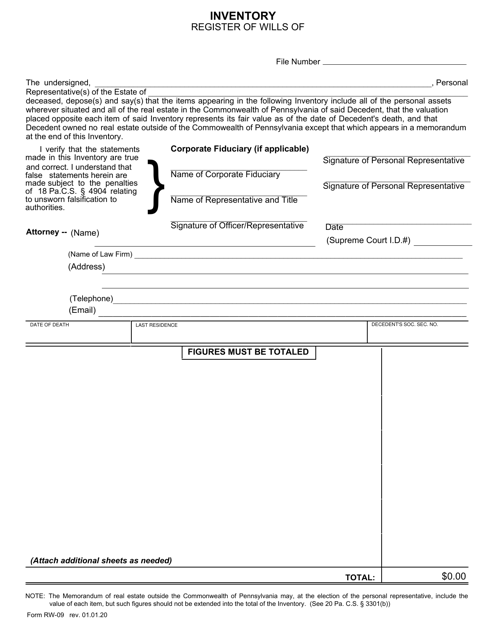

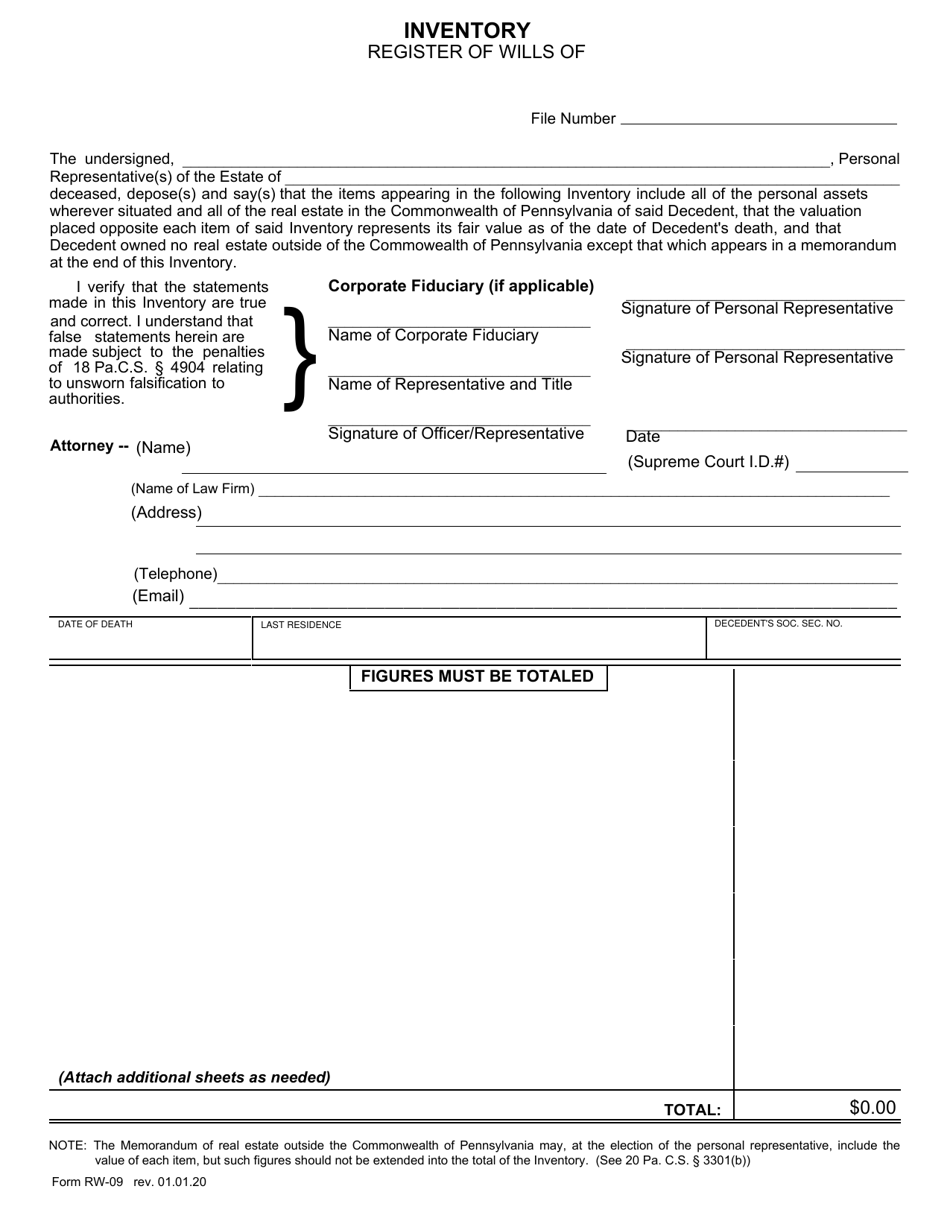

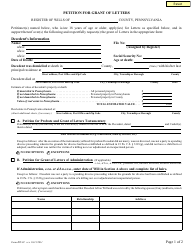

Form RW-09 Inventory - Pennsylvania

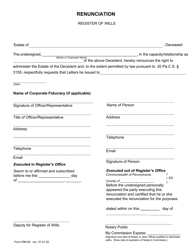

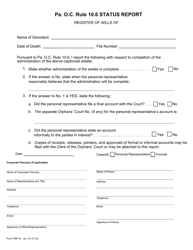

What Is Form RW-09?

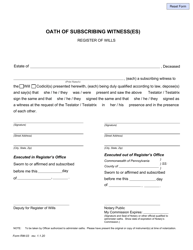

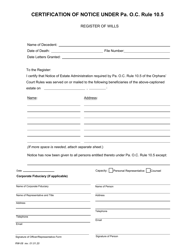

This is a legal form that was released by the Supreme Court of Pennsylvania - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

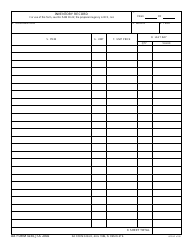

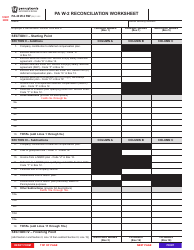

Q: What is Form RW-09 Inventory?

A: Form RW-09 Inventory is a tax form used in Pennsylvania to report inventory value for tax purposes.

Q: Who needs to file Form RW-09 Inventory?

A: Businesses in Pennsylvania that have inventory and meet the filing requirements must file Form RW-09 Inventory.

Q: When is the due date for filing Form RW-09 Inventory?

A: The due date for filing Form RW-09 Inventory in Pennsylvania is determined by the Department of Revenue and can vary each year. It is typically due in the early months of the year.

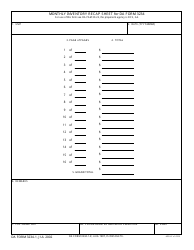

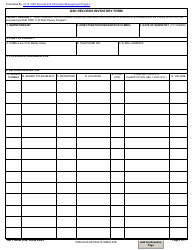

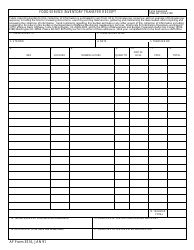

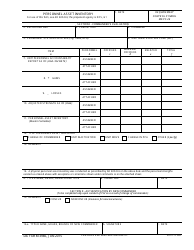

Q: What information is required on Form RW-09 Inventory?

A: Form RW-09 Inventory requires businesses to provide details about their inventory, including beginning and ending inventory amounts, purchases, and sales.

Q: Are there any penalties for not filing Form RW-09 Inventory?

A: Yes, there may be penalties for not filing Form RW-09 Inventory or for filing it late. It is important to comply with the filing requirements to avoid potential penalties.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Supreme Court of Pennsylvania;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW-09 by clicking the link below or browse more documents and templates provided by the Supreme Court of Pennsylvania.