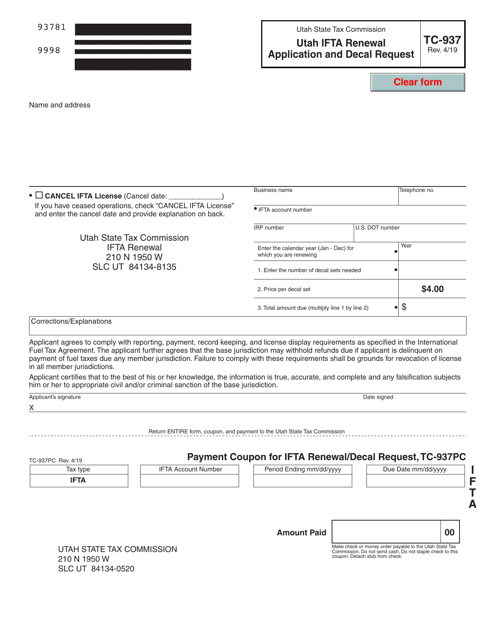

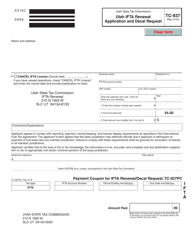

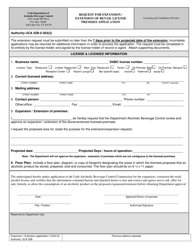

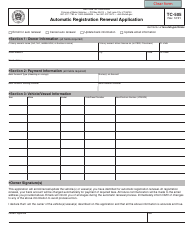

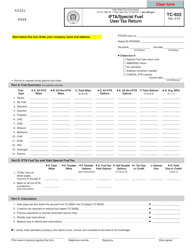

Form TC-937 Utah Ifta Renewal Application and Decal Request - Utah

What Is Form TC-937?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-937?

A: Form TC-937 is the Utah IFTA Renewal Application and Decal Request form.

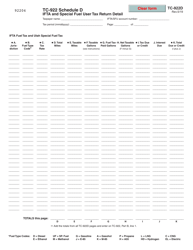

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is an agreement among the United States and Canadian provinces that simplifies the reporting and payment of fuel taxes across jurisdictions.

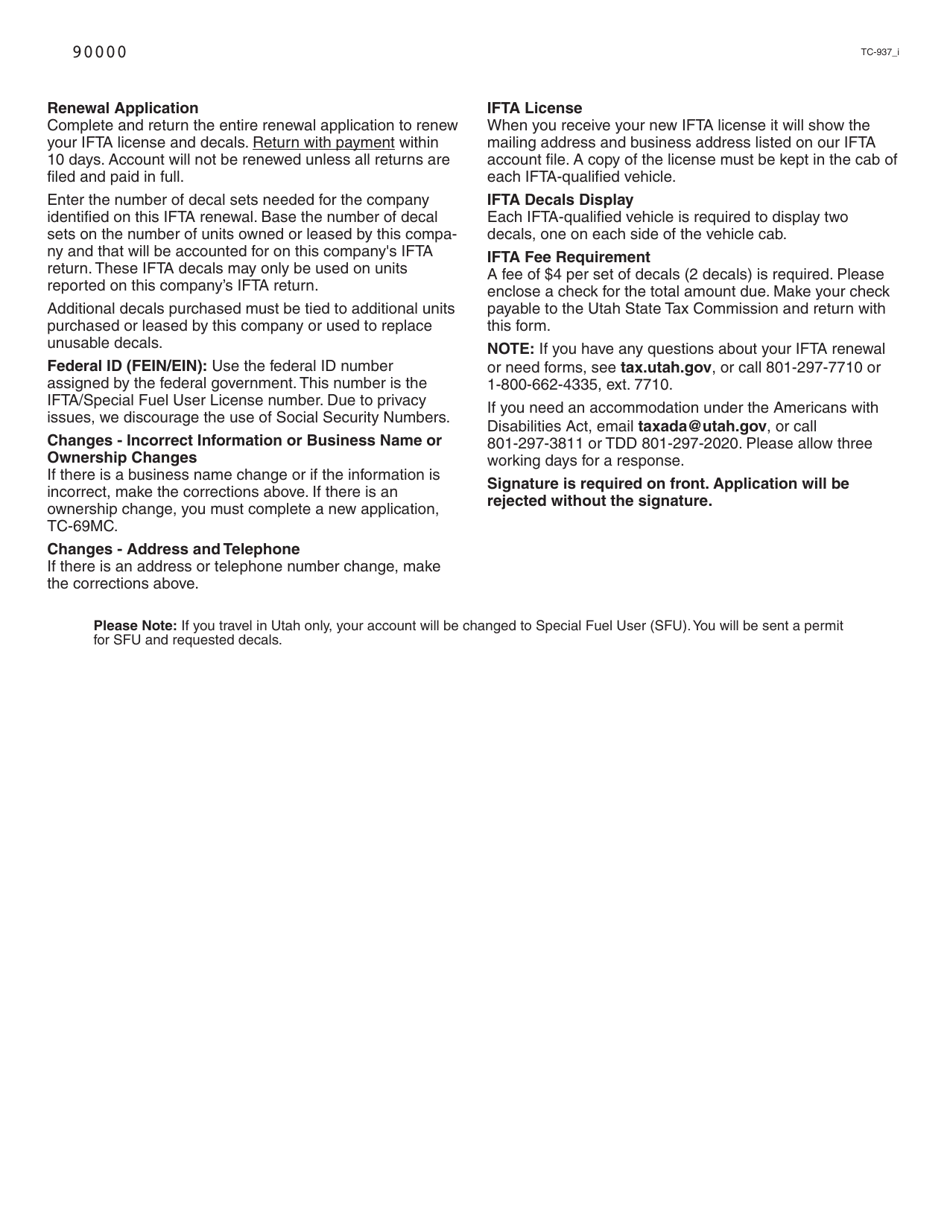

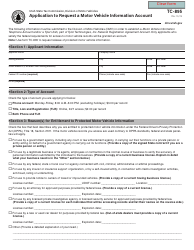

Q: Who needs to file Form TC-937?

A: Motor carriers who operate qualified motor vehicles in more than one jurisdiction and are registered for the IFTA need to file Form TC-937.

Q: What is the purpose of Form TC-937?

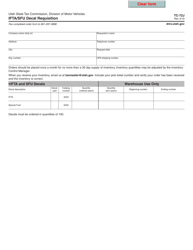

A: Form TC-937 is used to renew IFTA credentials, report fuel usage, and request new decals for qualified motor vehicles.

Q: What information is required on Form TC-937?

A: Form TC-937 requires information such as the account number, vehicle information, fuel purchases, and mileage for each jurisdiction.

Q: When is Form TC-937 due?

A: Form TC-937 is due on January 1st of each year for the upcoming calendar year.

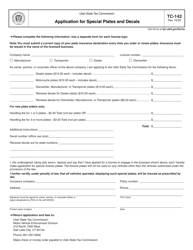

Q: Are there any fees associated with filing Form TC-937?

A: Yes, there are fees associated with filing Form TC-937. These fees vary depending on the number of qualified motor vehicles and jurisdictions.

Q: How can I submit Form TC-937?

A: Form TC-937 can be submitted electronically through the Utah Motor Carrier Portal or by mail to the Motor Carrier Services Division.

Q: What happens if I don't file Form TC-937?

A: Failure to file Form TC-937 or pay the required fees can result in penalties, fines, and the suspension of IFTA credentials.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-937 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.