This version of the form is not currently in use and is provided for reference only. Download this version of

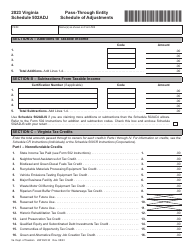

Schedule 502ADJ

for the current year.

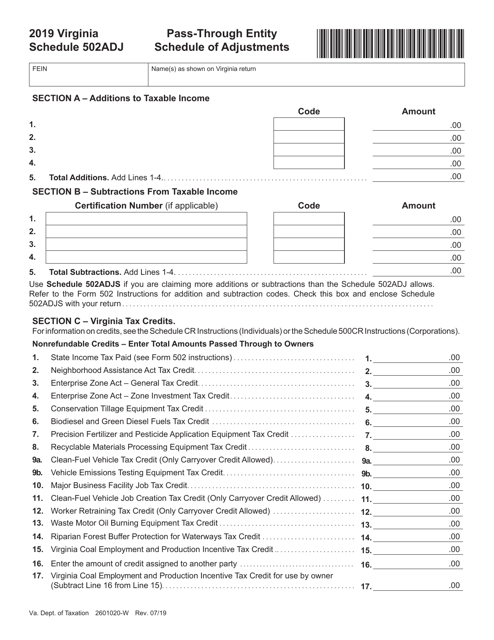

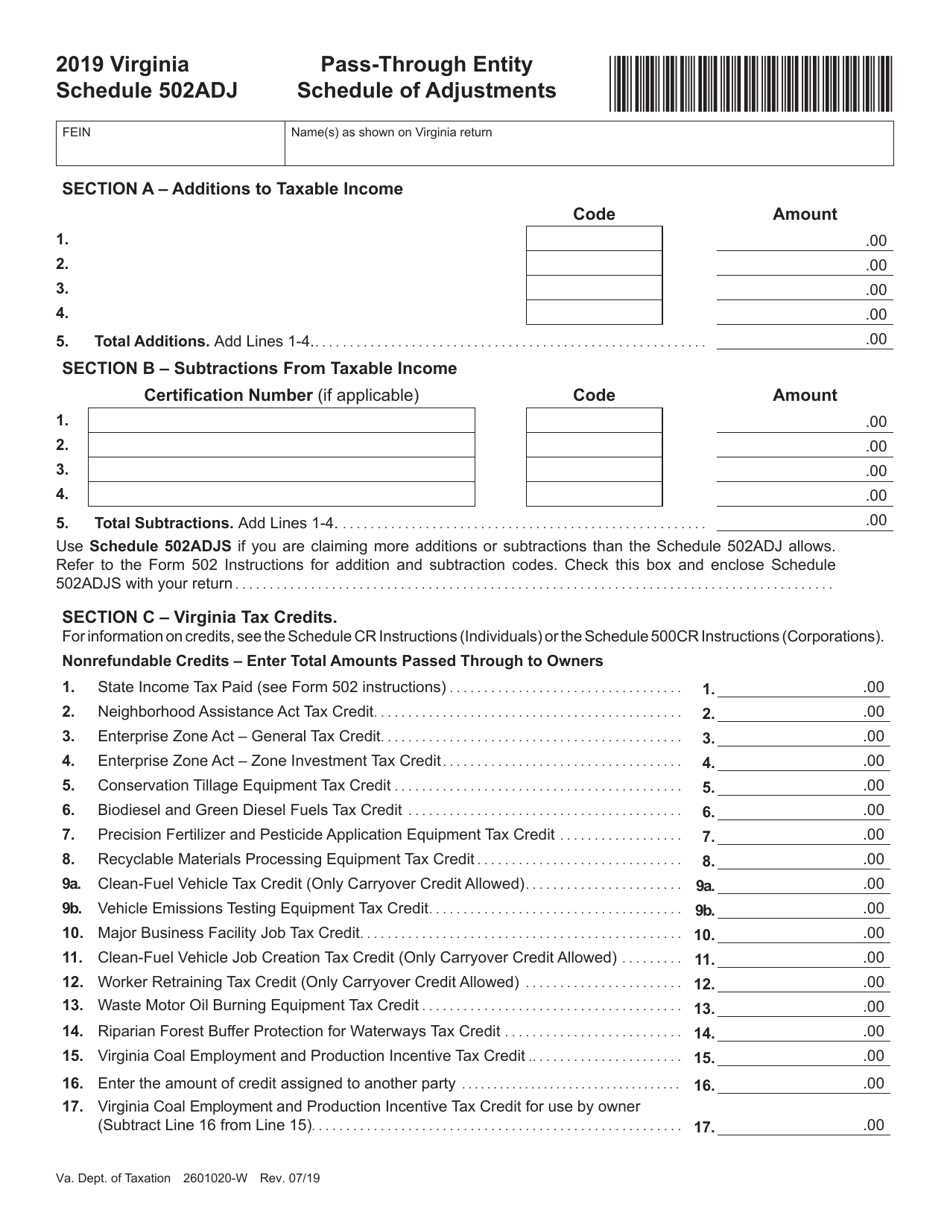

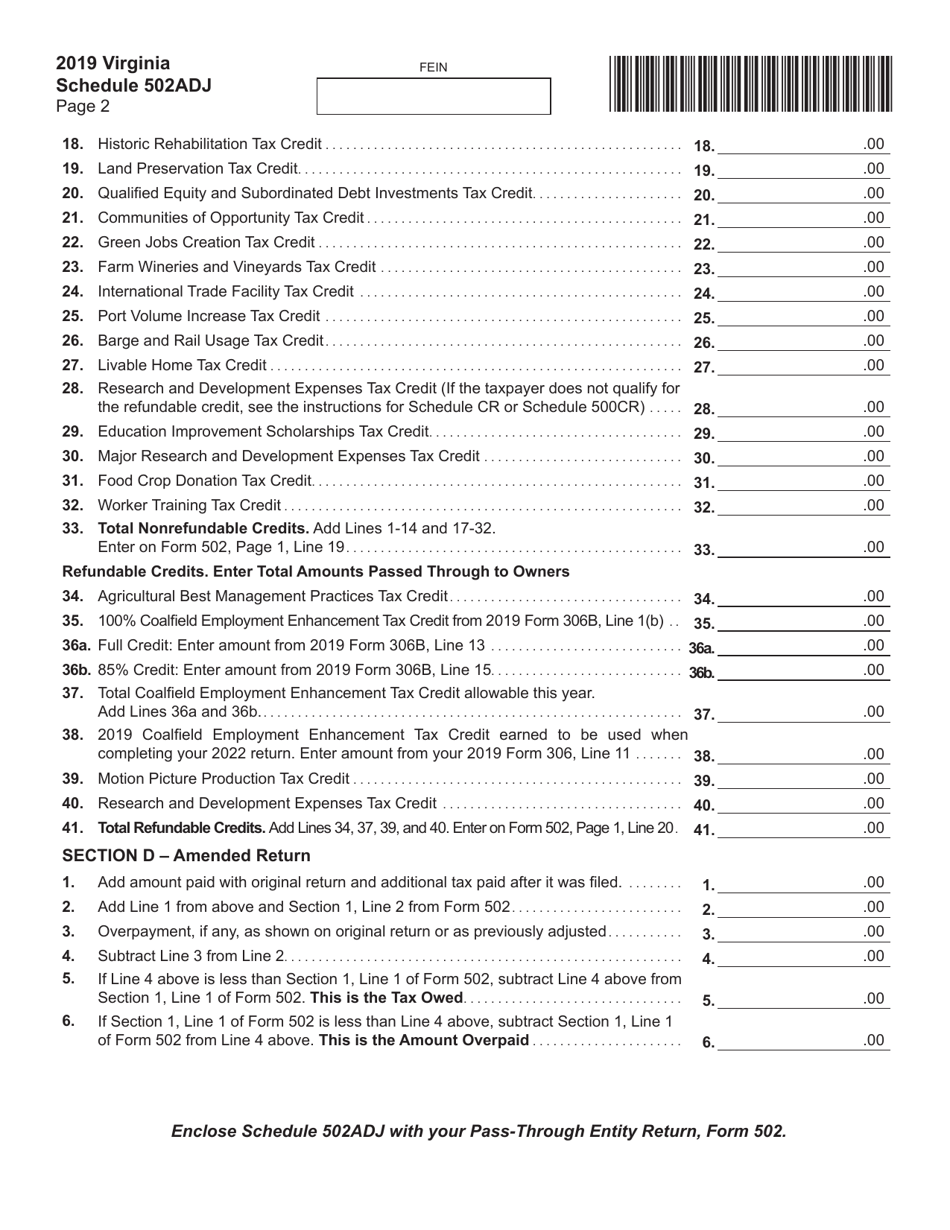

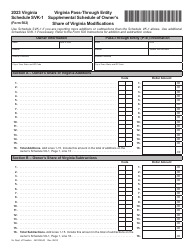

Schedule 502ADJ Pass-Through Entity Schedule of Adjustments - Virginia

What Is Schedule 502ADJ?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 502ADJ?

A: Schedule 502ADJ is the Pass-Through Entity Schedule of Adjustments in Virginia.

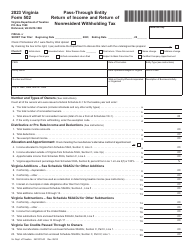

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax at the entity level, but instead passes the income, losses, deductions, and credits through to its owners.

Q: Why do I need to file Schedule 502ADJ?

A: You need to file Schedule 502ADJ if you are a pass-through entity in Virginia and need to report adjustments to your income, deductions, credits, or other tax items.

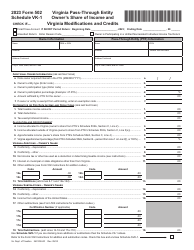

Q: Is Schedule 502ADJ only for Virginia residents?

A: No, Schedule 502ADJ is for both Virginia residents and non-residents who have income from a pass-through entity in Virginia.

Q: What types of adjustments are reported on Schedule 502ADJ?

A: On Schedule 502ADJ, you can report adjustments related to additions or subtractions to your Virginia taxable income, deductions, credits, or other tax items.

Q: When is the deadline to file Schedule 502ADJ?

A: The deadline to file Schedule 502ADJ is the same as the deadline for filing your pass-through entity's Virginia income tax return, which is generally due on April 15th.

Q: Are there any penalties for not filing Schedule 502ADJ?

A: Yes, if you fail to file Schedule 502ADJ or file it late, you may be subject to penalties and interest on any tax due.

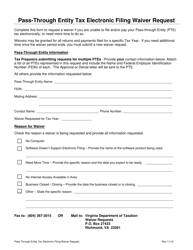

Q: Can I e-file Schedule 502ADJ?

A: No, currently Virginia does not offer e-filing options for Schedule 502ADJ, so you will need to file it by mail.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 502ADJ by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.