This version of the form is not currently in use and is provided for reference only. Download this version of

Form E-595E

for the current year.

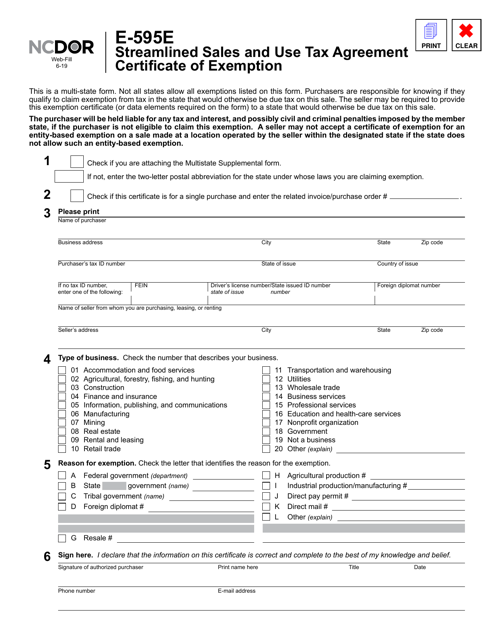

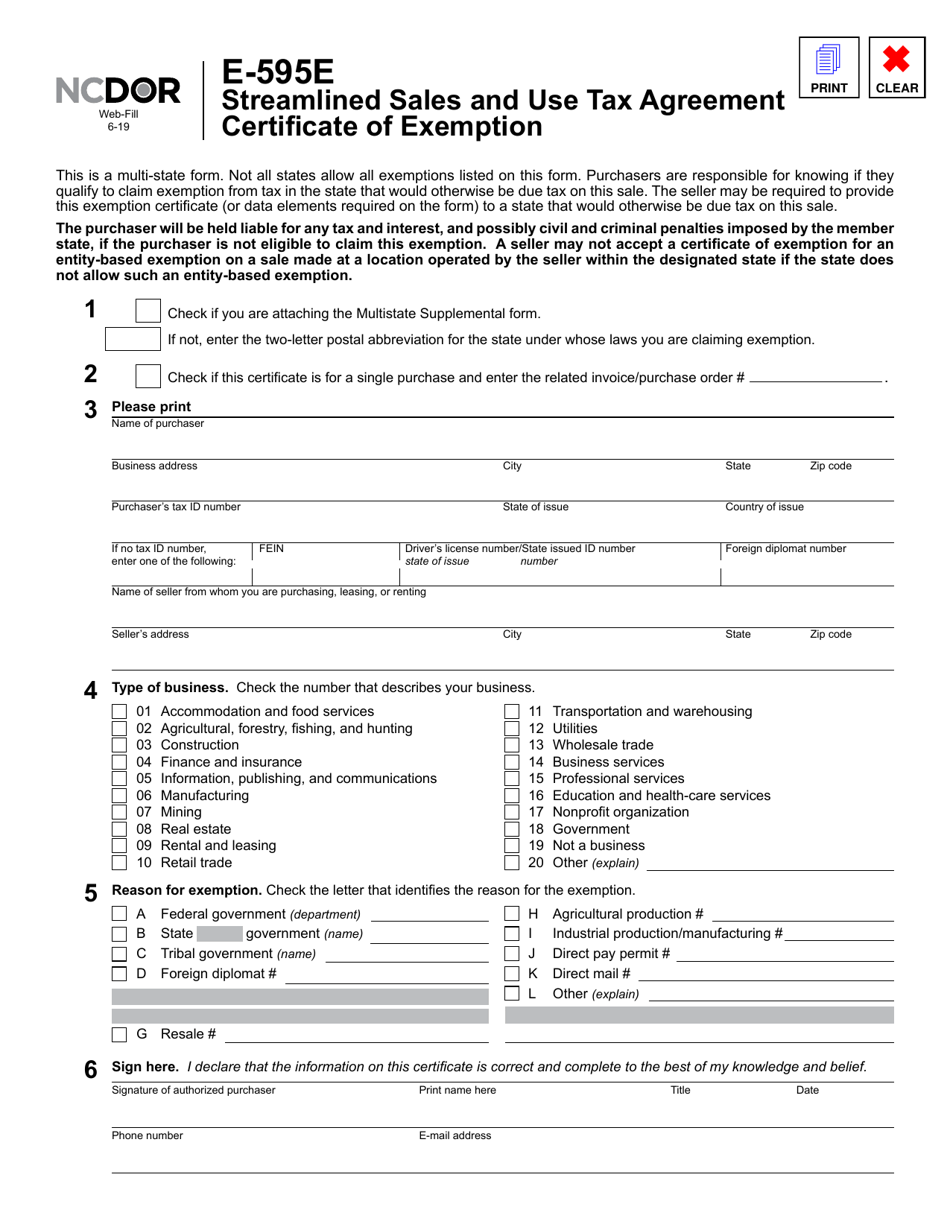

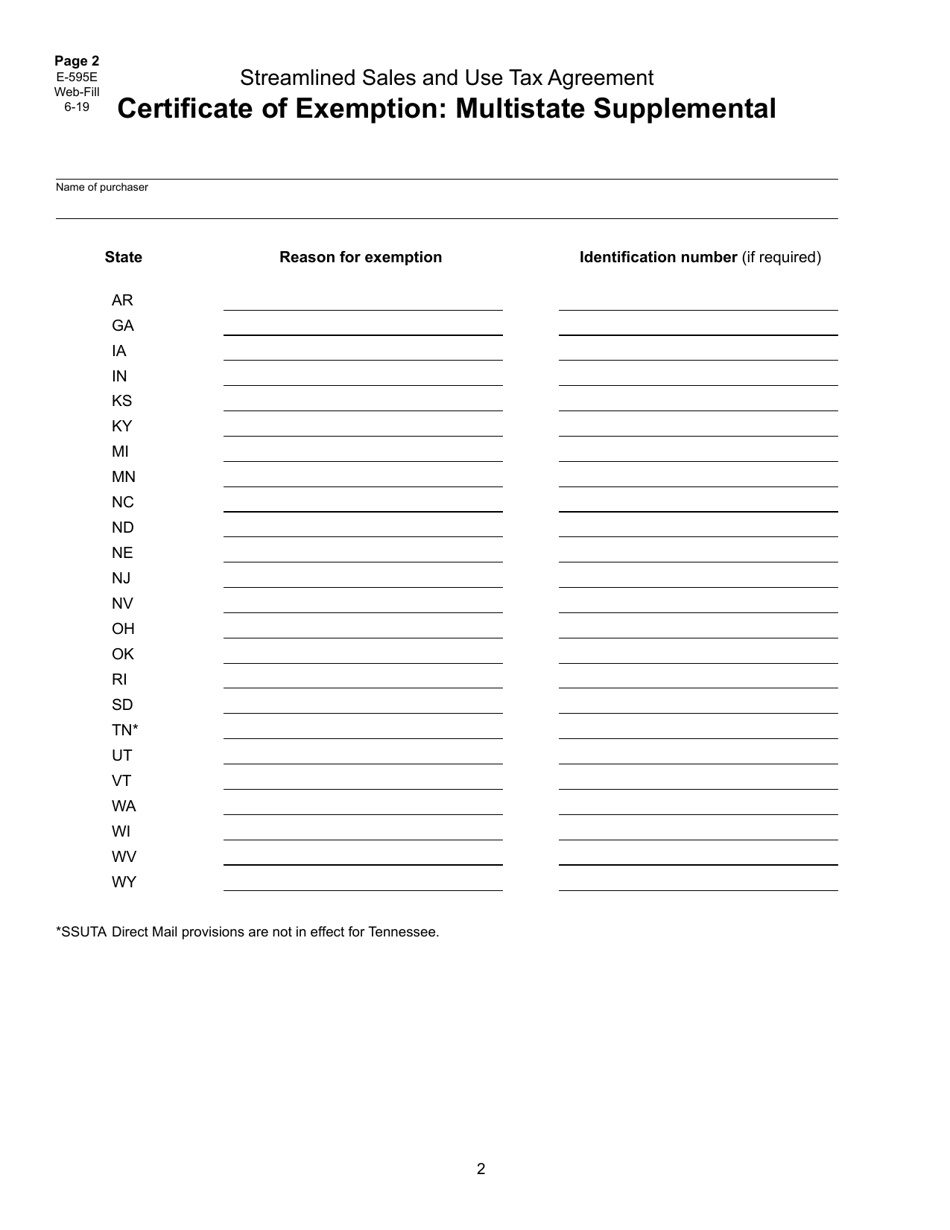

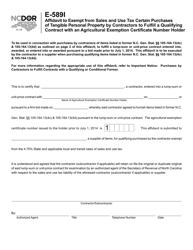

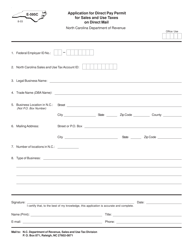

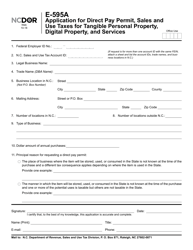

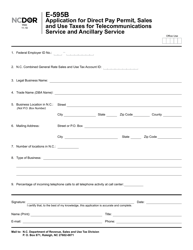

Form E-595E Streamlined Sales and Use Tax Agreement Certificate of Exemption - North Carolina

What Is Form E-595E?

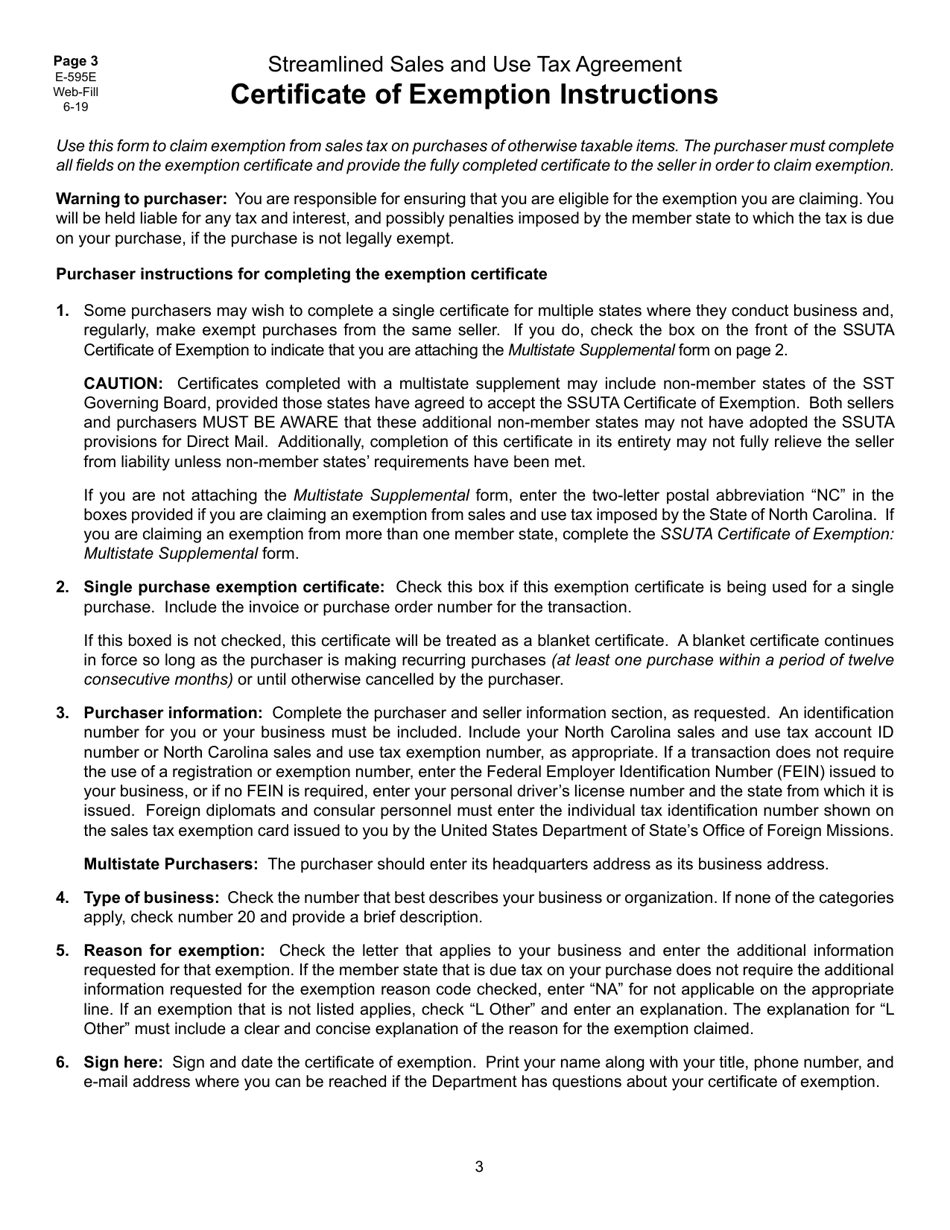

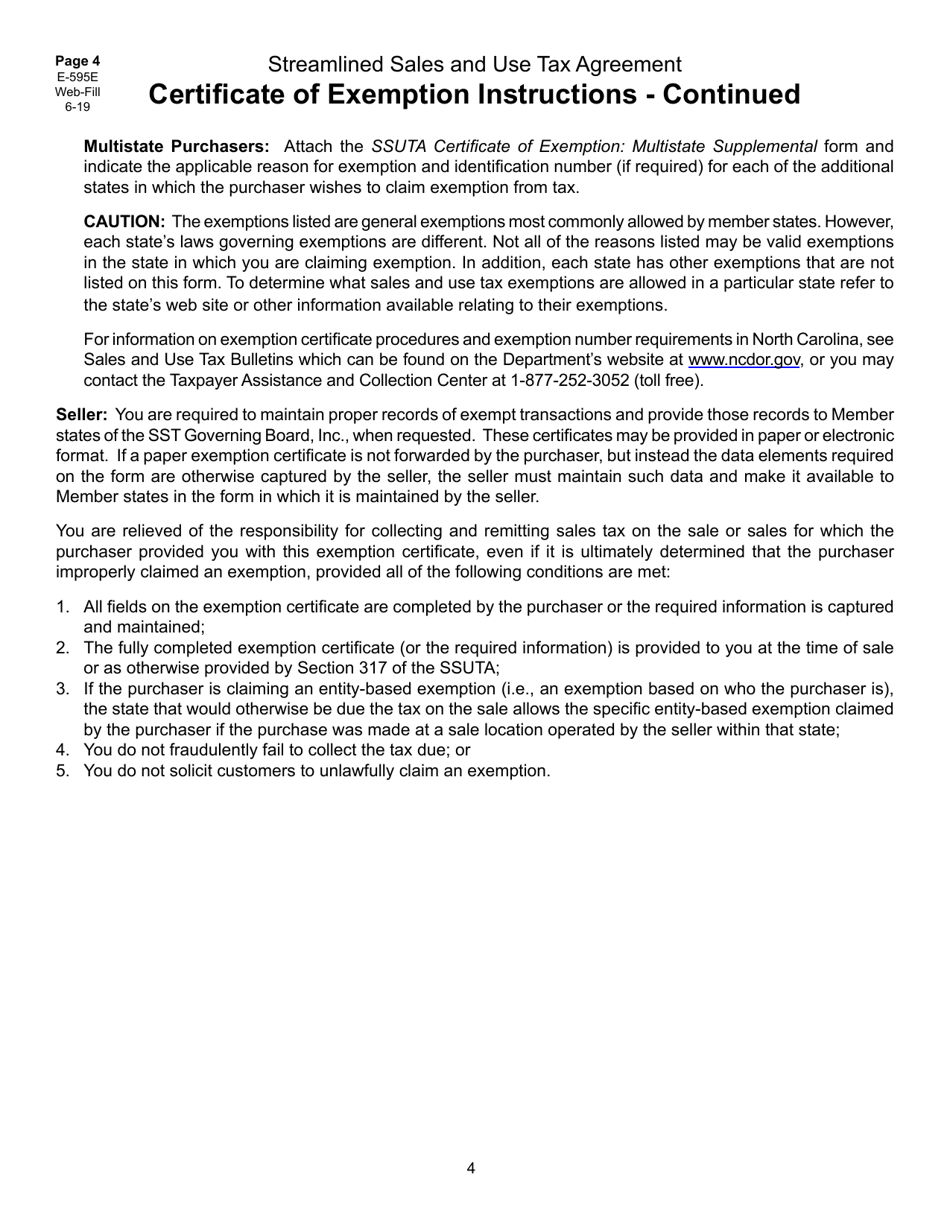

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-595E?

A: Form E-595E is a Streamlined Sales and Use Tax Agreement Certificate of Exemption specific to North Carolina.

Q: What is the purpose of Form E-595E?

A: The purpose of Form E-595E is to certify that certain transactions are exempt from sales and use tax in North Carolina.

Q: Who can use Form E-595E?

A: Form E-595E can be used by businesses or individuals who qualify for specific exemptions from sales and use tax in North Carolina.

Q: Do I need to renew Form E-595E?

A: Form E-595E does not need to be renewed unless the information provided on the form has changed or it has expired.

Q: Is Form E-595E specific to North Carolina?

A: Yes, Form E-595E is specific to North Carolina and cannot be used for exemptions in other states.

Q: What exemptions are covered by Form E-595E?

A: Form E-595E covers exemptions such as machinery and equipment, raw materials, sales for resale, and more. The form provides checkboxes for various exemptions.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-595E by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.