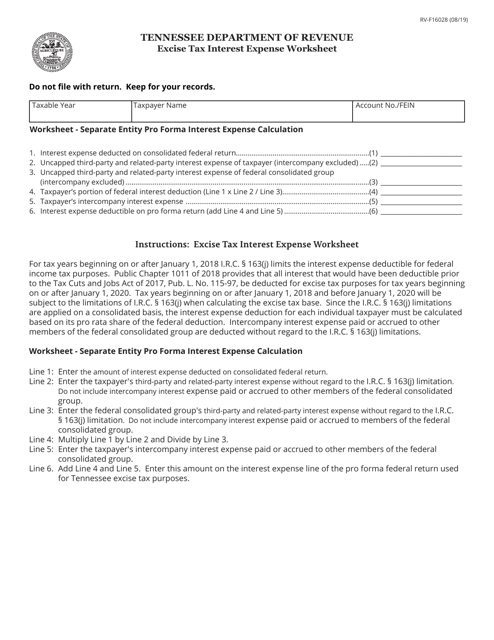

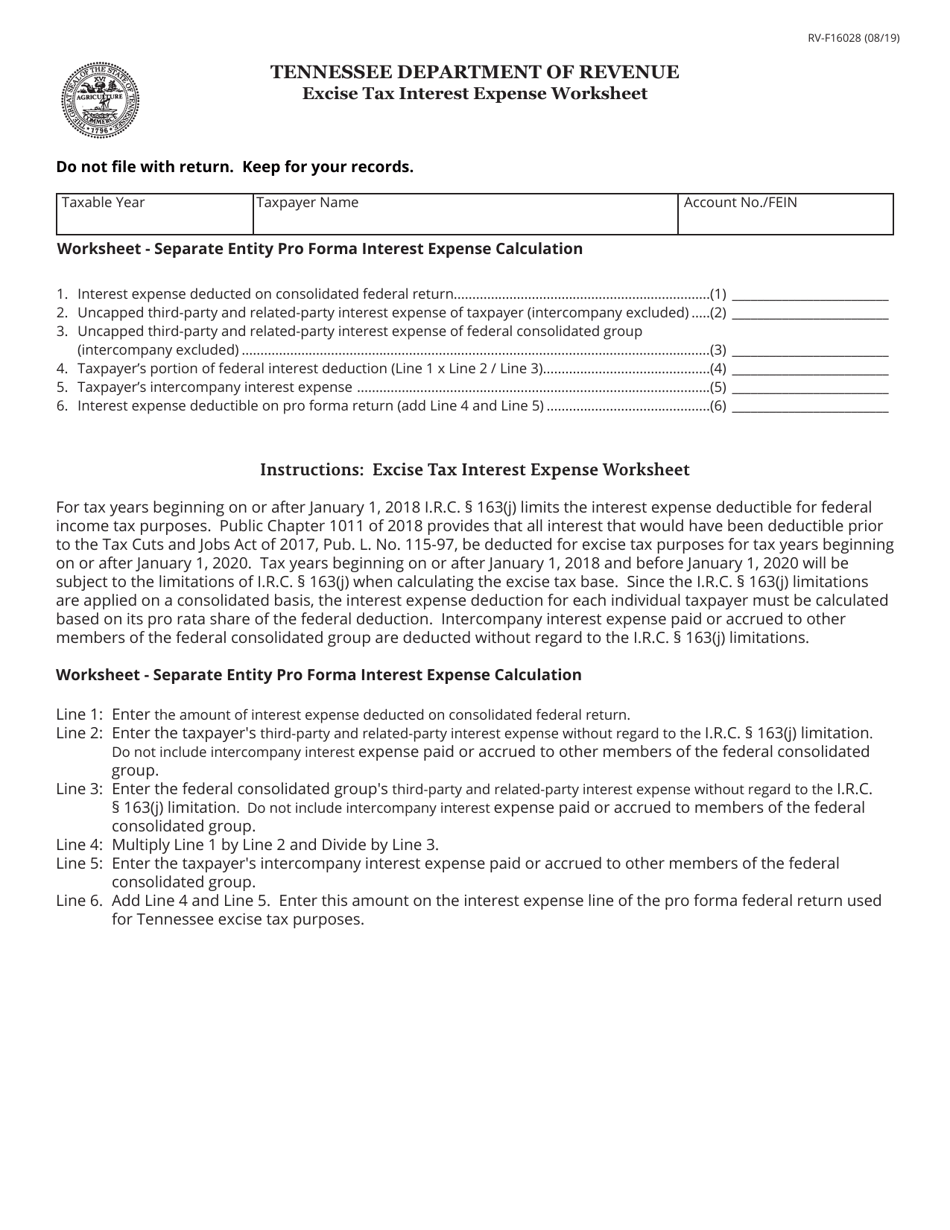

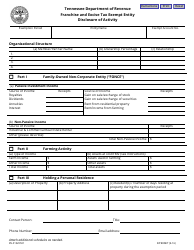

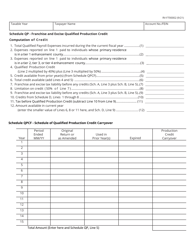

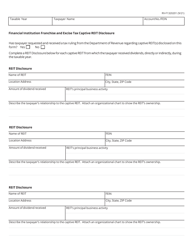

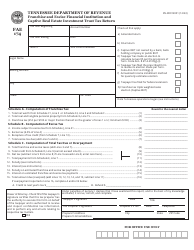

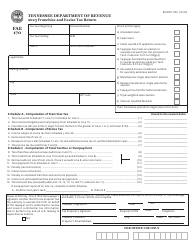

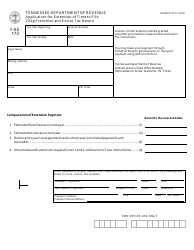

Form RV-F16028 Excise Tax Interest Expense Worksheet - Tennessee

What Is Form RV-F16028?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

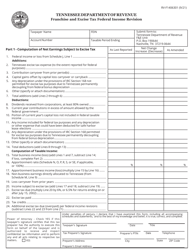

Q: What is the Form RV-F16028?

A: The Form RV-F16028 is the Excise Tax Interest Expense Worksheet specific to Tennessee.

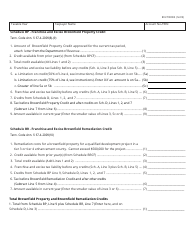

Q: What is excise tax?

A: Excise tax is a tax imposed on specific goods and activities, such as gasoline or tobacco.

Q: What is the purpose of the Form RV-F16028?

A: The purpose of the Form RV-F16028 is to calculate the interest expense deduction related to excise tax in Tennessee.

Q: Who needs to fill out this form?

A: This form needs to be filled out by individuals or businesses who have incurred interest expenses related to excise tax in Tennessee.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

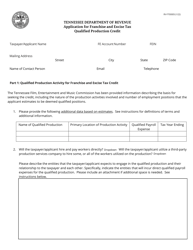

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F16028 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.