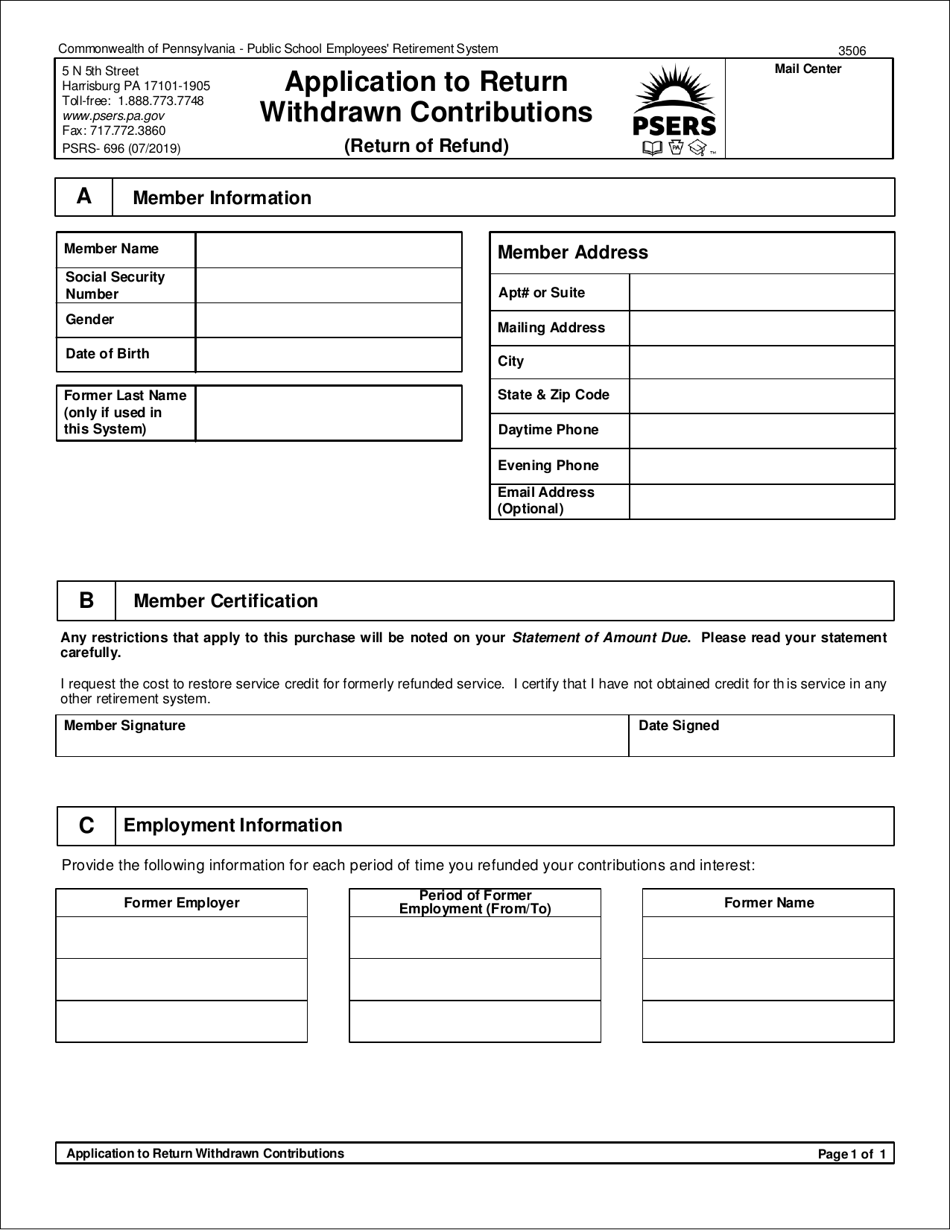

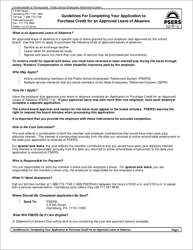

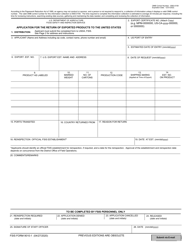

Form PSRS-696 Application to Return Withdrawn Contributions - Pennsylvania

What Is Form PSRS-696?

This is a legal form that was released by the Pennsylvania Public School Employees' Retirement System - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

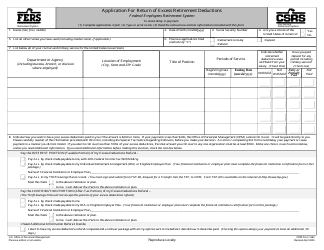

Q: What is Form PSRS-696?

A: Form PSRS-696 is an application used to request the return of withdrawn contributions from the Pennsylvania State Employees' Retirement System (PSERS).

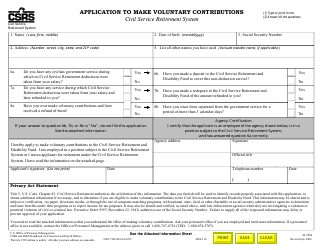

Q: Who can use Form PSRS-696?

A: Form PSRS-696 can be used by current and former employees of the Pennsylvania State Employees' Retirement System who have previously withdrawn their contributions.

Q: What is the purpose of Form PSRS-696?

A: The purpose of Form PSRS-696 is to request the return of previously withdrawn contributions from the Pennsylvania State Employees' Retirement System.

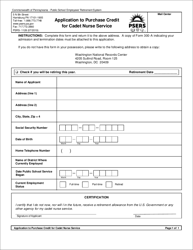

Q: How do I fill out Form PSRS-696?

A: You must fill out Form PSRS-696 with your personal and employment information, including your name, social security number, and dates of employment.

Q: Are there any fees associated with submitting Form PSRS-696?

A: No, there are no fees associated with submitting Form PSRS-696.

Q: Is there a deadline for submitting Form PSRS-696?

A: There is no specific deadline for submitting Form PSRS-696, but it is recommended to submit the form as soon as possible to expedite the return of your contributions.

Q: How long does it take to process Form PSRS-696?

A: The processing time for Form PSRS-696 may vary, but it typically takes several weeks.

Q: Can I submit Form PSRS-696 electronically?

A: No, Form PSRS-696 must be submitted by mail or in person, electronic submission is not currently available.

Q: What should I do if I have questions about Form PSRS-696?

A: If you have any questions about Form PSRS-696, you should contact the Pennsylvania State Employees' Retirement System directly for assistance.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Pennsylvania Public School Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PSRS-696 by clicking the link below or browse more documents and templates provided by the Pennsylvania Public School Employees' Retirement System.