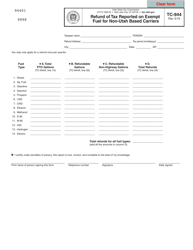

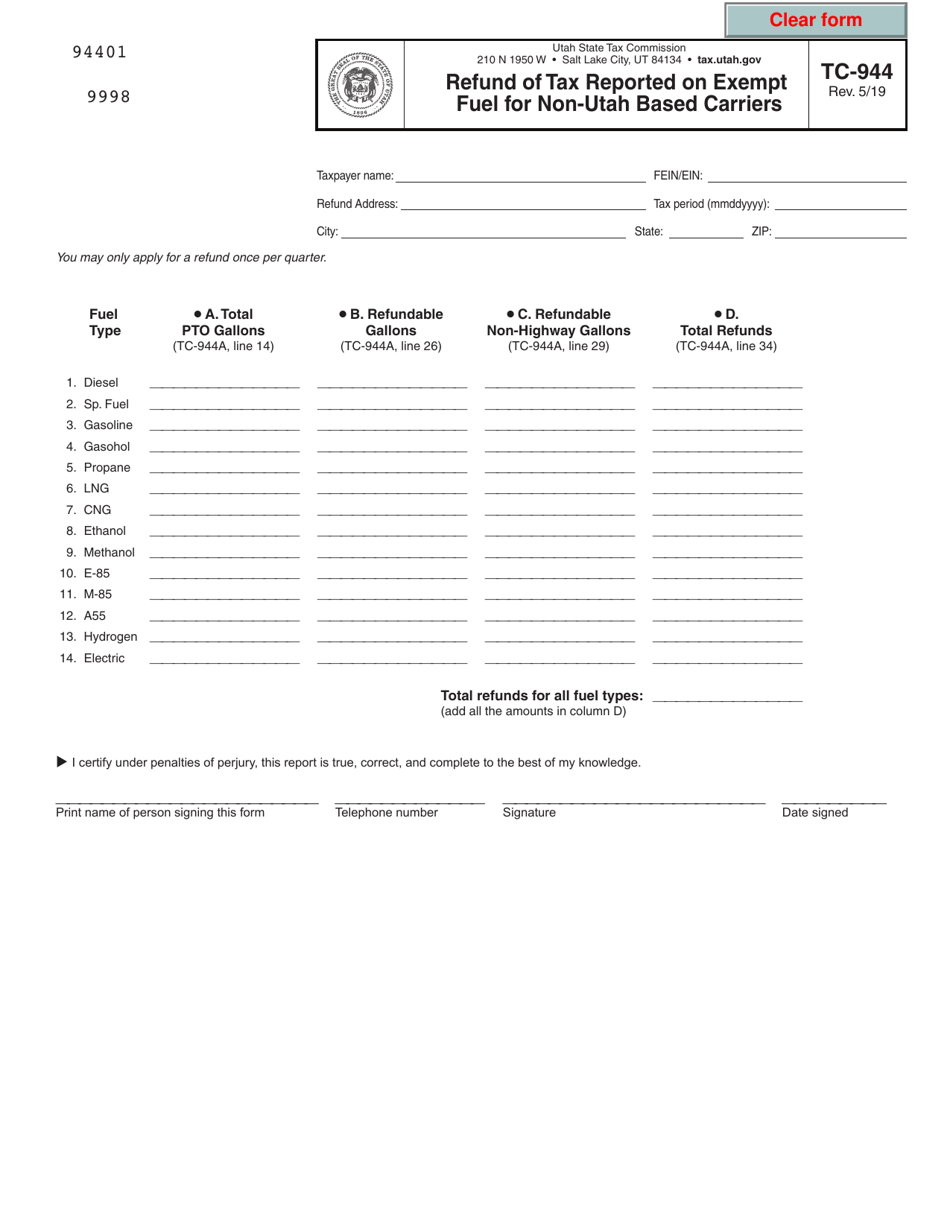

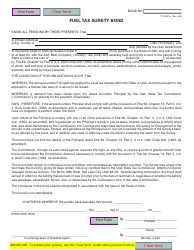

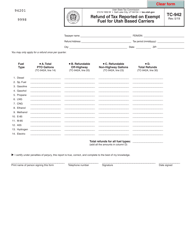

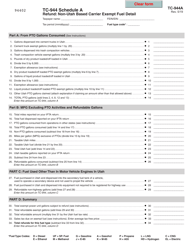

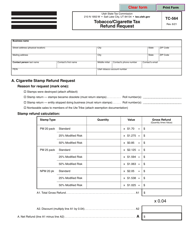

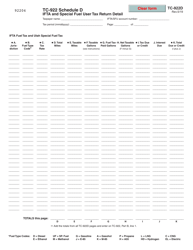

Form TC-944 Refund of Tax Reported on Exempt Fuel for Non-utah Based Carriers - Utah

What Is Form TC-944?

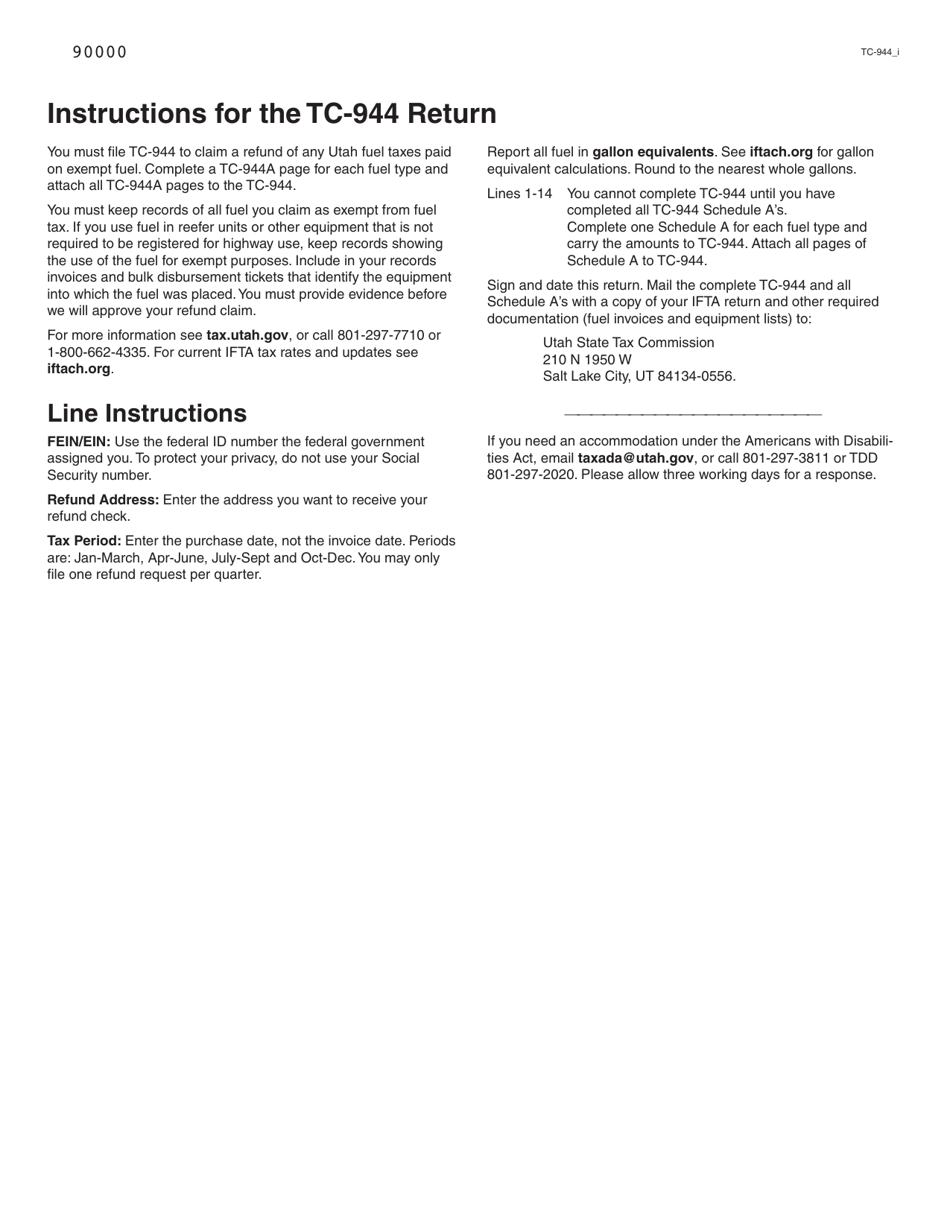

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-944?

A: Form TC-944 is a Refund of Tax Reported on Exempt Fuel for Non-Utah Based Carriers.

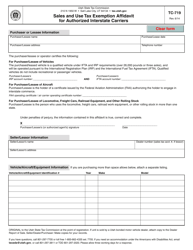

Q: Who can use Form TC-944?

A: Non-Utah based carriers can use Form TC-944 to claim a refund of tax reported on exempt fuel.

Q: What is the purpose of Form TC-944?

A: The purpose of Form TC-944 is to obtain a refund of tax paid on exempt fuel by non-Utah based carriers.

Q: Is there a deadline for submitting Form TC-944?

A: Yes, Form TC-944 must be submitted within one year from the end of the calendar quarter in which the tax was paid.

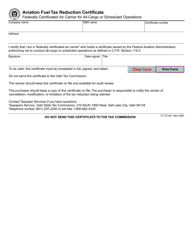

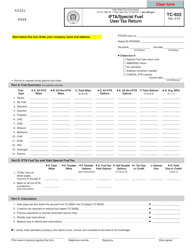

Q: What supporting documents are required with Form TC-944?

A: You must attach copies of your IFTA (International Fuel Tax Agreement) quarterly returns and schedules to Form TC-944.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-944 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.