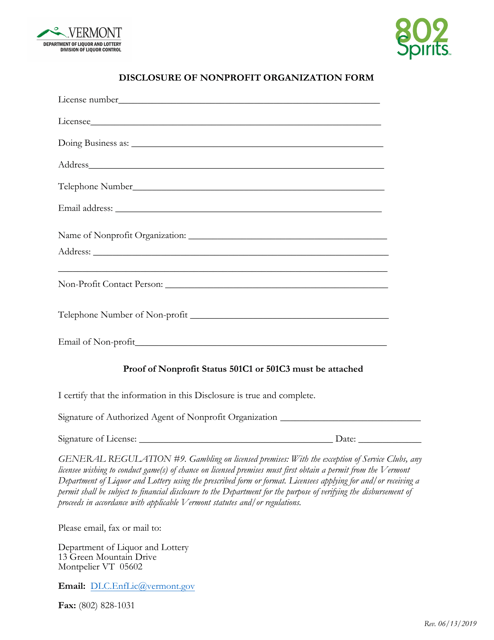

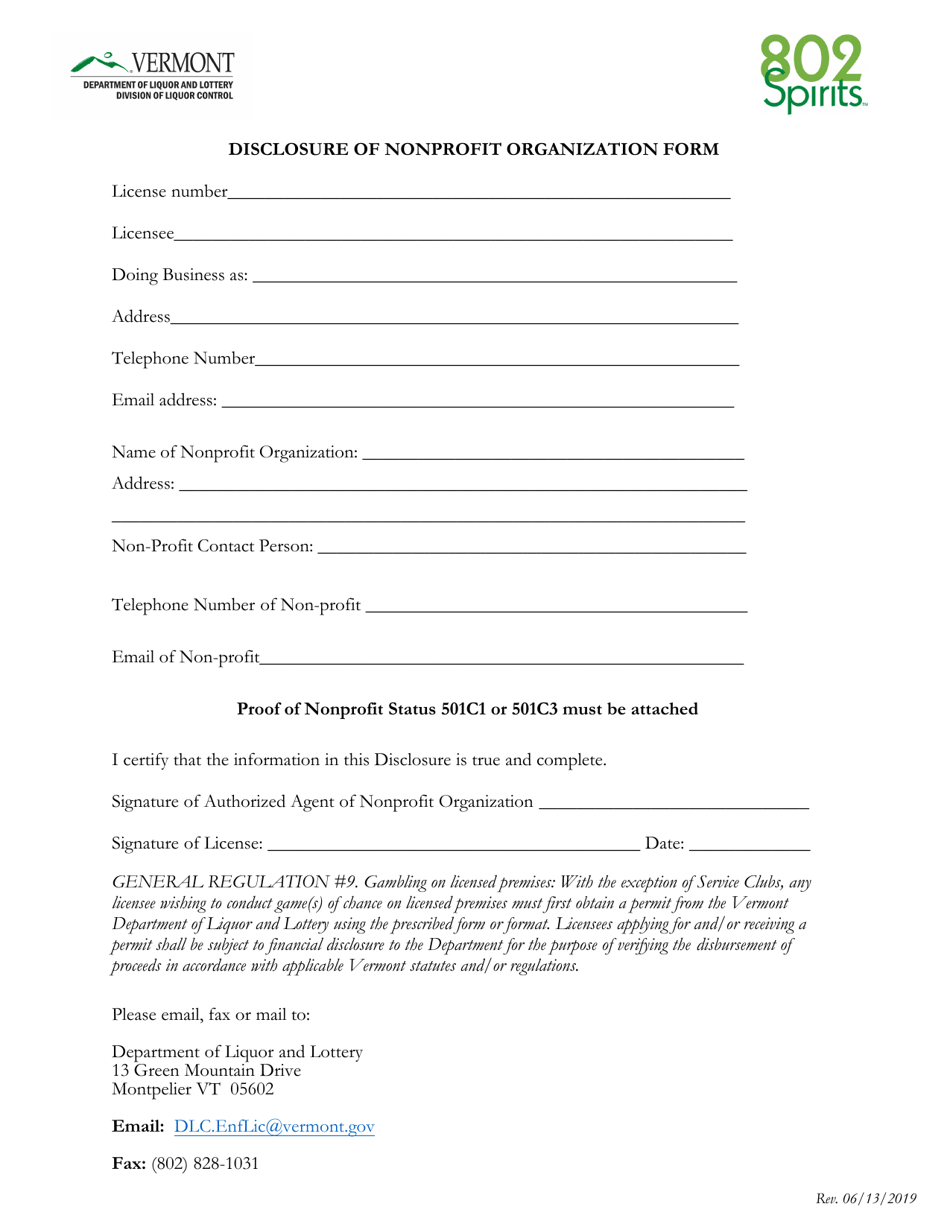

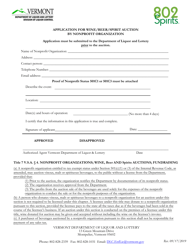

Disclosure of Nonprofit Organization Form - Vermont

Disclosure of Nonprofit Organization Form is a legal document that was released by the Vermont Department of Liquour and Lottery - a government authority operating within Vermont.

FAQ

Q: What is the Disclosure of Nonprofit Organization Form in Vermont?

A: The Disclosure of Nonprofit Organization Form in Vermont is a form that nonprofit organizations are required to submit to disclose certain information.

Q: Why do nonprofit organizations in Vermont need to submit the Disclosure Form?

A: Nonprofit organizations in Vermont need to submit the Disclosure Form to provide transparency and accountability to the public and government.

Q: What information is required to be disclosed on the form?

A: The form requires disclosure of the organization's name, address, purpose, activities, financial information, and key personnel.

Q: Is the Disclosure Form publicly accessible?

A: Yes, the Disclosure Form is publicly accessible and can be viewed by anyone who requests it.

Q: Is there a fee associated with submitting the Disclosure Form?

A: No, there is no fee associated with submitting the Disclosure Form.

Q: Is there a deadline for submitting the Disclosure Form?

A: Yes, nonprofit organizations in Vermont must submit the Disclosure Form annually by a specified deadline.

Q: What are the consequences of not submitting the Disclosure Form?

A: Nonprofit organizations may face penalties, including fines or loss of tax-exempt status, for failure to submit the Disclosure Form.

Q: Are there any exceptions or exemptions to filing the Disclosure Form?

A: Certain small nonprofit organizations may be exempt from filing the Disclosure Form, but it is best to consult with the Vermont Secretary of State's office for specific eligibility criteria.

Form Details:

- Released on June 13, 2019;

- The latest edition currently provided by the Vermont Department of Liquour and Lottery;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Liquour and Lottery.