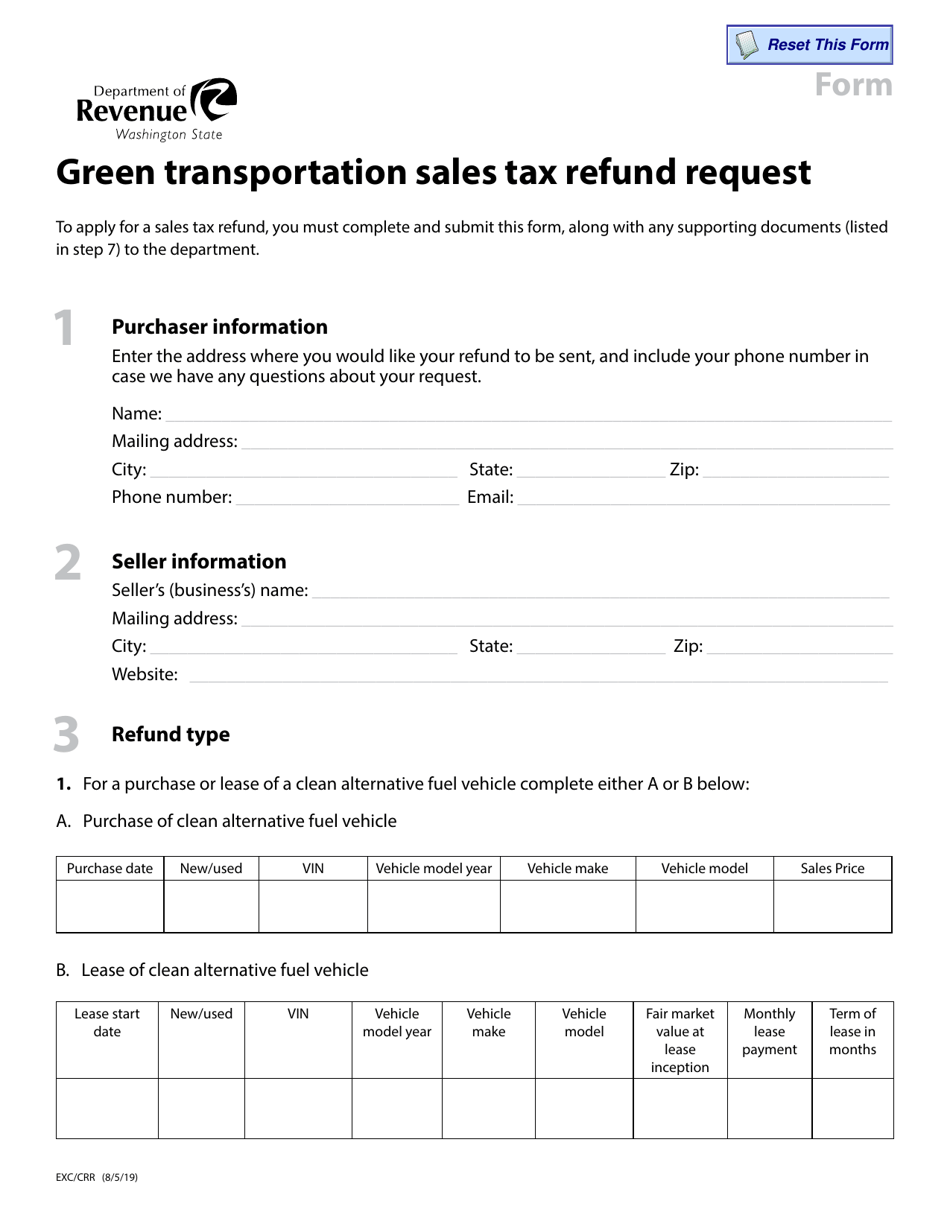

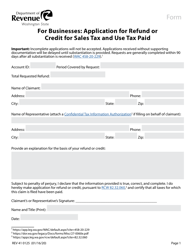

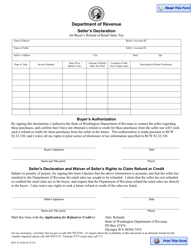

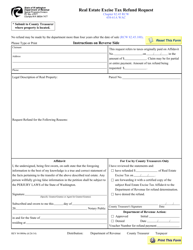

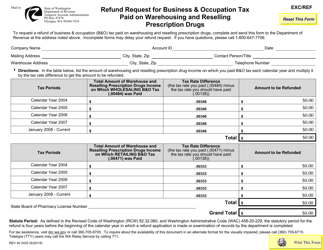

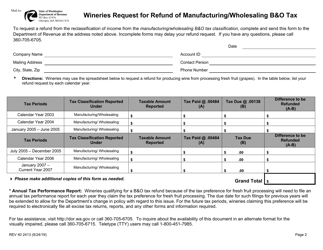

Form EXC / CRR Green Transportation Sales Tax Refund Request - Washington

What Is Form EXC/CRR?

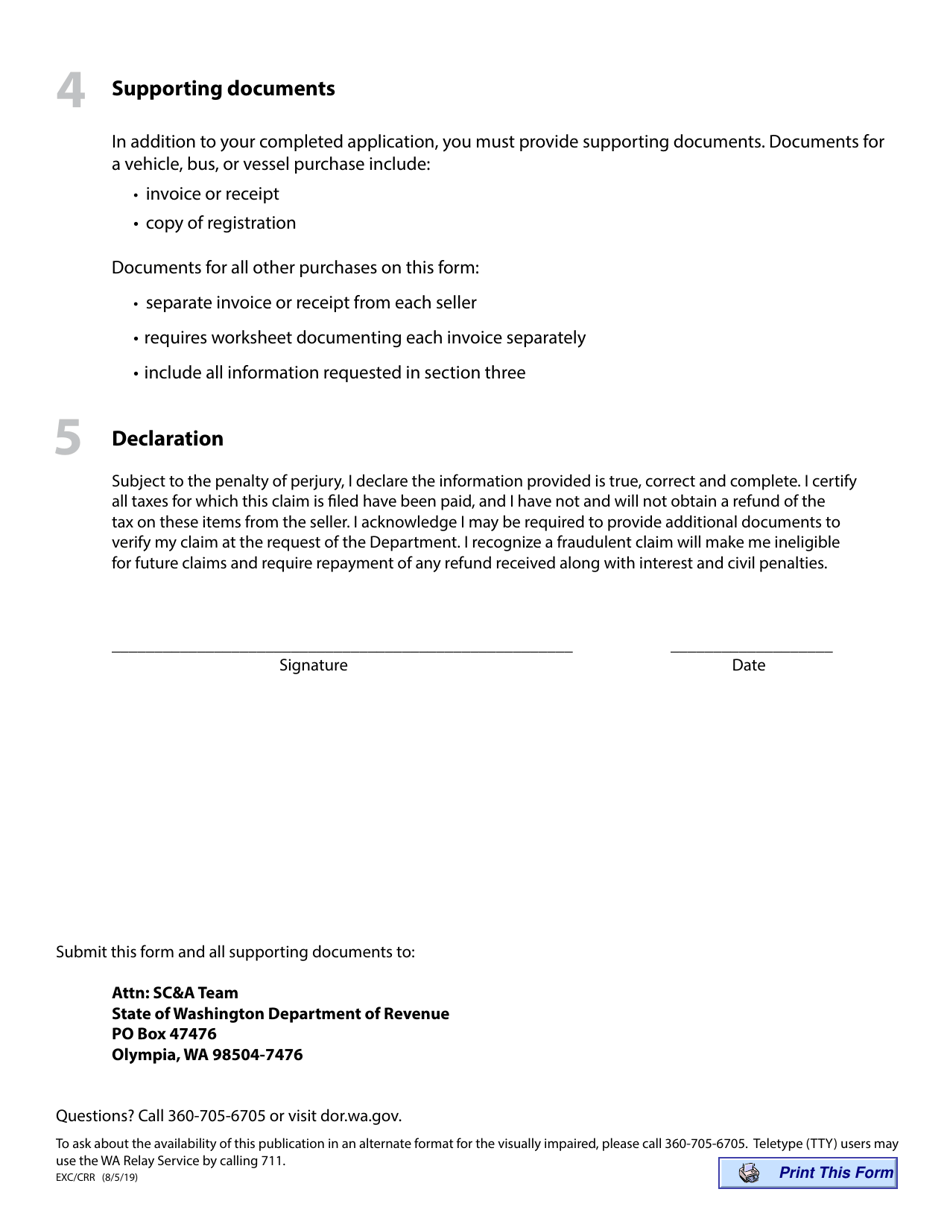

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

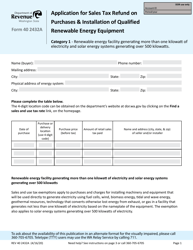

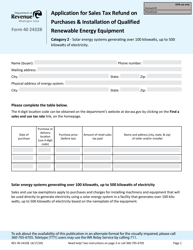

Q: What is Form EXC/CRR?

A: Form EXC/CRR is a form used to request a Green Transportation Sales Tax Refund in Washington.

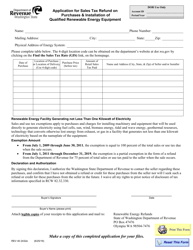

Q: What is a Green Transportation Sales Tax Refund?

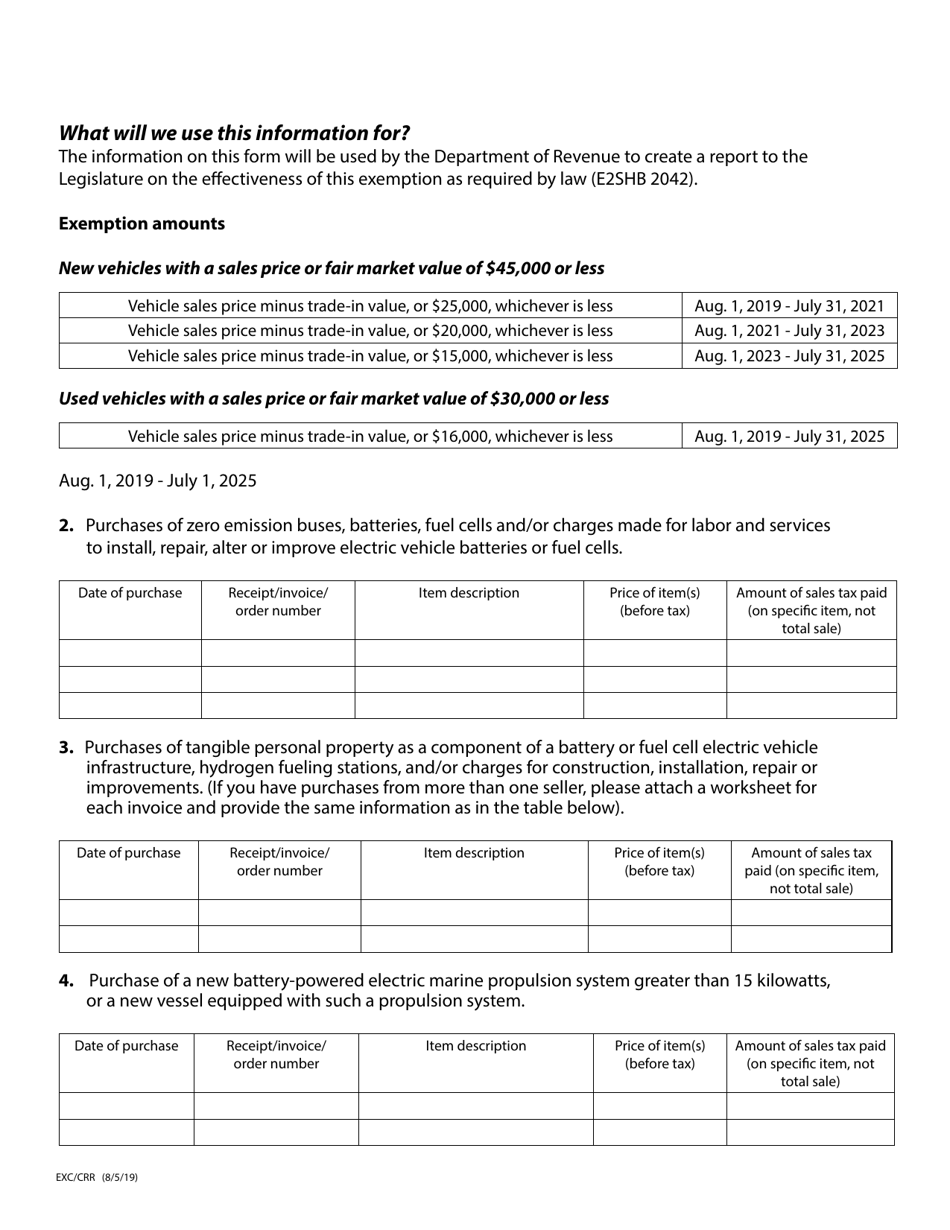

A: A Green Transportation Sales Tax Refund is a refund of sales tax paid on qualifying green transportation.

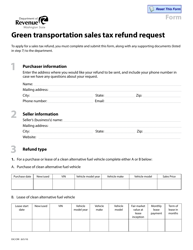

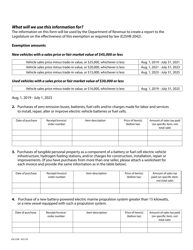

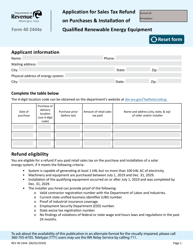

Q: Who is eligible for a Green Transportation Sales Tax Refund?

A: Eligibility for a Green Transportation Sales Tax Refund depends on the type of vehicle and the purpose for which it is being used.

Q: What vehicles qualify for a Green Transportation Sales Tax Refund?

A: Vehicles powered by electricity, hydrogen, natural gas, or a blend of biodiesel and petroleum are some examples of vehicles that may qualify.

Q: What is the purpose of the Form EXC/CRR?

A: The purpose of the Form EXC/CRR is to request a refund of sales tax paid on qualifying green transportation.

Form Details:

- Released on August 5, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EXC/CRR by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.