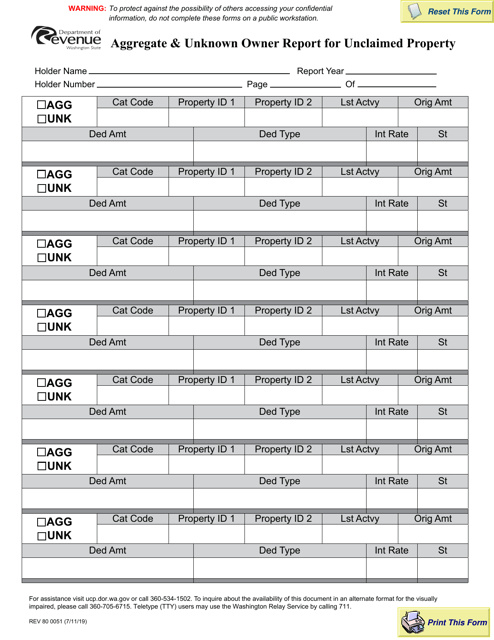

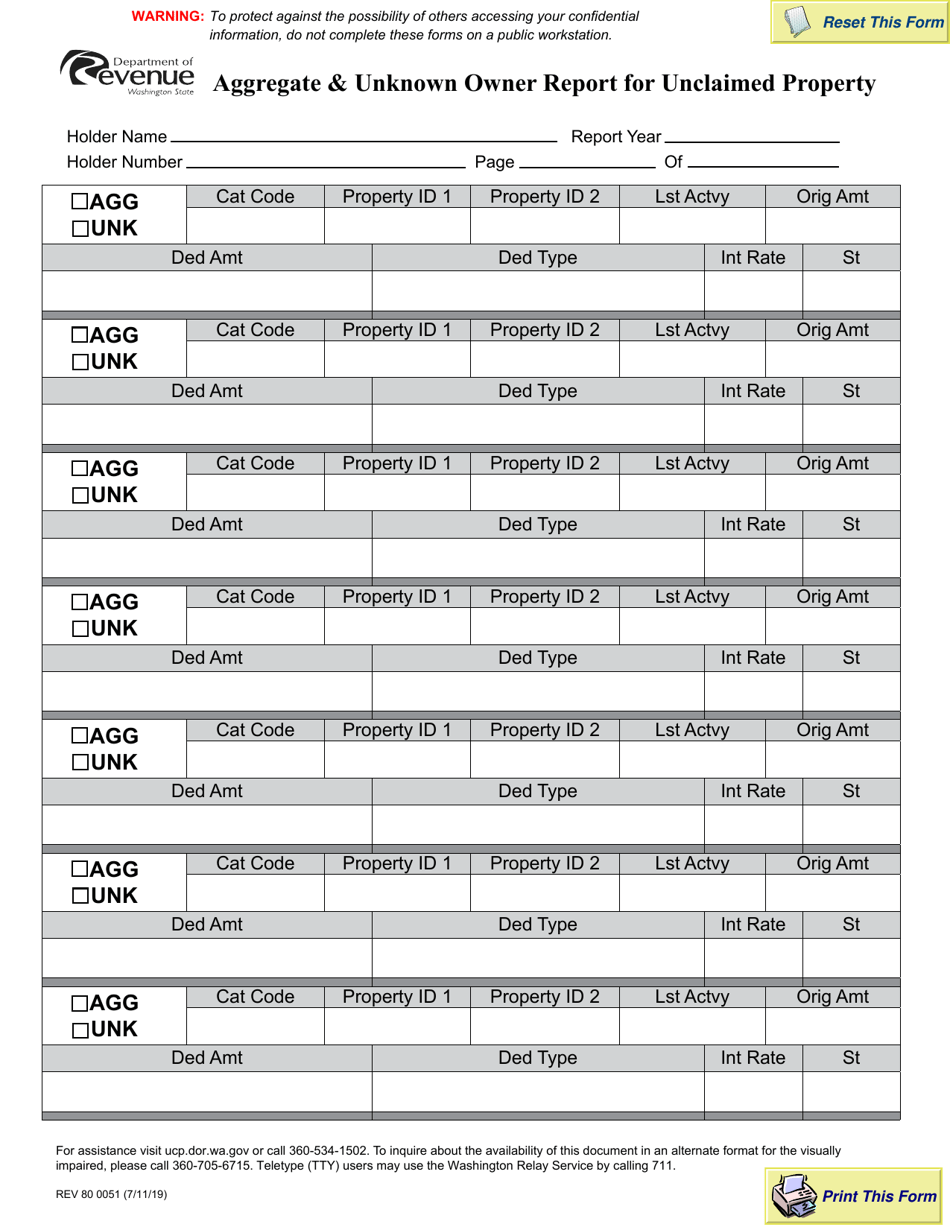

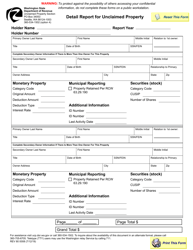

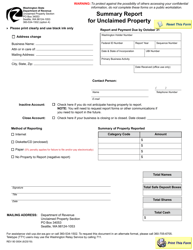

Form REV80 0051 Aggregate & Unknown Owner Report for Unclaimed Property - Washington

What Is Form REV80 0051?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV80 0051?

A: Form REV80 0051 is the Aggregate & Unknown Owner Report for Unclaimed Property in Washington.

Q: What is unclaimed property?

A: Unclaimed property refers to financial assets that have been abandoned by their owners for an extended period of time.

Q: Why is the Aggregate & Unknown Owner Report required?

A: The report is required by the state of Washington to identify and report unclaimed property to the appropriate authorities.

Q: Who needs to file Form REV80 0051?

A: Any business or organization that is in possession of unclaimed property in Washington is required to file this form.

Q: When is the Form REV80 0051 due?

A: The due date for filing Form REV80 0051 can vary, so it is important to check the specific deadlines set by the state of Washington.

Q: Are there any penalties for not filing the report?

A: Yes, failure to file the report or filing it late can result in penalties and interest.

Q: Is there a minimum threshold for reporting unclaimed property?

A: Yes, there is a minimum reporting threshold set by the state of Washington. It is advisable to review the specific requirements.

Q: Can I amend a previously filed report?

A: Yes, you can amend a previously filed report if there are errors or omissions. It is recommended to consult the instructions for details on how to do this.

Q: What happens to the unclaimed property after it is reported?

A: Once the unclaimed property is reported, the state will make efforts to locate and return it to the rightful owners.

Form Details:

- Released on July 11, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV80 0051 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.