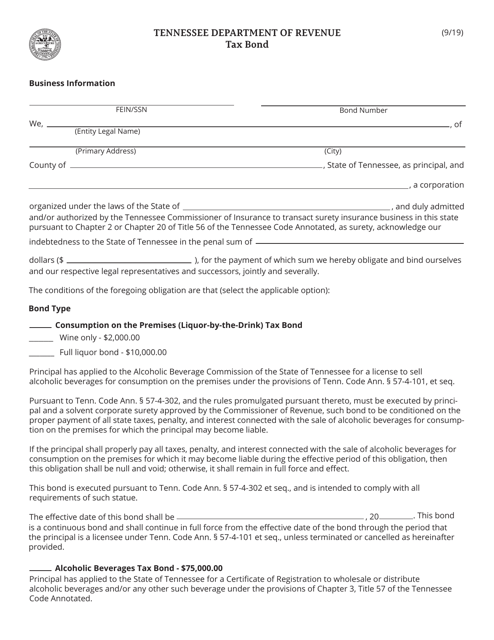

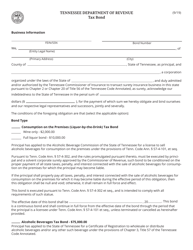

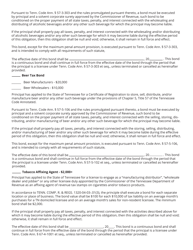

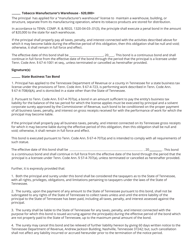

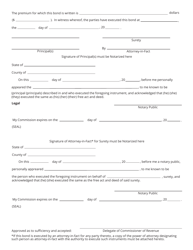

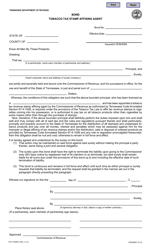

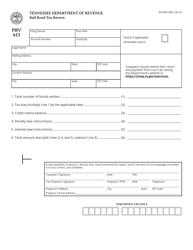

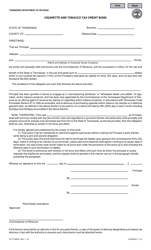

Tax Bond - Tennessee

Tax Bond is a legal document that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee.

FAQ

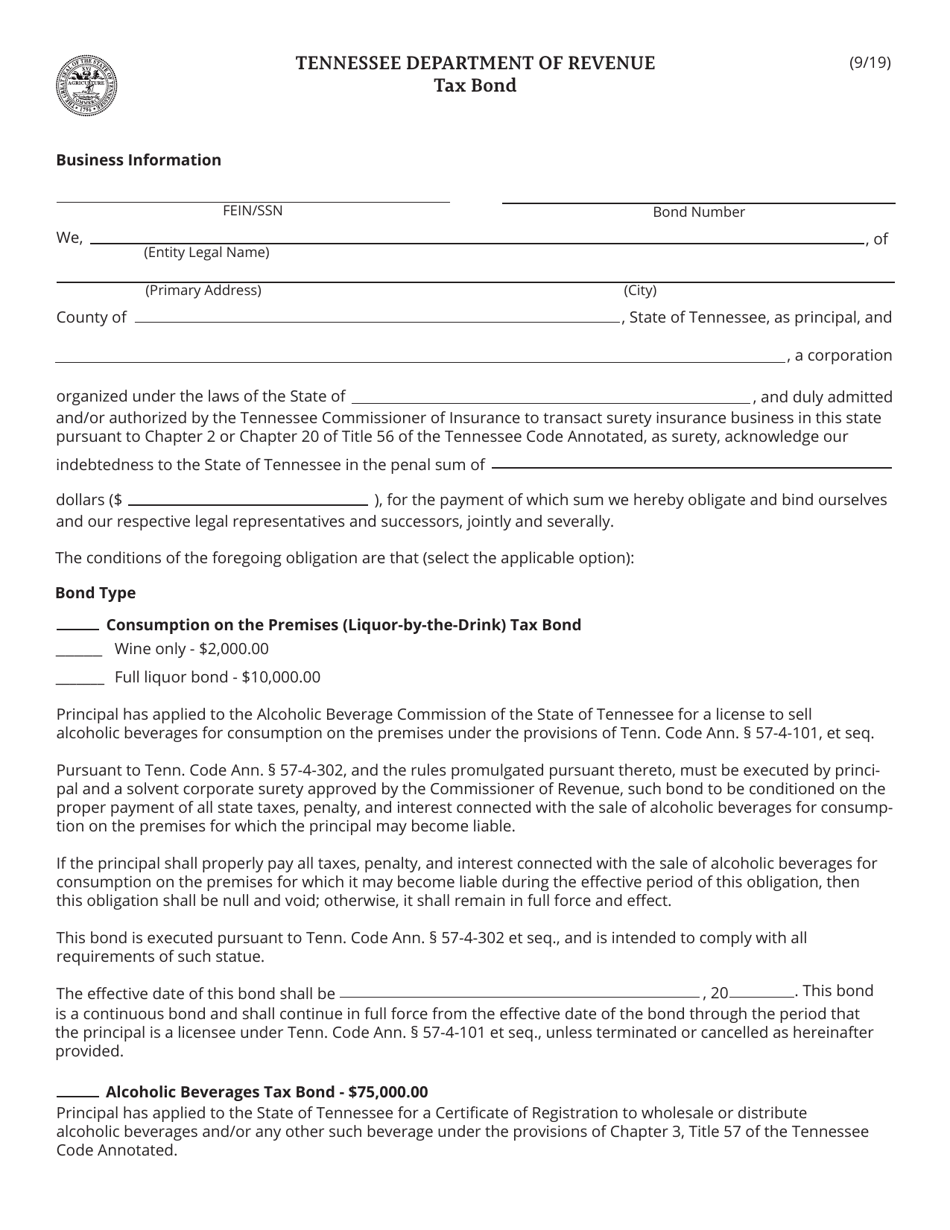

Q: What is a tax bond?

A: A tax bond is a type of surety bond that guarantees payment of taxes owed to the government.

Q: Why would I need a tax bond in Tennessee?

A: In Tennessee, individuals or businesses may be required to obtain a tax bond as a condition for obtaining a business license or to ensure compliance with the state's tax laws.

Q: Who requires tax bonds in Tennessee?

A: The Tennessee Department of Revenue may require tax bonds from certain taxpayers, such as those with a history of non-payment or non-compliance.

Q: How much does a tax bond in Tennessee cost?

A: The cost of a tax bond in Tennessee varies depending on factors such as the bond amount required and the applicant's credit history.

Q: How long does a tax bond in Tennessee remain valid?

A: Tax bonds in Tennessee typically remain valid for one year, but they may need to be renewed annually or as specified by the government agency that requires the bond.

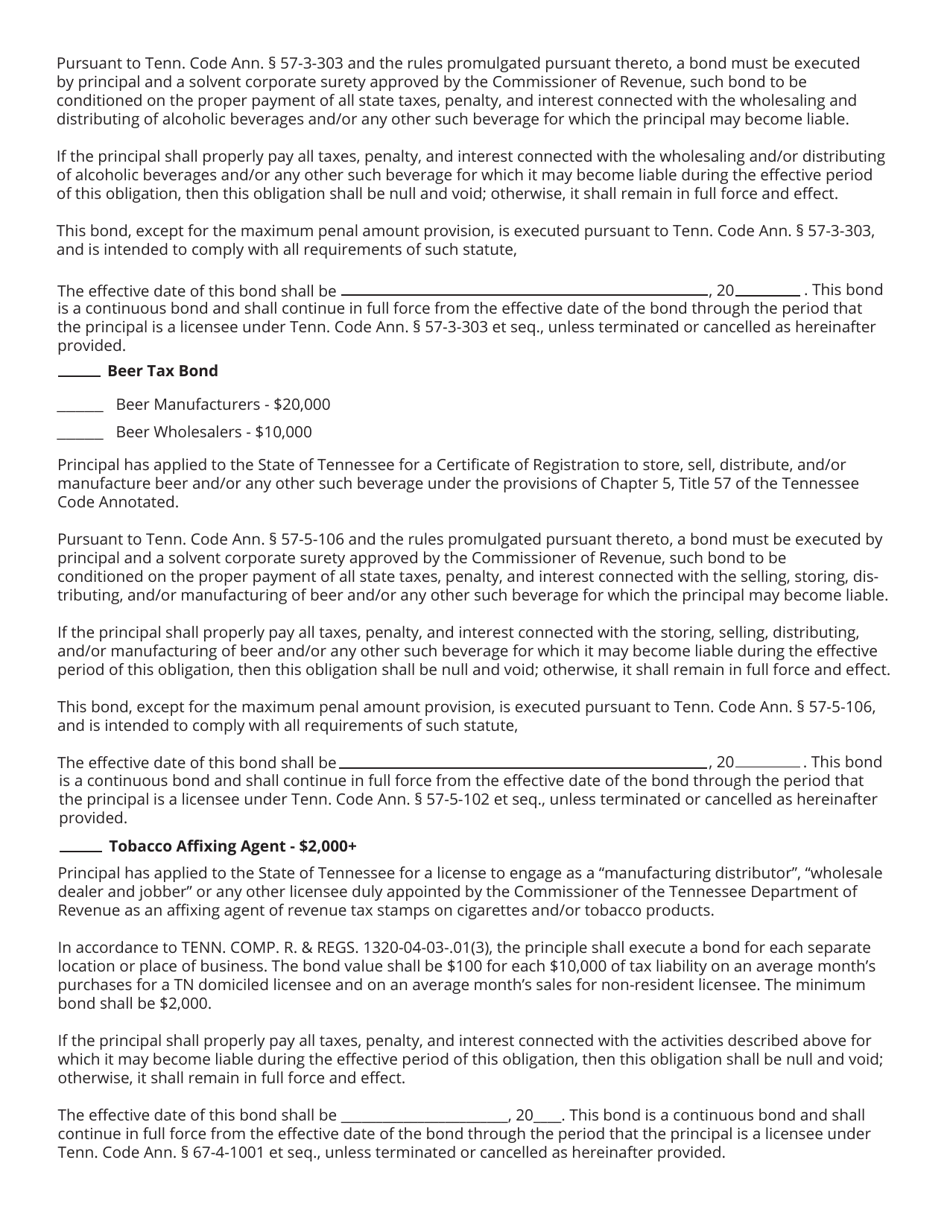

Q: What happens if I fail to pay my taxes in Tennessee?

A: If you fail to pay your taxes in Tennessee, the government may make a claim on your tax bond to recover the unpaid taxes.

Q: Can I get a tax bond in Tennessee with bad credit?

A: Yes, even individuals with bad credit can typically obtain a tax bond in Tennessee, although the cost may be higher.

Q: Are tax bonds refundable in Tennessee?

A: No, tax bonds are not refundable in Tennessee. Once obtained, the bond remains in effect until it expires or is canceled by the surety company.

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Tennessee Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.