This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-403TC

for the current year.

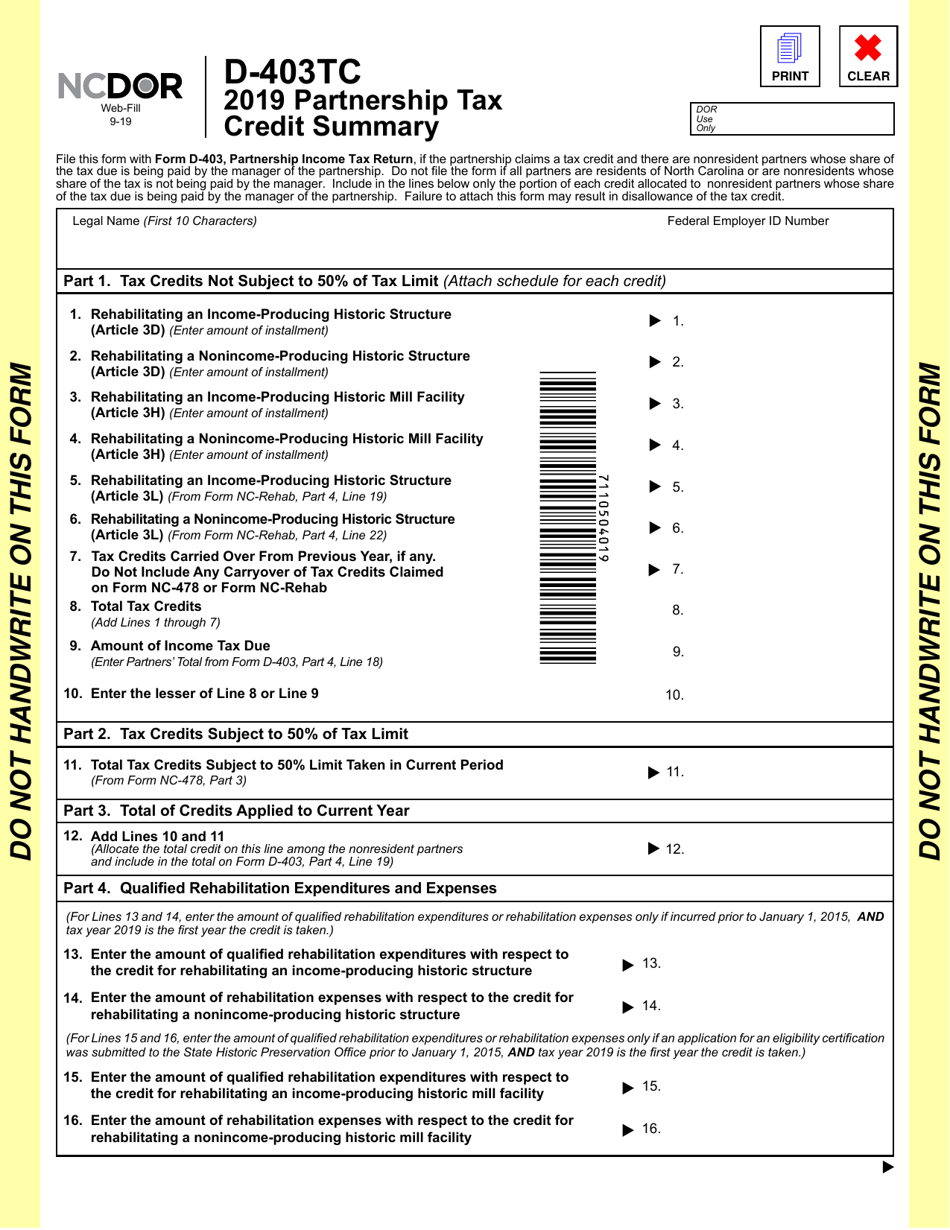

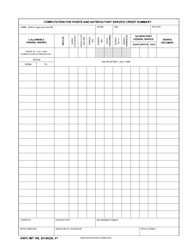

Form D-403TC Partnership Tax Credit Summary - North Carolina

What Is Form D-403TC?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

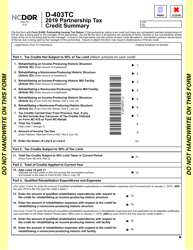

Q: What is Form D-403TC?

A: Form D-403TC is a tax form used to report partnership tax credits in the state of North Carolina.

Q: What is a partnership tax credit?

A: A partnership tax credit is a credit that can be claimed by partnerships for certain activities or investments.

Q: What information is included in the Partnership Tax Credit Summary?

A: The Partnership Tax Credit Summary includes details of the tax credits claimed by the partnership, including the type of credit and the amount claimed.

Q: Who needs to file Form D-403TC?

A: Partnerships that have claimed tax credits in North Carolina need to file Form D-403TC.

Q: Is there a deadline for filing Form D-403TC?

A: Yes, the deadline for filing Form D-403TC is generally the same as the deadline for filing the partnership's tax return.

Q: What should I do if I made a mistake on Form D-403TC?

A: If you made a mistake on Form D-403TC, you should submit an amended form to correct the error.

Q: Are there penalties for not filing Form D-403TC?

A: Yes, if a partnership fails to file Form D-403TC, they may be subject to penalties and interest on the tax credits claimed.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

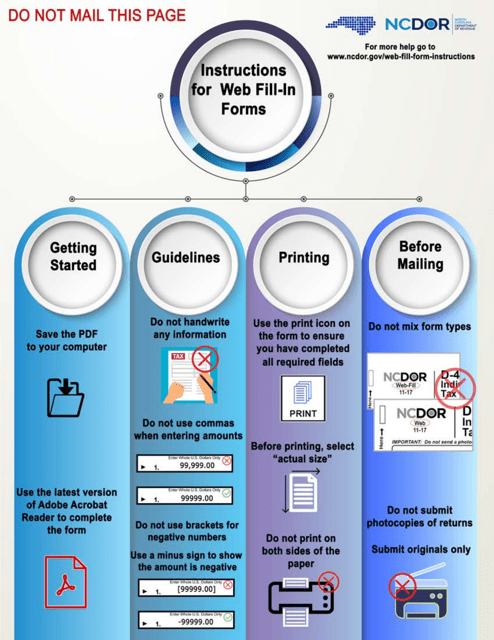

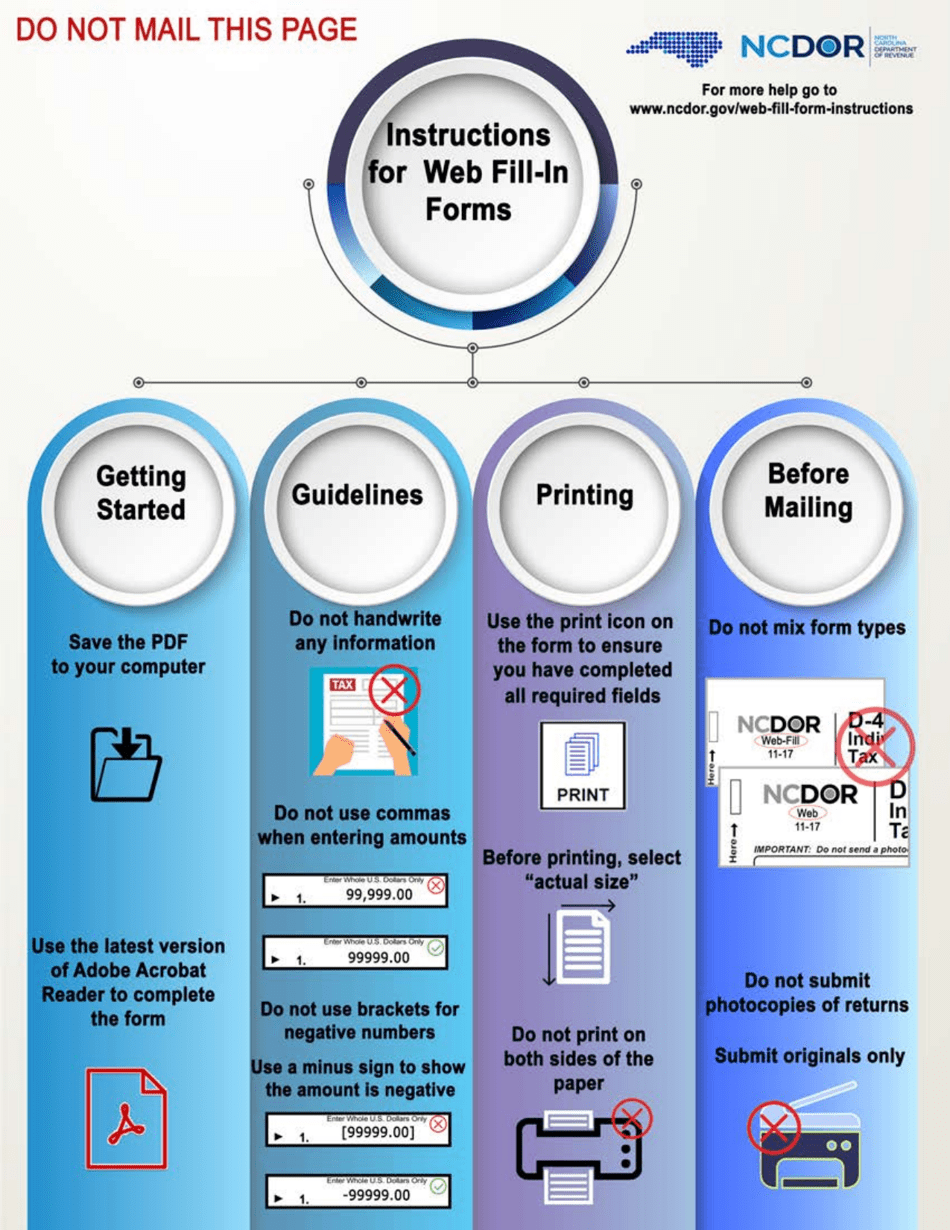

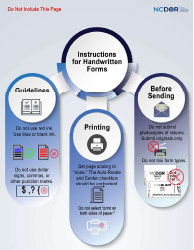

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-403TC by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.