This version of the form is not currently in use and is provided for reference only. Download this version of

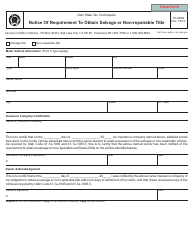

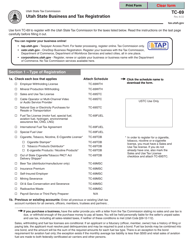

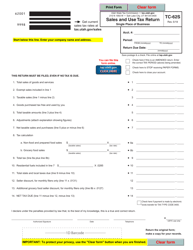

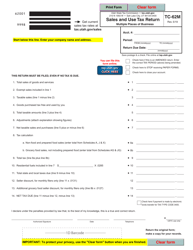

Form TC-69C

for the current year.

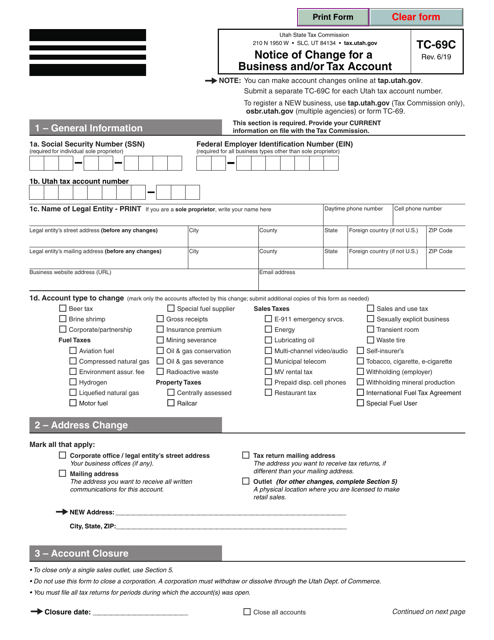

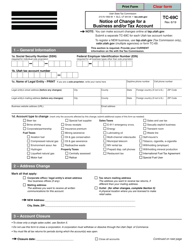

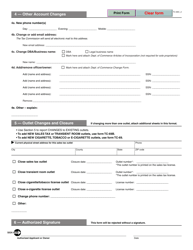

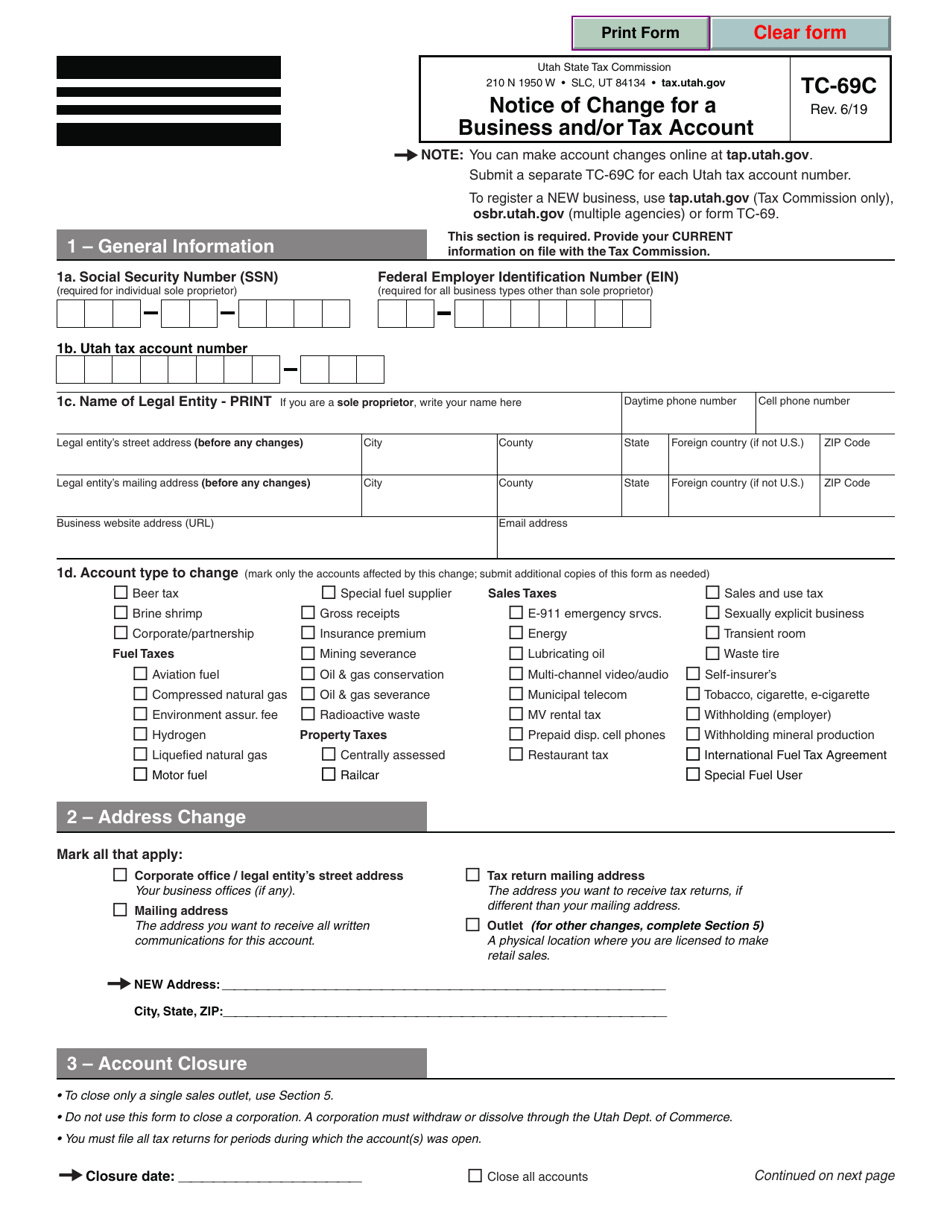

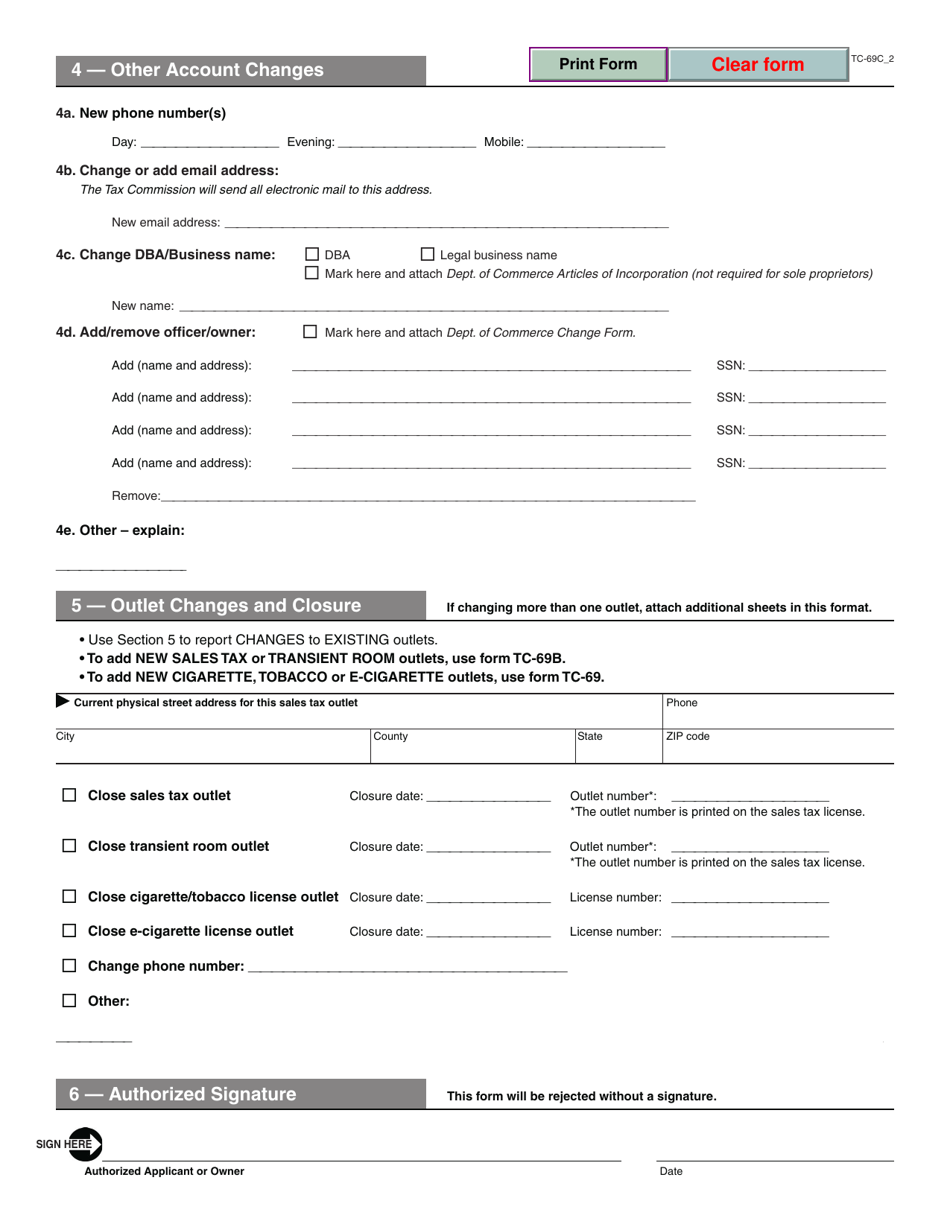

Form TC-69C Notice of Change for a Business and / or Tax Account - Utah

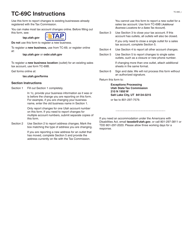

What Is Form TC-69C?

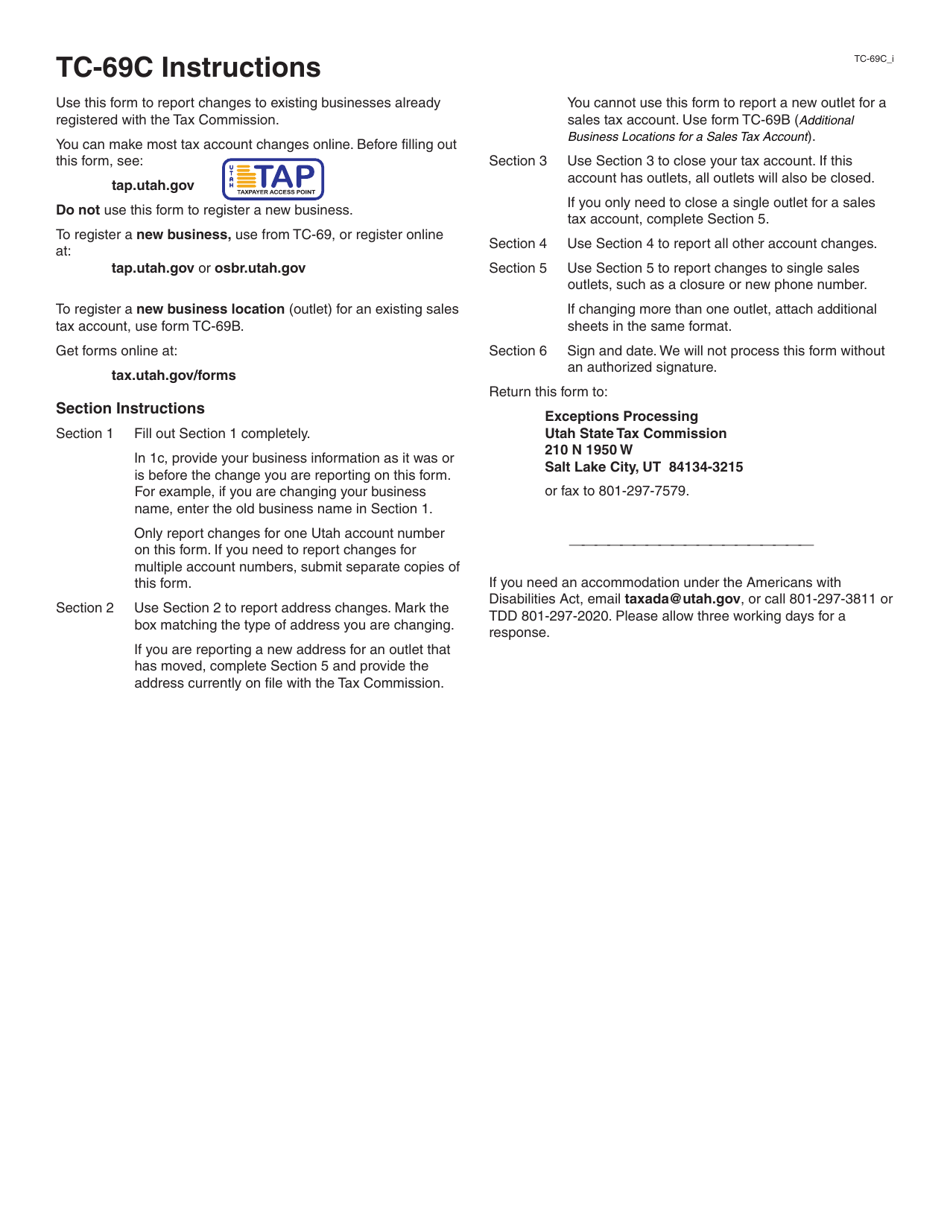

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-69C Notice of Change for a Business and/or Tax Account?

A: Form TC-69C Notice of Change for a Business and/or Tax Account is a document used in Utah to notify the Department of Revenue of any changes in your business or tax account.

Q: When do I need to file Form TC-69C Notice of Change for a Business and/or Tax Account?

A: You need to file Form TC-69C Notice of Change for a Business and/or Tax Account within 30 days of any changes to your business or tax account information, such as changes in ownership, address, or business activities.

Q: What information do I need to provide on Form TC-69C Notice of Change for a Business and/or Tax Account?

A: You will need to provide your business name, tax identification number, contact information, and details of the changes being made to your business or tax account.

Q: What are the consequences of not filing Form TC-69C Notice of Change for a Business and/or Tax Account?

A: Failure to file Form TC-69C Notice of Change for a Business and/or Tax Account may result in penalties or other enforcement actions by the Utah Department of Revenue.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69C by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.