This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-400TC

for the current year.

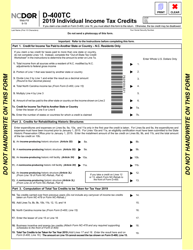

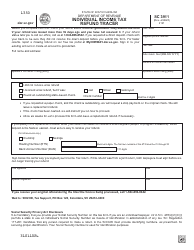

Form D-400TC Individual Income Tax Credits - North Carolina

What Is Form D-400TC?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-400TC?

A: Form D-400TC is the North Carolina Individual Income Tax Credits form.

Q: Who can use Form D-400TC?

A: Form D-400TC can be used by individuals who are claiming tax credits on their North Carolina income tax return.

Q: What are tax credits?

A: Tax credits are reductions in the amount of tax owed and can help decrease a person's overall tax liability.

Q: What types of tax credits are available on Form D-400TC?

A: Form D-400TC allows individuals to claim various tax credits, such as child and dependent care expenses, education expenses, renewable energy credits, and more.

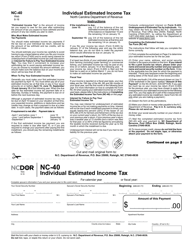

Q: When is Form D-400TC due?

A: Form D-400TC is due on the same date as the North Carolina individual income tax return, which is typically April 15th.

Q: Can Form D-400TC be e-filed?

A: Yes, Form D-400TC can be e-filed along with the individual income tax return.

Q: Are there any income limits for claiming tax credits on Form D-400TC?

A: Yes, certain tax credits on Form D-400TC have income limits and eligibility requirements.

Q: What should I do if I have questions about Form D-400TC?

A: If you have any questions about Form D-400TC or tax credits, you can contact the North Carolina Department of Revenue for assistance.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

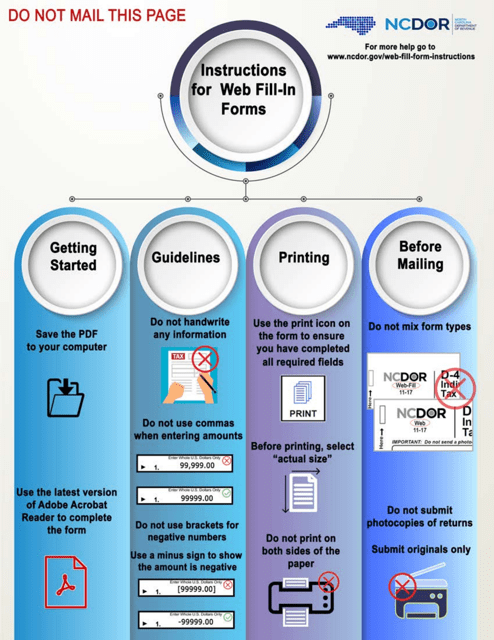

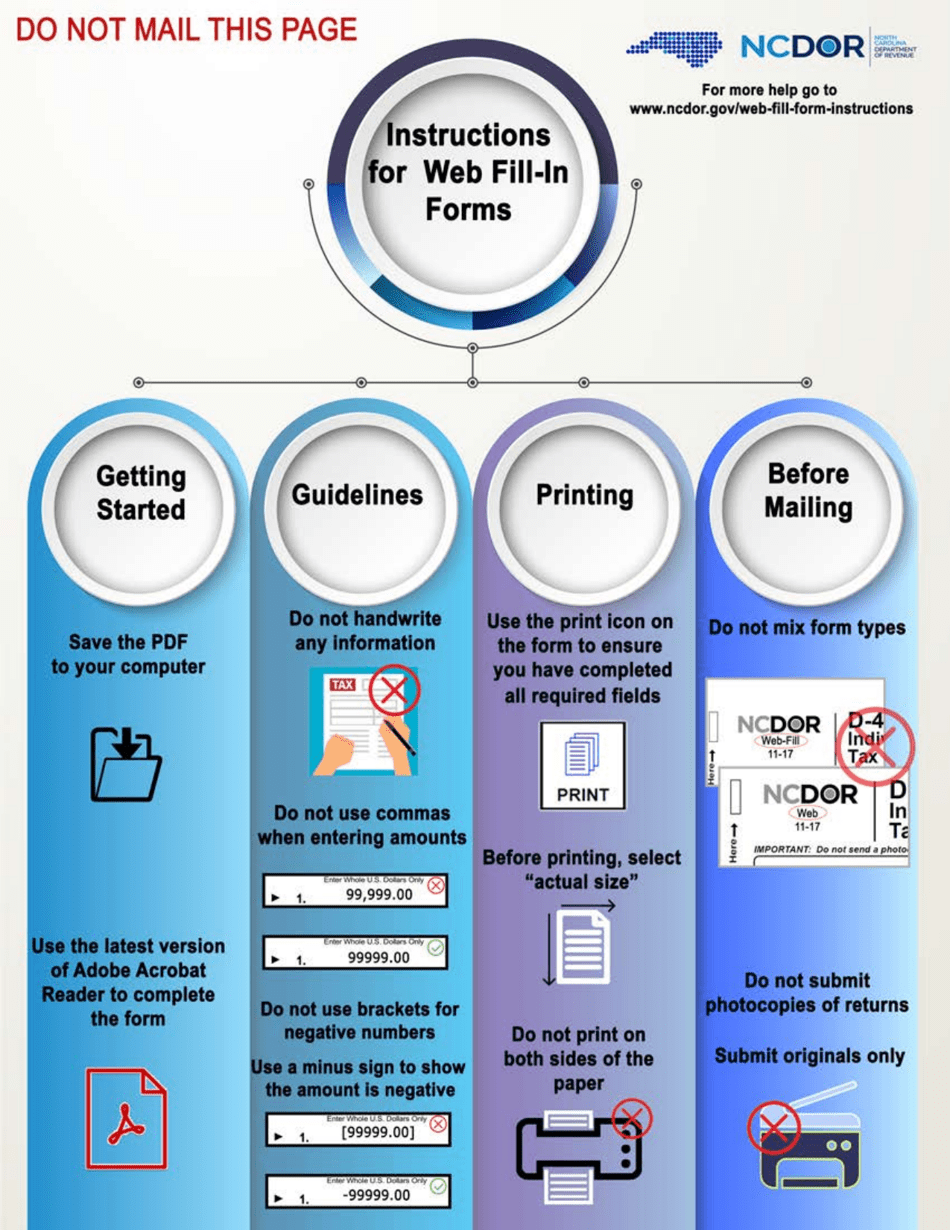

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400TC by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.