This version of the form is not currently in use and is provided for reference only. Download this version of

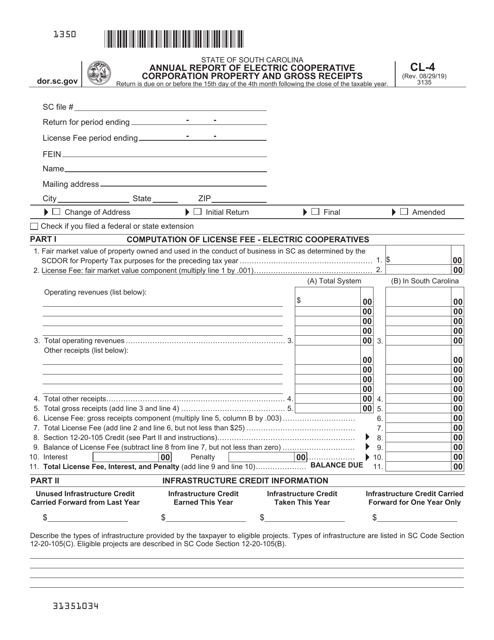

Form CL-4

for the current year.

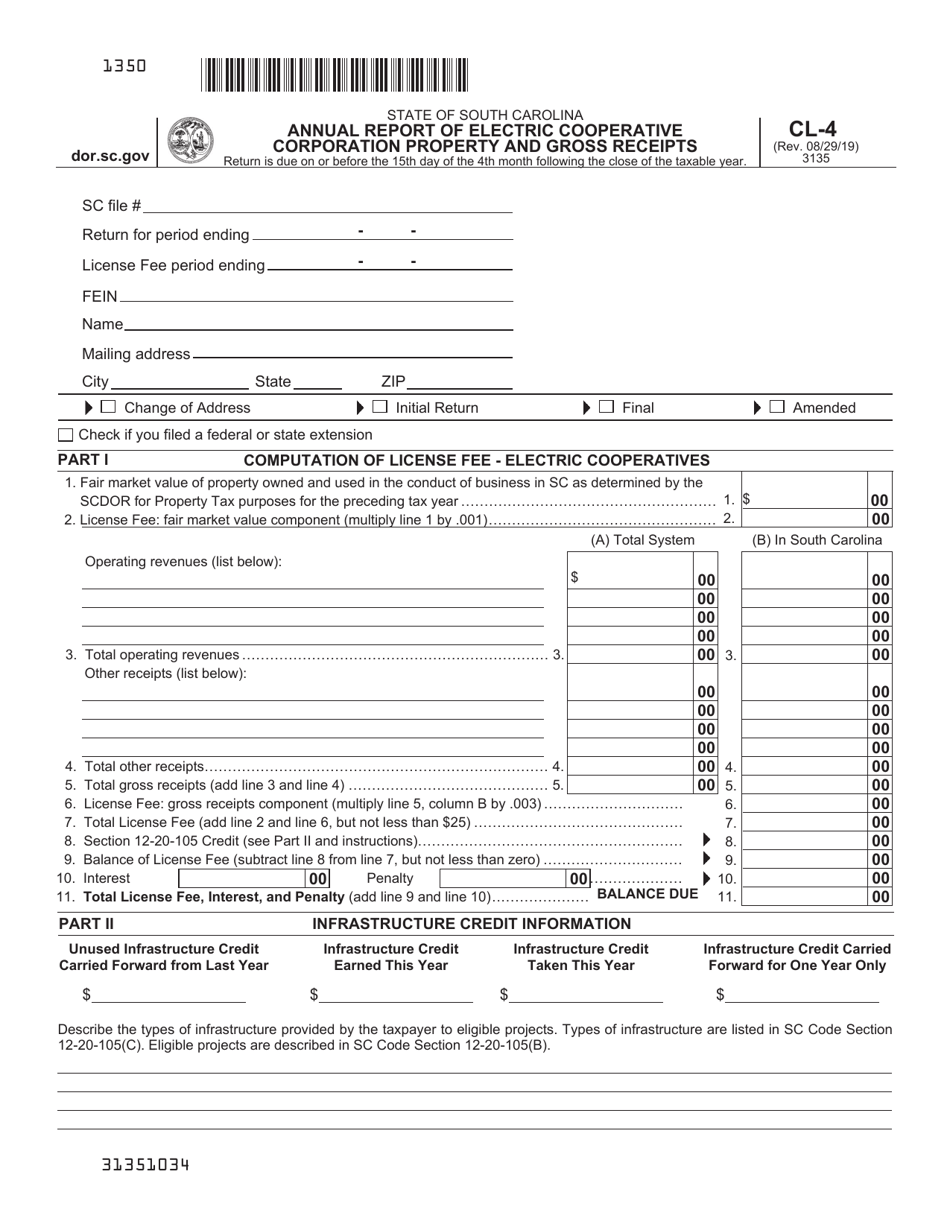

Form CL-4 Annual Report of Electric Cooperative Corporation Property and Gross Receipts - South Carolina

What Is Form CL-4?

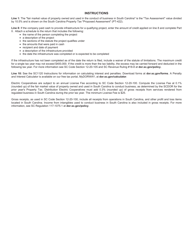

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CL-4?

A: Form CL-4 is the Annual Report of Electric Cooperative Corporation Property and Gross Receipts in South Carolina.

Q: Who needs to file Form CL-4?

A: Electric cooperative corporations in South Carolina need to file Form CL-4.

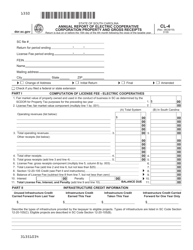

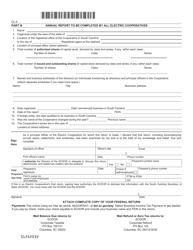

Q: What information is required on Form CL-4?

A: Form CL-4 requires information about the property and gross receipts of the electric cooperative corporation.

Q: When is Form CL-4 due?

A: Form CL-4 is due on or before the 15th day of the 5th month following the close of the corporation's fiscal year.

Q: Are there any penalties for late filing of Form CL-4?

A: Yes, there are penalties for late filing of Form CL-4, including potential fines and interest charges.

Q: Is there a fee for filing Form CL-4?

A: Yes, there is a fee for filing Form CL-4. The fee amount may vary depending on the gross receipts of the corporation.

Form Details:

- Released on August 29, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CL-4 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.